Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(a) Prepare the statement of changes in equity of Avery Bhd. for the year ended 30 June 2021. (10 marks) (b) Prepare the non-current assets

(a) Prepare the statement of changes in equity of Avery Bhd. for the year ended 30 June 2021. (10 marks)

(b) Prepare the non-current assets schedule of Avery Bhd. for the year ended 30 June 2021. (4 marks)

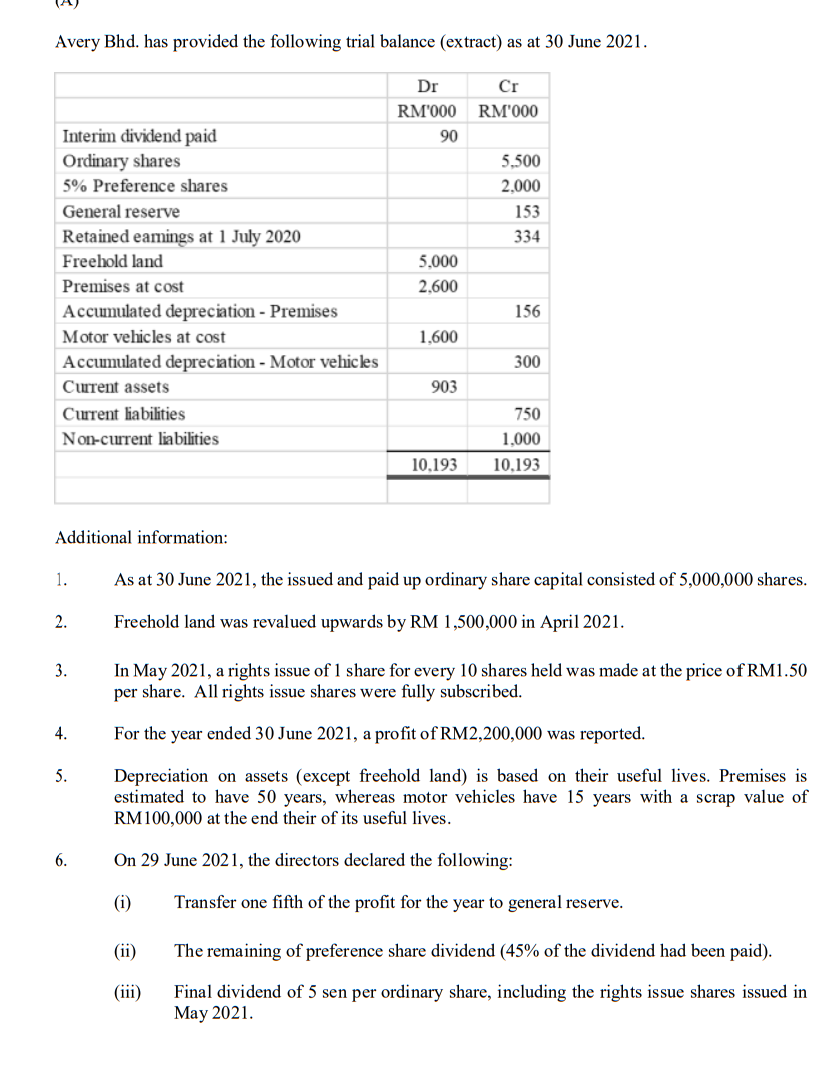

Avery Bhd. has provided the following trial balance (extract) as at 30 June 2021. Dr RM000 90 Cr RM'000 5,500 2.000 153 334 5,000 Interim dividend paid Ordinary shares 5% Preference shares General reserve Retained eamings at 1 July 2020 Freehold land Premises at cost Accumulated depreciation - Premises Motor vehicles at cost Accumulated depreciation - Motor vehicles Current assets Current liabilities Non-current liabilities 2.600 156 1,600 300 903 750 1,000 10.193 10.193 Additional information: 1. As at 30 June 2021, the issued and paid up ordinary share capital consisted of 5,000,000 shares. 2. Freehold land was revalued upwards by RM 1,500,000 in April 2021. 3. In May 2021, a rights issue of 1 share for every 10 shares held was made at the price of RM1.50 per share. All rights issue shares were fully subscribed. 4. For the year ended 30 June 2021, a profit of RM2,200,000 was reported. 5. Depreciation on assets (except freehold land) is based on their useful lives. Premises is estimated to have 50 years, whereas motor vehicles have 15 years with a scrap value of RM100,000 at the end their of its useful lives. 6. On 29 June 2021, the directors declared the following: (i) Transfer one fifth of the profit for the year to general reserve. (ii) The remaining of preference share dividend (45% of the dividend had been paid). Final dividend of 5 sen per ordinary share, including the rights issue shares issued in May 2021. (iii)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started