Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. Prepare all necessary adjusting entries as of March 31 for the three-month period ended March 31. b. Prenare an adiusted trial balance on March

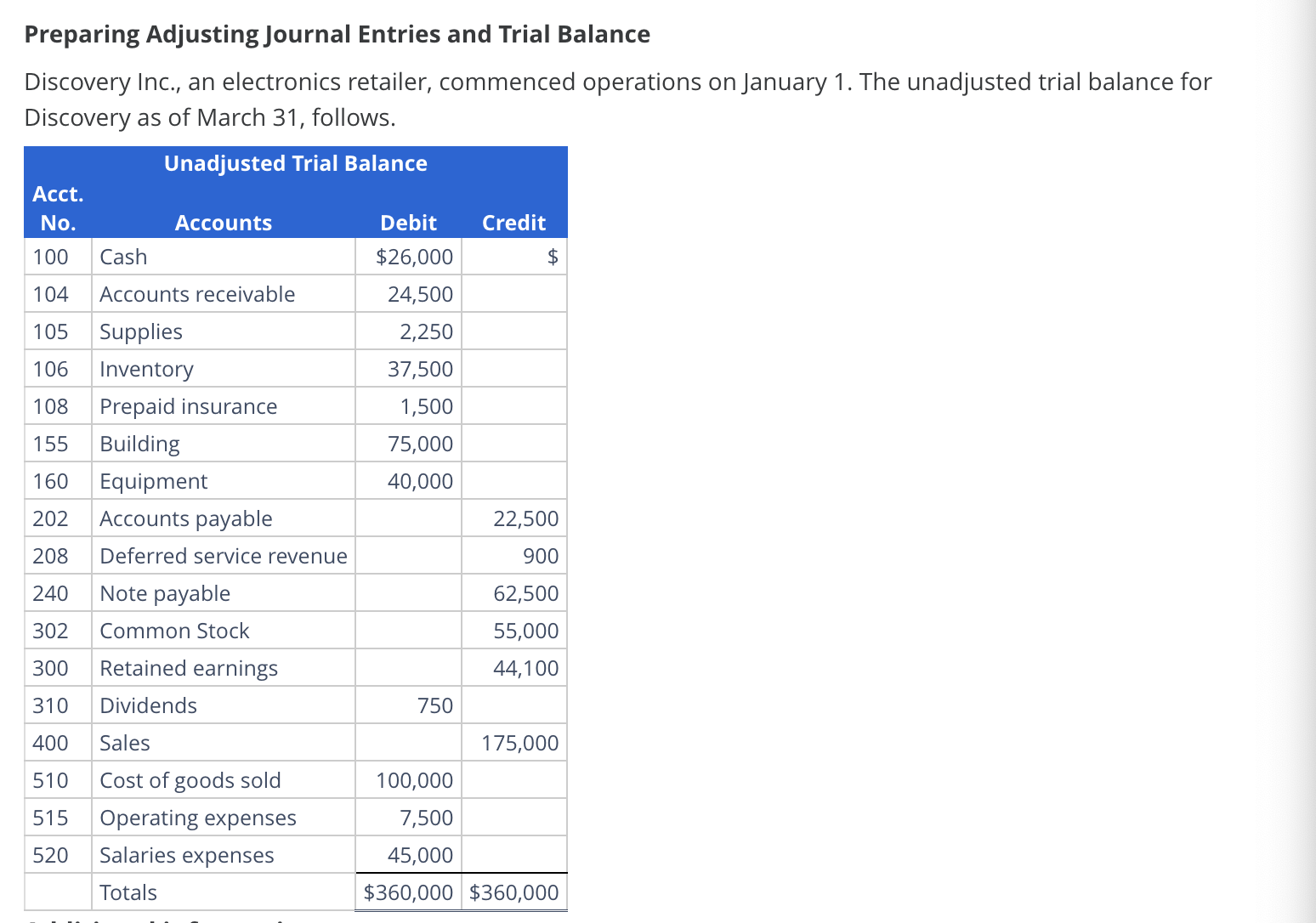

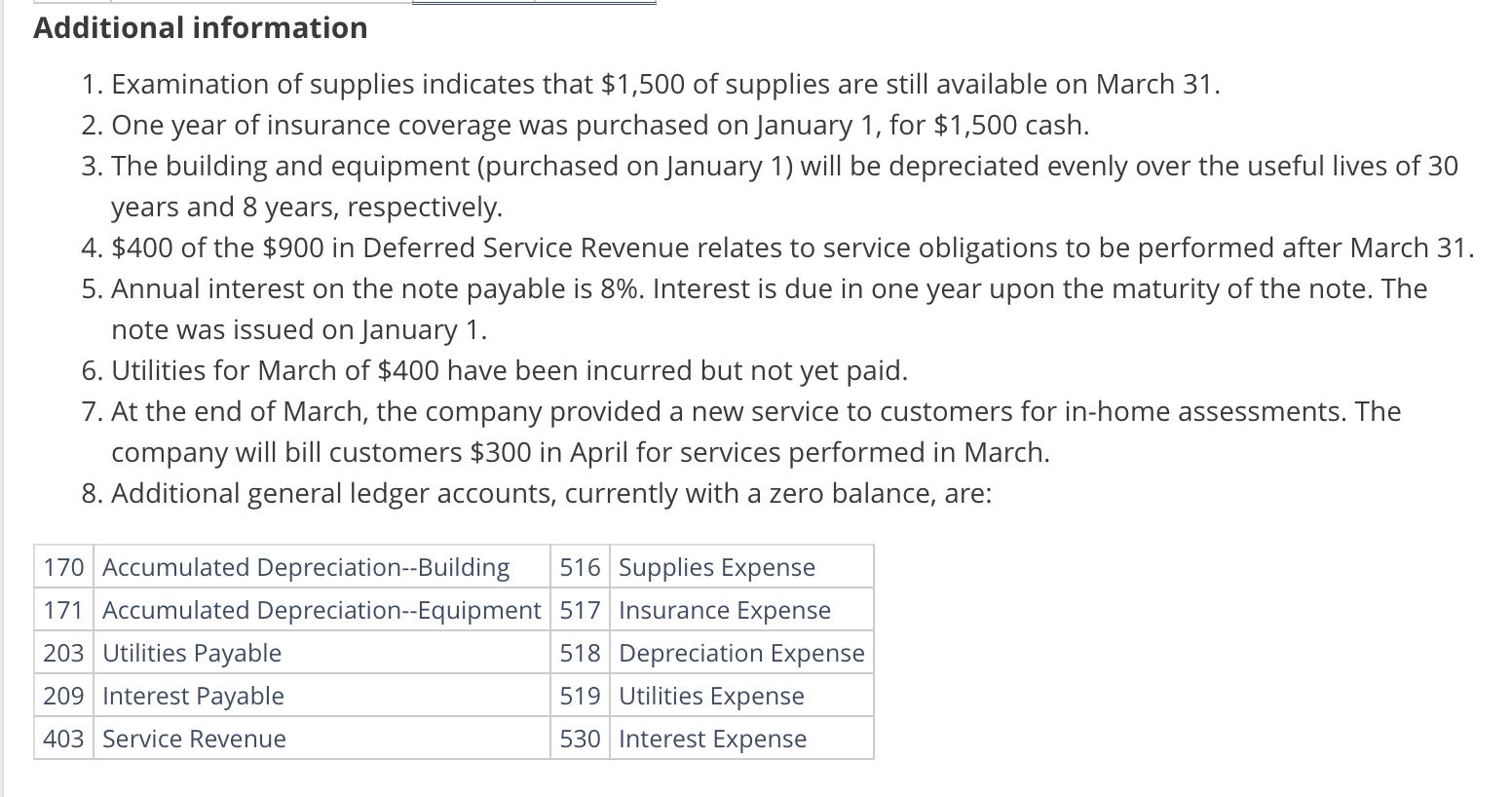

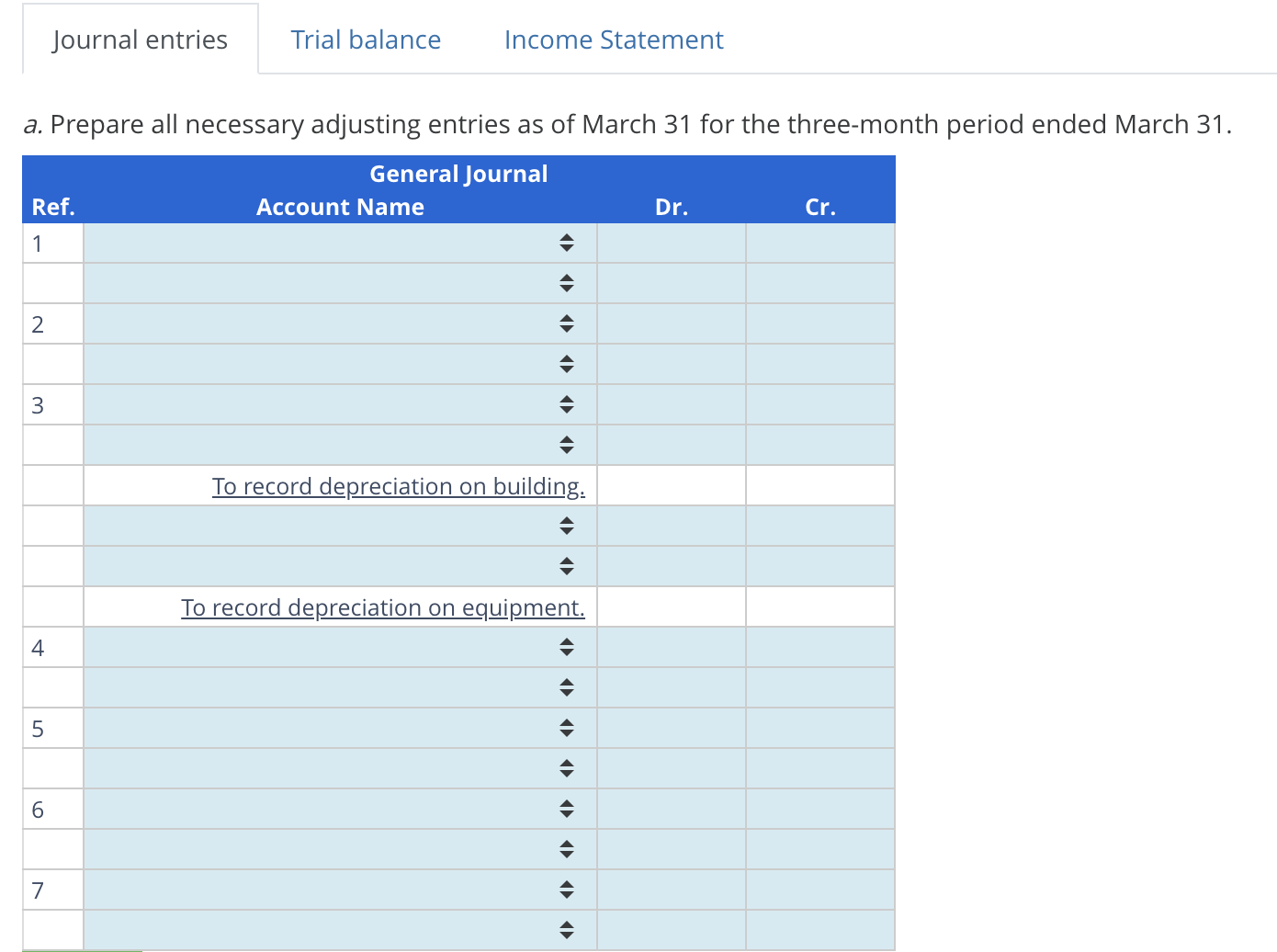

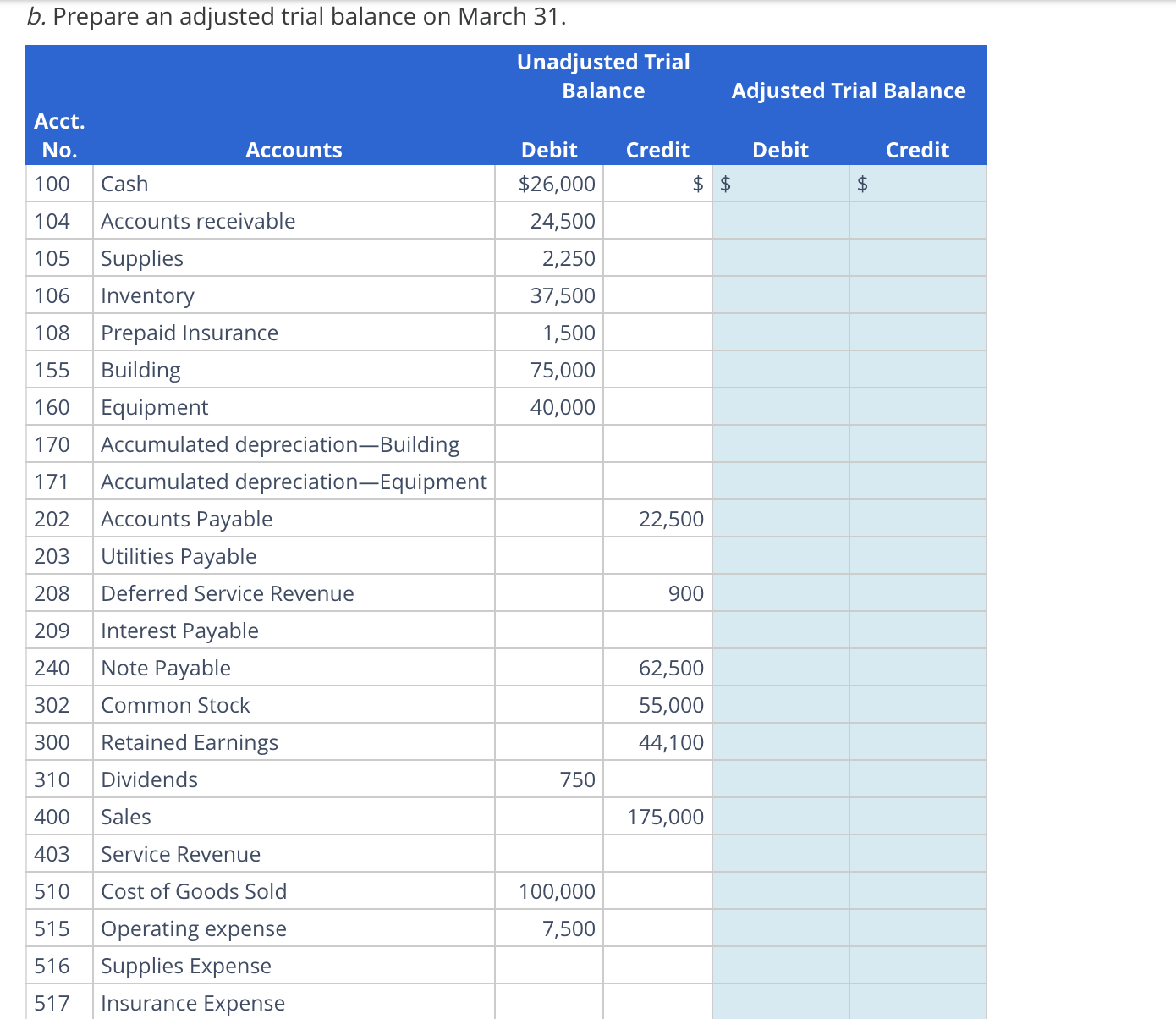

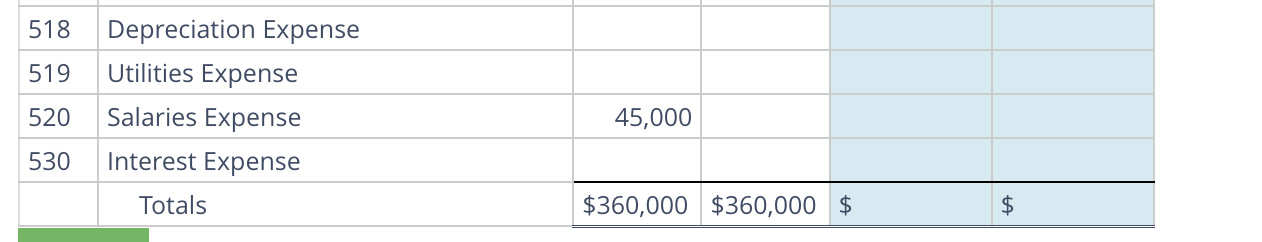

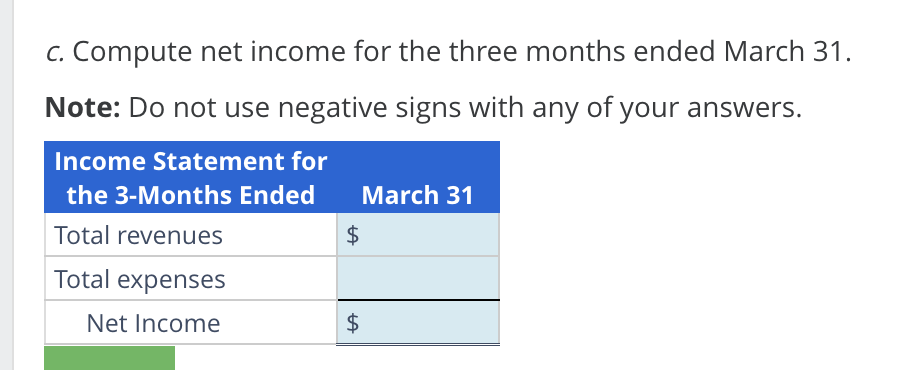

a. Prepare all necessary adjusting entries as of March 31 for the three-month period ended March 31. b. Prenare an adiusted trial balance on March 31. Additional information 1. Examination of supplies indicates that $1,500 of supplies are still available on March 31 . 