Question: a. Prepare a materials variance information table showing the standard price, the actual price, the standard quantity, and the actual quantity. b. Calculate the materials

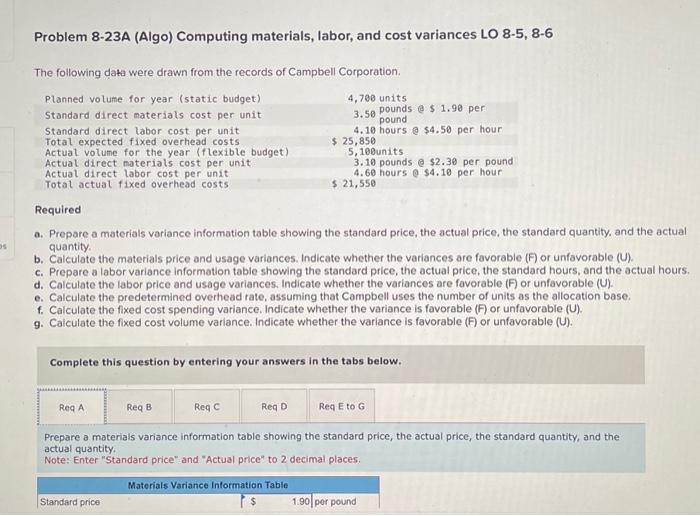

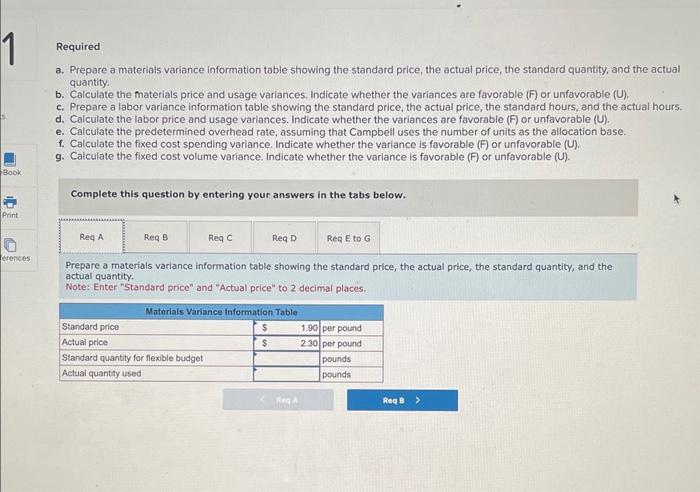

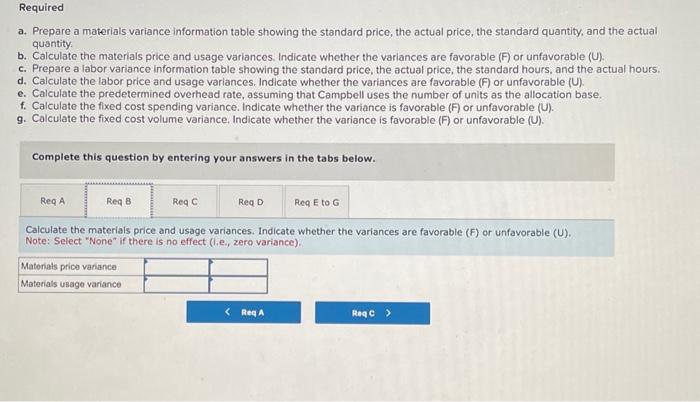

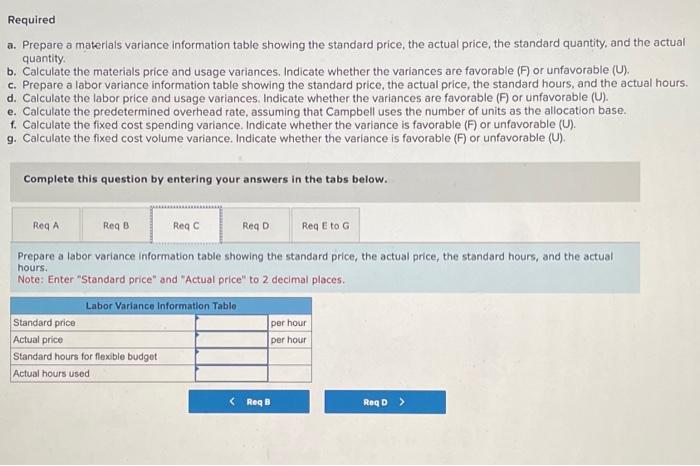

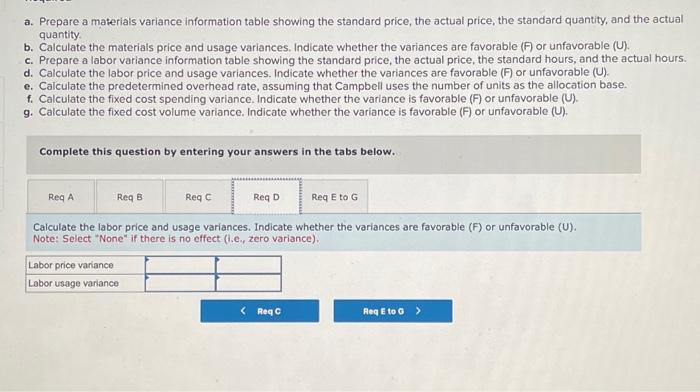

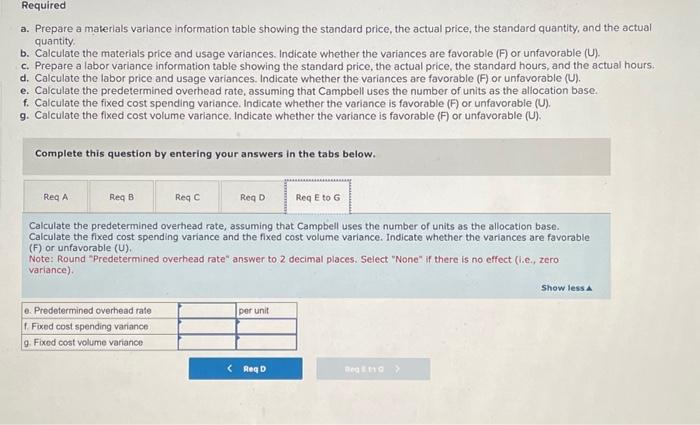

a. Prepare a materials variance information table showing the standard price, the actual price, the standard quantity, and the actual quantity. b. Calculate the materials price and usage variances, Indicate whether the variances are favorable (F) or unfavorable (U). c. Prepare a labor variance information table showing the standard price, the actual price, the standard hours, and the actual hours. d. Calculate the labor price and usage variances. Indicate whether the variances are favorable (F) or unfavorable (U). e. Calculate the predetermined overhead rate, assuming that Campbell uses the number of units as the allocation base. f. Calculate the fixed cost spending variance. Indicate whether the variance is favorable (F) or unfavorable (U). g. Calculate the fixed cost volume variance. Indicate whether the variance is favorable (F) or unfavorable (U). Complete this question by entering your answers in the tabs below. Calculate the labor price and usage variances. Indicate whether the variances are favorable (F) or unfavorable (U). Note: Select "None" if there is no effect (i.e., zero variance). Required a. Prepare a materials variance information table showing the standard price, the actual price, the standard quantity, and the actual quantity. b. Calculate the materials price and usage variances. Indicate whether the variances are favorable (F) or unfavorable (U), c. Prepare a labor variance information table showing the standard price, the actual price, the standard hours, and the actual hours. d. Calculate the labor price and usage varlances. Indicate whether the variances are favorable (F) or unfavorable (U). e. Calculate the predetermined overhead rate, assuming that Campbell uses the number of units as the allocation base. f. Calculate the fixed cost spending variance. Indicate whether the variance is favorable (F) or unfavorable (U). g. Calculate the fixed cost volume variance. Indicate whether the variance is favorable (F) or unfavorable (U). Complete this question by entering your answers in the tabs below. Prepare a materials variance information table showing