Answered step by step

Verified Expert Solution

Question

1 Approved Answer

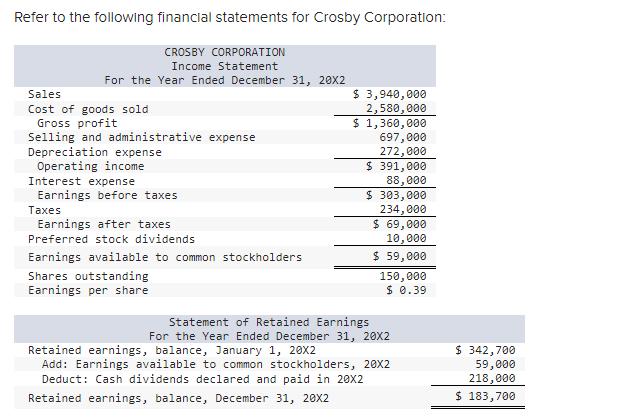

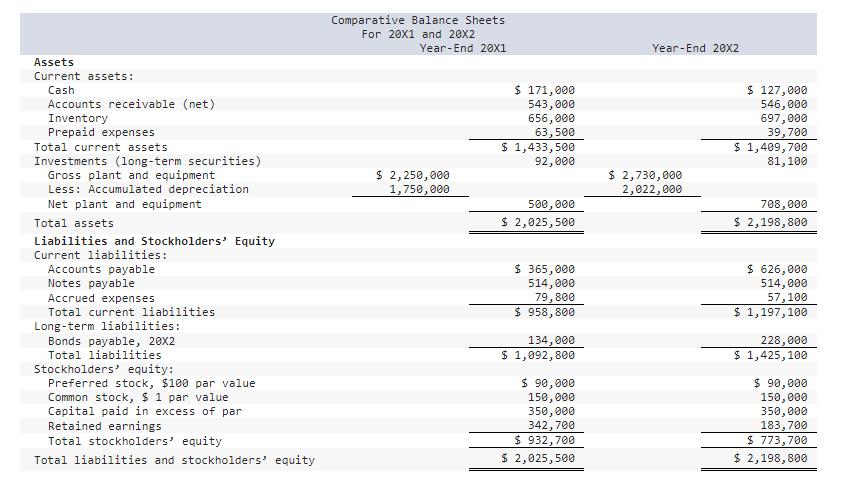

a. Prepare the statement of cash flow. b. Compute the book value per common share for both 20X1 and 20X2 for the Crosby Corporation.

a. Prepare the statement of cash flow.

b. Compute the book value per common share for both 20X1 and 20X2 for the Crosby Corporation.c. If the market value of a share of common stock is 3.2 times book value for 20X2, what is the firm's P/E ratio for 20X2?

Refer to the following financial statements for Crosby Corporation: CROSBY CORPORATION Income Statement For the Year Ended December 31, 20X2 Sales Cost of goods sold Gross profit Selling and administrative expense Depreciation expense Operating income Interest expense Earnings before taxes. Taxes Earnings after taxes Preferred stock dividends Earnings available to common stockholders Shares outstanding Earnings per share $ 3,940,000 2,580,000 $ 1,360,000 697,000 272,000 $ 391,000 88,000 $ 303,000 234,000 $ 69,000 10,000 $ 59,000 150,000 $ 0.39 Statement of Retained Earnings For the Year Ended December 31, 20X2 Retained earnings, balance, January 1, 20X2 Add: Earnings available to common stockholders, 20X2 Deduct: Cash dividends declared and paid in 20X2 Retained earnings, balance, December 31, 20X2 $ 342,700 59,000 218,000 $ 183,700

Step by Step Solution

★★★★★

3.37 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION a Statement of Cash Flows for Crosby Corporation for the year ended December 31 20X2 Cash F...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started