Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A price-weighted index consists of four stocks. They are: Stock W, 1 million shares outstanding, priced at $200 per share Stock X, 15 million

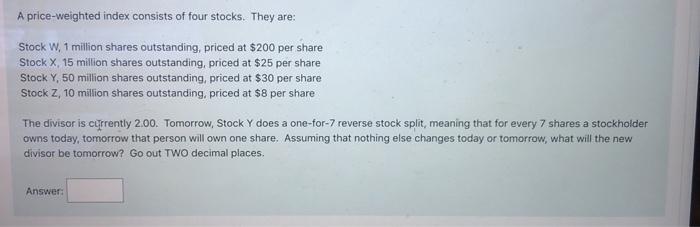

A price-weighted index consists of four stocks. They are: Stock W, 1 million shares outstanding, priced at $200 per share Stock X, 15 million shares outstanding, priced at $25 per share Stock Y, 50 million shares outstanding, priced at $30 per share Stock Z, 10 million shares outstanding, priced at $8 per share The divisor is currently 2.00. Tomorrow, Stock Y does a one-for-7 reverse stock split, meaning that for every 7 shares a stockholder owns today, tomorrow that person will own one share. Assuming that nothing else changes today or tomorrow, what will the new divisor be tomorrow? Go out TWO decimal places. Answer:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the new divisor after the reverse stock split we can use the formula for the priceweigh...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started