the standard price, the actual price, the standard quantity, and the actual quantity. Note: Enter "Standard price" and "Actual price" to 2 decimal places, a. Prepare a materials variance information table showing the standard price, the actual price, the standard quantity, and the actual quantity. b. Calculate the materials price and usage variances. Indicate whether the variances are favorable (F) or unfavorable (U). c. Prepare a labor variance information table showing the standard price, the actual price, the standard hours, and the actual hours. d. Calculate the labor price and usage variances. Indicate whether the variances are favorable (F) or unfavorable (U). e. Calculate the predetermined overhead rate, assuming that Campbell uses the number of units as the allocation base. f. Calculate the fixed cost spending variance. Indicate whether the variance is favorable (F) or unfavorable (U). g. Calculate the fixed cost volume variance. Indicate whether the variance is favorable (F) or unfavorable (U). Complete this question by entering your answers in the tabs below. Calculate the materials price and usage variances. Indicate whether the variances are favorable (F) or unfavorable (U). Note: Select "None" if there is no effect (i.e., zero variance). a. Prepare a materials variance information table showing the standard price, the actual price, the standard quantity, and the actual quantity. b. Calculate the materials price and usage variances. Indicate whether the variances are favorable (F) or unfavorable (U). c. Prepare a labor variance information table showing the standard price, the actual price, the standard hours, and the actual hours. d. Calculate the labor price and usage variances. Indicate whether the variances are favorable (F) or unfavorable (U). e. Calculate the predetermined overhead rate, assuming that Campbell uses the number of units as the allocation base. f. Calculate the fixed cost spending variance. Indicate whether the variance is favorable (F) or unfavorable (U). 9. Calculate the fixed cost volume variance. Indicate whether the variance is favorable (F) or unfavorable (U). Complete this question by entering your answers in the tabs below. Calculate the predetermined overhead rate, assuming that Campbell uses the number of units as the allocation base. Calculate the fixed cost spending variance and the fixed cost volume variance. Indicate whether the variances are favorable (F) or unfavorable (U). Note: Round "Predetermined overhead rate" answer to 2 decimal places. Select "None" if there is no effect (i.e., zero variance). Required a. Prepare a materials variance information table showing the standard price, the actual price, the standard quantity, and the actual quantity. b. Calculate the materials price and usage variances. Indicate whether the variances are favorable (F) or unfavorable (U). c. Prepare a labor variance information table showing the standard price, the actual price, the standard hours, and the actual hours. d. Calculate the labor price and usage variances. Indicate whether the variances are favorable (F) or unfavorable (U). e. Calculate the predetermined overhead rate, assuming that Campbell uses the number of units as the allocation base. f. Calculate the fixed cost spending variance, Indicate whether the variance is favorable (F) or unfavorable (U). g. Calculate the fixed cost volume variance. Indicate whether the variance is favorable (F) or unfavorable (U). Complete this question by entering your answers in the tabs below. Prepare a labor variance information table showing the standard price, the actual price, the standard hours, and the actual hours. Note: Enter "Standard price" and "Actual price" to 2 decimal places. Problem 8-23A (Algo) Computing materials, labor, and cost variances LO 8-5, 8-6 The following data were drawn from the records of Campbell Corporation. Required a. Prepare a materials variance information table showing the standard price, the actual price, the standard quantity, and the actual quantity. b. Calculate the materials price and usage variances. Indicate whether the variances are favorable (F) or unfavorable (U). c. Prepare a labor variance information table showing the standard price, the actual price, the standard hours, and the actual hours. d. Calculate the labor price and usage variances. Indicate whether the variances are favorable (F) or unfavorable (U). e. Calculate the predetermined overhead rate, assuming that Campbell uses the number of units as the allocation base. f. Calculate the fixed cost spending variance. Indicate whether the variance is favorable (F) or unfavorable (U). g. Calculate the fixed cost volume variance. Indicate whether the variance is favorable (F) or unfavorable (U). Complete this question by entering your answers in the tabs below. Prepare a materials variance information table showing the standard price, the actual price, the standard quantity, and the actual quantity. Note: Enter "Standard price" and "Actual price" to 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts