Question

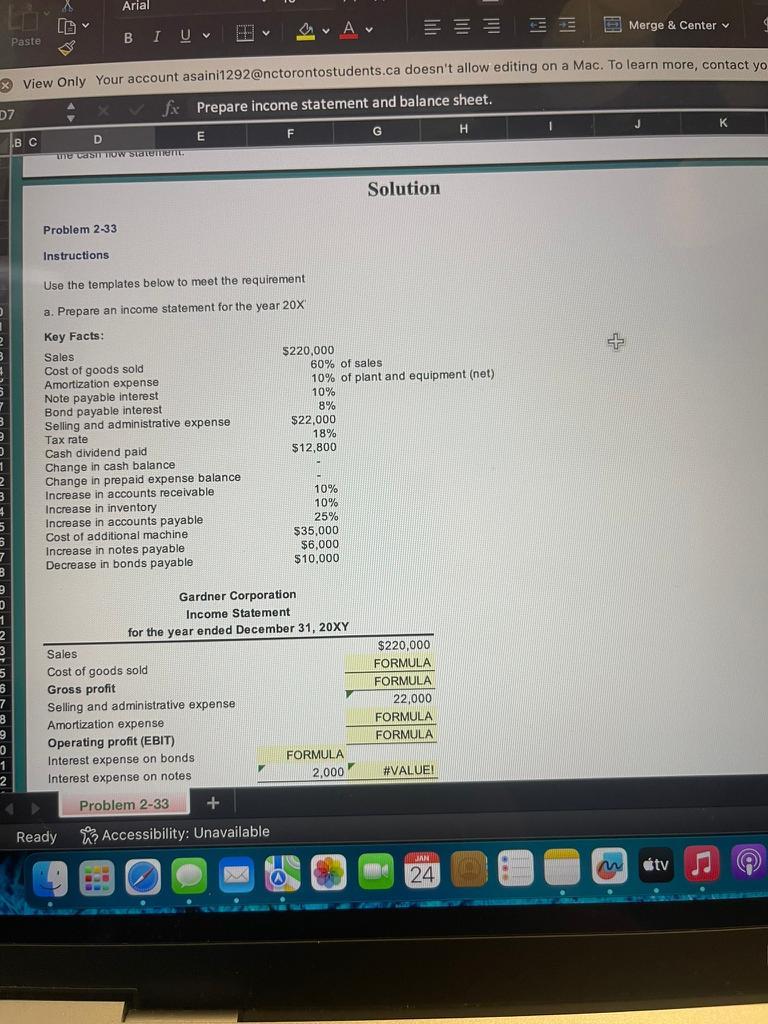

a. Prepare an income statement for the year 20X Key Facts: Sales Cost of goods sold Amortization expense Note payable interest Bond payable interest Selling

a. Prepare an income statement for the year 20X

Key Facts:

Sales

Cost of goods sold

Amortization expense

Note payable interest

Bond payable interest

Selling and administrative expense

Tax rate

Cash dividend paid

Change in cash balance

Change in prepaid expense balance

Increase in accounts receivable

Increase in inventory

Increase in accounts payable

Cost of additional machine

Increase in notes payable

Decrease in bonds payable

$220,000

60% of sales

10% of plant and equipment (net)

10%

8%

$22,000

18%

$12.800

10%

10%

535.350

$6,000

$10.000

Gardner Corporation

Income Statement

for the year ended December 31, 20XY

Sales

Cost of goods sold

Gross profit

Selling and administrative expense

Amortization expense

Operating profit (EBIT)

Interest expense on bonds

Interest expense on notes

$220.000

FORMULA

FORMULA

22,000

FORMULA

FORMULA

FORMULA

2,000

#VALUE!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started