2. One year of insurance coverage was purchased on January 1 , for $1,500 cash. 3. The building and equipment (purchased on January 1 ) will be depreciated evenly over the useful lives of 30 years and 8 years, respectively. 4. $400 of the $900 in Deferred Service Revenue relates to service obligations to be performed after March 31 . 5. Annual interest on the note payable is 8%. Interest is due in one year upon the maturity of the note. The note was issued on January 1. 6. Utilities for March of $400 have been incurred but not yet paid. 7. At the end of March, the company provided a new service to customers for in-home assessments. The company will bill customers $300 in April for services performed in March. 8. Additional general ledger accounts, currently with a zero balance, are: \begin{tabular}{|l|l|l|l|l|} \hline 518 & Depreciation Expense & & & \\ \hline 519 & Utilities Expense & & & \\ \hline 520 & Salaries Expense & 45,000 & & \\ \hline 530 & Interest Expense & & & \\ \hline & Totals & $360,000 & $360,000 & $ \\ \hline \end{tabular} Preparing Adjusting Journal Entries and Trial Balance Discovery Inc., an electronics retailer, commenced operations on January 1 . The unadjusted trial balance for Disenverv as of Marrh 31 follows c. Compute net income for the three months ended March 31. Note: Do not use negative signs with any of your answers

a. Prepare all necessary adjusting entries as of March 31 for the three-month period ended March 31. b. Prenare an adiusted trial balance on March 31. Additional information 1. Examination of supplies indicates that $1,500 of supplies are still available on March 31 . 