Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A private foundation made a multi-year pledge to a nonprofit entity on December 31, 2020. The foundation pledged to contribute $10,000 per year for

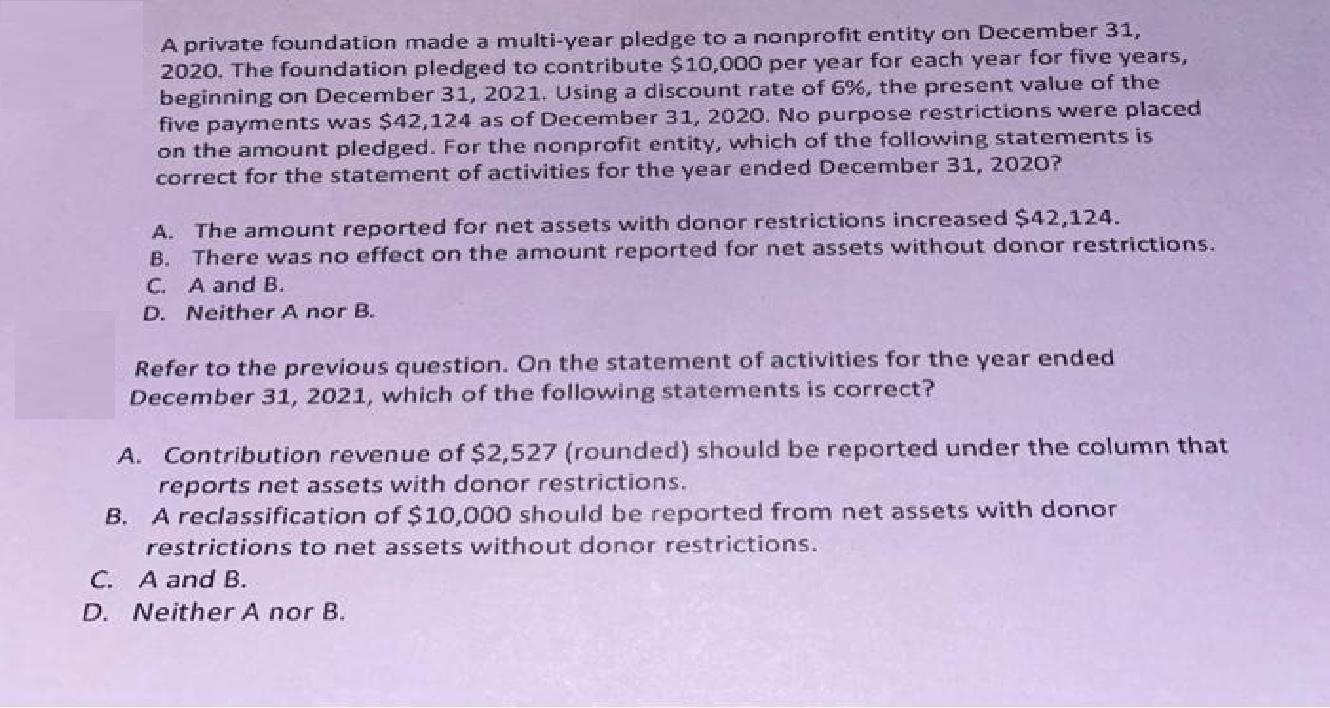

A private foundation made a multi-year pledge to a nonprofit entity on December 31, 2020. The foundation pledged to contribute $10,000 per year for each year for five years, beginning on December 31, 2021. Using a discount rate of 6%, the present value of the five payments was $42,124 as of December 31, 2020. No purpose restrictions were placed on the amount pledged. For the nonprofit entity, which of the following statements is correct for the statement of activities for the year ended December 31, 2020? A. The amount reported for net assets with donor restrictions increased $42,124. B. There was no effect on the amount reported for net assets without donor restrictions. C. A and B. D. Neither A nor B. Refer to the previous question. On the statement of activities for the year ended December 31, 2021, which of the following statements is correct? A. Contribution revenue of $2,527 (rounded) should be reported under the column that reports net assets with donor restrictions. B. A reclassification of $10,000 should be reported from net assets with donor restrictions to net assets without donor restrictions. C. A and B. D. Neither A nor B.

Step by Step Solution

★★★★★

3.48 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Step 11 25 A The amount reported for net assets with donor restrictions increased 4212...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started