Answered step by step

Verified Expert Solution

Question

1 Approved Answer

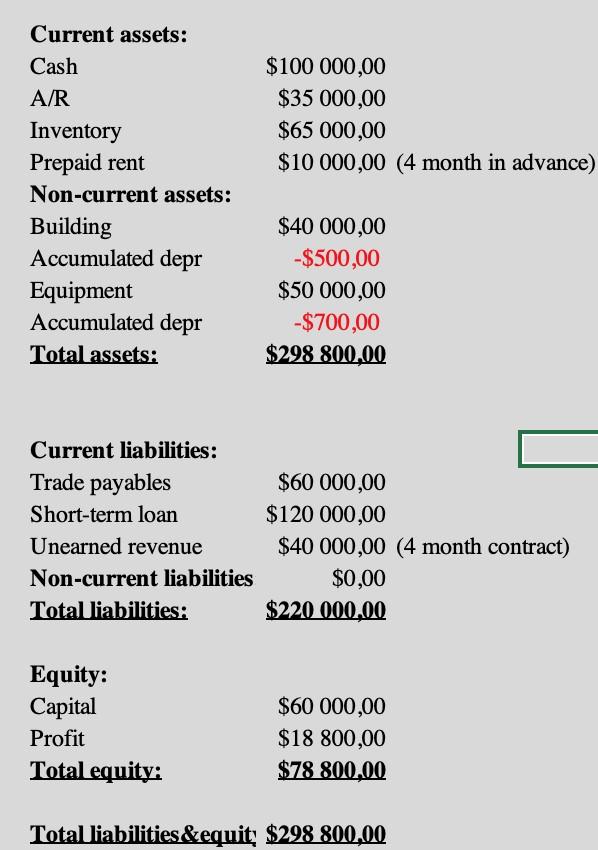

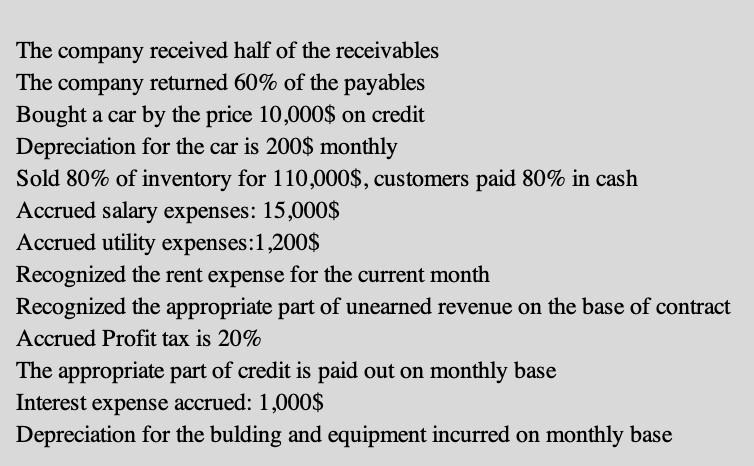

a) Prepare journal entries (7 points) b) Prepare Income statement from the results of transactions (5 points) c) Prepare Balance sheet (5 points) 2.Which operations

a) Prepare journal entries (7 points)

b) Prepare Income statement from the results of transactions (5 points)

c) Prepare Balance sheet (5 points)

2.Which operations should you add to financing activity? (2 points)

Please explain all steps detally.How and with the help of which rule did you solve this exercise.Also answer to all questions.

$100 000,00 $35 000,00 $65 000,00 $10 000,00 (4 month in advance) Current assets: Cash AR Inventory Prepaid rent Non-current assets: Building Accumulated depr Equipment Accumulated depr Total assets: $40 000,00 -$500,00 $50 000,00 -$700,00 $298 800.00 Current liabilities: Trade payables Short-term loan Unearned revenue Non-current liabilities Total liabilities: $60 000,00 $120 000,00 $40 000,00 (4 month contract) $0,00 $220.000,00 Equity: Capital Profit Total equity: $60 000,00 $18 800,00 $78 800.00 Total liabilities &equit; $298 800,00 The company received half of the receivables The company returned 60% of the payables Bought a car by the price 10,000$ on credit Depreciation for the car is 200$ monthly Sold 80% of inventory for 110,000$, customers paid 80% in cash Accrued salary expenses: 15,000$ Accrued utility expenses:1,200$ Recognized the rent expense for the current month Recognized the appropriate part of unearned revenue on the base of contract Accrued Profit tax is 20% The appropriate part of credit is paid out on monthly base Interest expense accrued: 1,000$ Depreciation for the bulding and equipment incurred on monthly base $100 000,00 $35 000,00 $65 000,00 $10 000,00 (4 month in advance) Current assets: Cash AR Inventory Prepaid rent Non-current assets: Building Accumulated depr Equipment Accumulated depr Total assets: $40 000,00 -$500,00 $50 000,00 -$700,00 $298 800.00 Current liabilities: Trade payables Short-term loan Unearned revenue Non-current liabilities Total liabilities: $60 000,00 $120 000,00 $40 000,00 (4 month contract) $0,00 $220.000,00 Equity: Capital Profit Total equity: $60 000,00 $18 800,00 $78 800.00 Total liabilities &equit; $298 800,00 The company received half of the receivables The company returned 60% of the payables Bought a car by the price 10,000$ on credit Depreciation for the car is 200$ monthly Sold 80% of inventory for 110,000$, customers paid 80% in cash Accrued salary expenses: 15,000$ Accrued utility expenses:1,200$ Recognized the rent expense for the current month Recognized the appropriate part of unearned revenue on the base of contract Accrued Profit tax is 20% The appropriate part of credit is paid out on monthly base Interest expense accrued: 1,000$ Depreciation for the bulding and equipment incurred on monthly baseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started