Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A private company subject to ASPE operates a defined benefit plan for its employees. Data on the plan for 20x3 and 20x4 are as

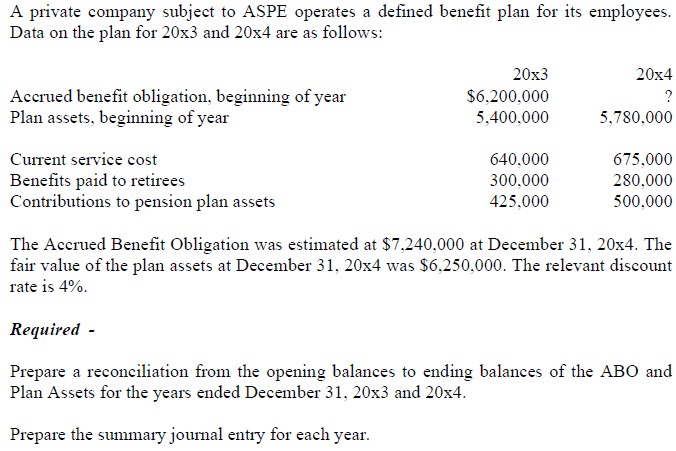

A private company subject to ASPE operates a defined benefit plan for its employees. Data on the plan for 20x3 and 20x4 are as follows: 20x3 20x4 Accrued benefit obligation, beginning of year Plan assets, beginning of year $6,200,000 5,400,000 ? 5,780,000 Current service cost 640,000 675,000 Benefits paid to retirees Contributions to pension plan assets 300,000 280,000 425,000 500,000 The Accrued Benefit Obligation was estimated at $7,240,000 at December 31, 20x4. The fair value of the plan assets at December 31, 20x4 was $6,250,000. The relevant discount rate is 4%. Required - Prepare a reconciliation from the opening balances to ending balances of the ABO and Plan Assets for the years ended December 31, 20x3 and 20x4. Prepare the summary journal entry for each year.

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Solution Journal Entry In the Books of Private Company for the Year Ended 31 Dec 2003 Dr ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started