Question

A private equity firm requested your help in deciding between two investments in the Medical Services Sector (Investment A and B). The following points should

A private equity firm requested your help in deciding between two investments in the Medical Services Sector (Investment A and B). The following points should be noted before making a decision on those two investments.

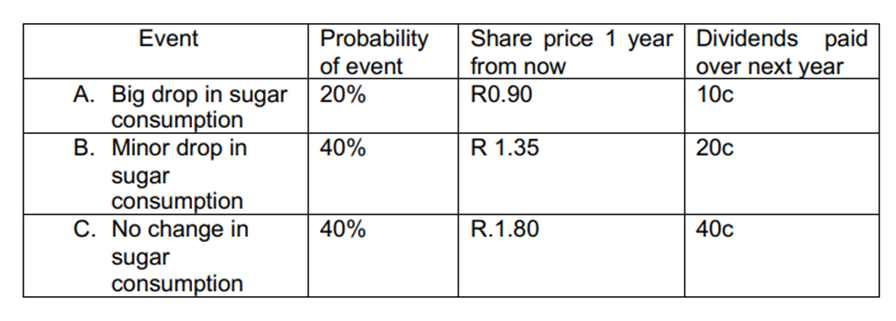

Investment A is currently trading at R1.25 per share and the following is estimated for the investment.

Investment B has shown in the past that its returns are much more volatile than that of the market. This volatility is evident from a Beta of 1.4. The returns that can be achieved in this market is currently estimated at 18% and risk-free investments are attracting 8%.

2.1 Calculate the rate of return for each of the events (A, B, C) that is associated with investment A.

2.2 Calculate the expected rate of return for investment A.

2.3 Using the CAPM, calculate the required return from Investment B that will warrant an investment. (4 Marks) 2.4 Differentiate between market risk and specific risk.

\begin{tabular}{|c|l|l|l|} \hline \multicolumn{1}{|c|}{ Event } & Probabilityofevent & Shareprice1yearfromnow & Dividendspaidovernextyear \\ \hline A.Bigdropinsugarconsumption & 20% & R0.90 & 10c \\ \hline B.Minordropinsugarconsumption & 40% & R 1.35 & 20c \\ \hline C.Nochangeinsugarconsumption & 40% & R.1.80 & 40c \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started