Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. Prepare the Statement of Profit or Loss and Statement of Financial Position extracts to account for the government Grant from March 2020 to the

a. Prepare the Statement of Profit or Loss and Statement of Financial Position extracts to account for the government Grant from March 2020 to the year ended 31 December 2022.

b. Prepare the Statement of Profit or Loss and Statement of Financial Position extracts to account for the borrowing costs related to the construction of the Office Complex

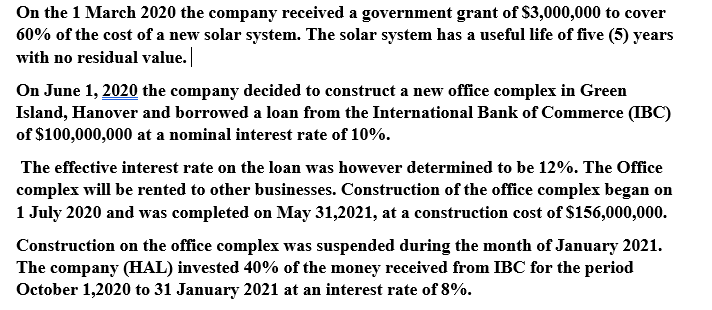

On the 1 March 2020 the company received a government grant of $3,000,000 to cover 60% of the cost of a new solar system. The solar system has a useful life of five (5) years with no residual value. On June 1, 2020 the company decided to construct a new office complex in Green Island, Hanover and borrowed a loan from the International Bank of Commerce (IBC) of $100,000,000 at a nominal interest rate of 10%. The effective interest rate on the loan was however determined to be 12%. The Office complex will be rented to other businesses. Construction of the office complex began on 1 July 2020 and was completed on May 31,2021, at a construction cost of $156,000,000. Construction on the office complex was suspended during the month of January 2021. The company (HAL) invested 40% of the money received from IBC for the period October 1,2020 to 31 January 2021 at an interest rate of 8%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started