Answered step by step

Verified Expert Solution

Question

1 Approved Answer

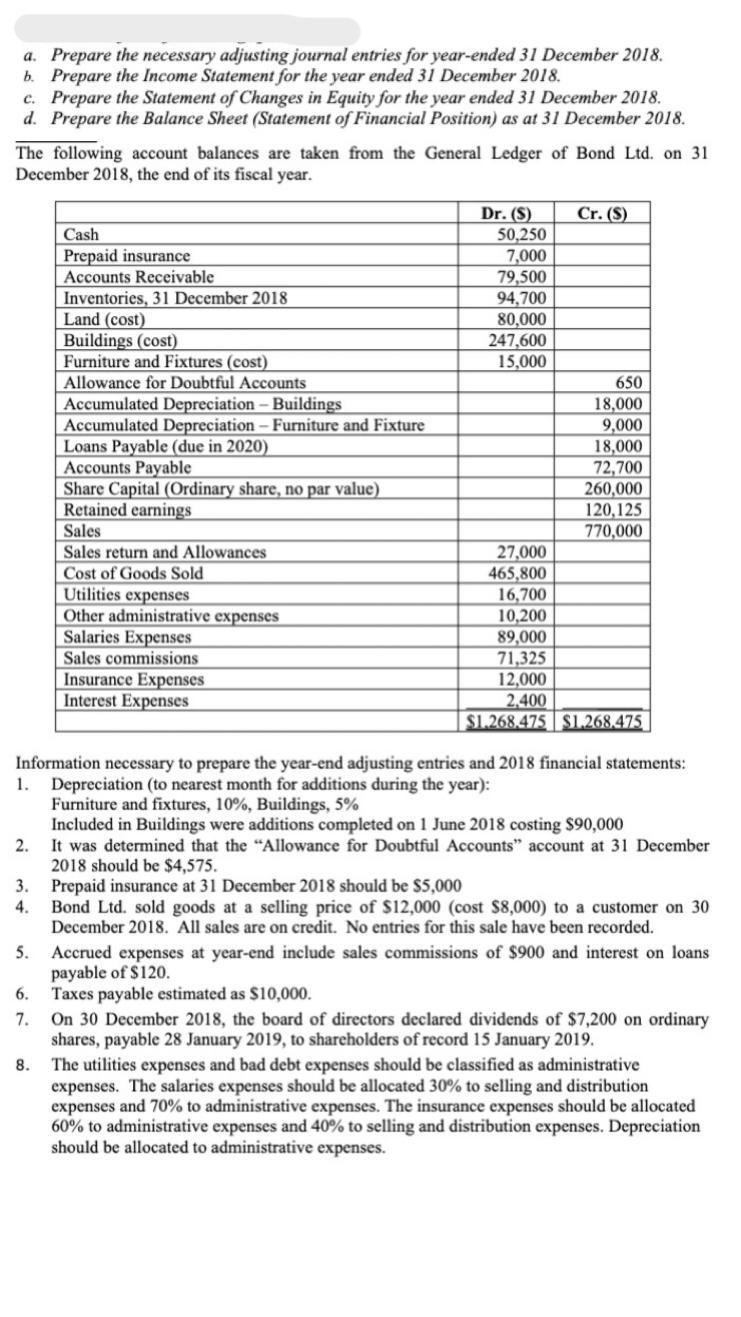

a. Prepare the necessary adjusting journal entries for year-ended 31 December 2018. b. Prepare the Income Statement for the year ended 31 December 2018.

a. Prepare the necessary adjusting journal entries for year-ended 31 December 2018. b. Prepare the Income Statement for the year ended 31 December 2018. c. Prepare the Statement of Changes in Equity for the year ended 31 December 2018. d. Prepare the Balance Sheet (Statement of Financial Position) as at 31 December 2018. The following account balances are taken from the General Ledger of Bond Ltd. on 31 December 2018, the end of its fiscal year. Dr. (S) Cr. (S) Cash 50,250 Prepaid insurance 7,000 Accounts Receivable 79,500 Inventories, 31 December 2018 94,700 Land (cost) 80,000 Buildings (cost) 247,600 Furniture and Fixtures (cost) 15,000 Allowance for Doubtful Accounts 650 Accounts Payable Retained earnings Sales Sales return and Allowances Cost of Goods Sold Utilities expenses Other administrative expenses Accumulated Depreciation - Buildings Accumulated Depreciation - Furniture and Fixture Loans Payable (due in 2020) Share Capital (Ordinary share, no par value) 18,000 9,000 18,000 72,700 260,000 120,125 770,000 27,000 465,800 16,700 10,200 Salaries Expenses Sales commissions Insurance Expenses 89,000 71,325 12,000 Interest Expenses 2,400 $1.268.475 $1,268,475 Information necessary to prepare the year-end adjusting entries and 2018 financial statements: 1. Depreciation (to nearest month for additions during the year): Furniture and fixtures, 10%, Buildings, 5% Included in Buildings were additions completed on 1 June 2018 costing $90,000 2. It was determined that the "Allowance for Doubtful Accounts" account at 31 December 2018 should be $4,575. 3. Prepaid insurance at 31 December 2018 should be $5,000 4. Bond Ltd. sold goods at a selling price of $12,000 (cost $8,000) to a customer on 30 December 2018. All sales are on credit. No entries for this sale have been recorded. 5. Accrued expenses at year-end include sales commissions of $900 and interest on loans payable of $120. 6. Taxes payable estimated as $10,000. On 30 December 2018, the board of directors declared dividends of $7,200 on ordinary shares, payable 28 January 2019, to shareholders of record 15 January 2019. 8. The utilities expenses and bad debt expenses should be classified as administrative expenses. The salaries expenses should be allocated 30% to selling and distribution expenses and 70% to administrative expenses. The insurance expenses should be allocated 60% to administrative expenses and 40% to selling and distribution expenses. Depreciation should be allocated to administrative expenses.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started