2. One year of insurance coverage was purchased on January 1 , for $1,500 cash. 3. The building and equipment (purchased on January 1 ) will be depreciated evenly over the useful lives of 30 years and 8 years, respectively. 4. $400 of the $900 in Deferred Service Revenue relates to service obligations to be performed after March 31 . 5. Annual interest on the note payable is 8%. Interest is due in one year upon the maturity of the note. The note was issued on January 1. 6. Utilities for March of $400 have been incurred but not yet paid. 7. At the end of March, the company provided a new service to customers for in-home assessments. The company will bill customers $300 in April for services performed in March. 8. Additional general ledger accounts, currently with a zero balance, are: \begin{tabular}{|l|l|l|l|l|} \hline 518 & Depreciation Expense & & & \\ \hline 519 & Utilities Expense & & & \\ \hline 520 & Salaries Expense & 45,000 & & \\ \hline 530 & Interest Expense & & & \\ \hline & Totals & $360,000 & $360,000 & $ \\ \hline \end{tabular} Preparing Adjusting Journal Entries and Trial Balance Discovery Inc., an electronics retailer, commenced operations on January 1 . The unadjusted trial balance for Disenverv as of Marrh 31 follows c. Compute net income for the three months ended March 31. Note: Do not use negative signs with any of your answers Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started