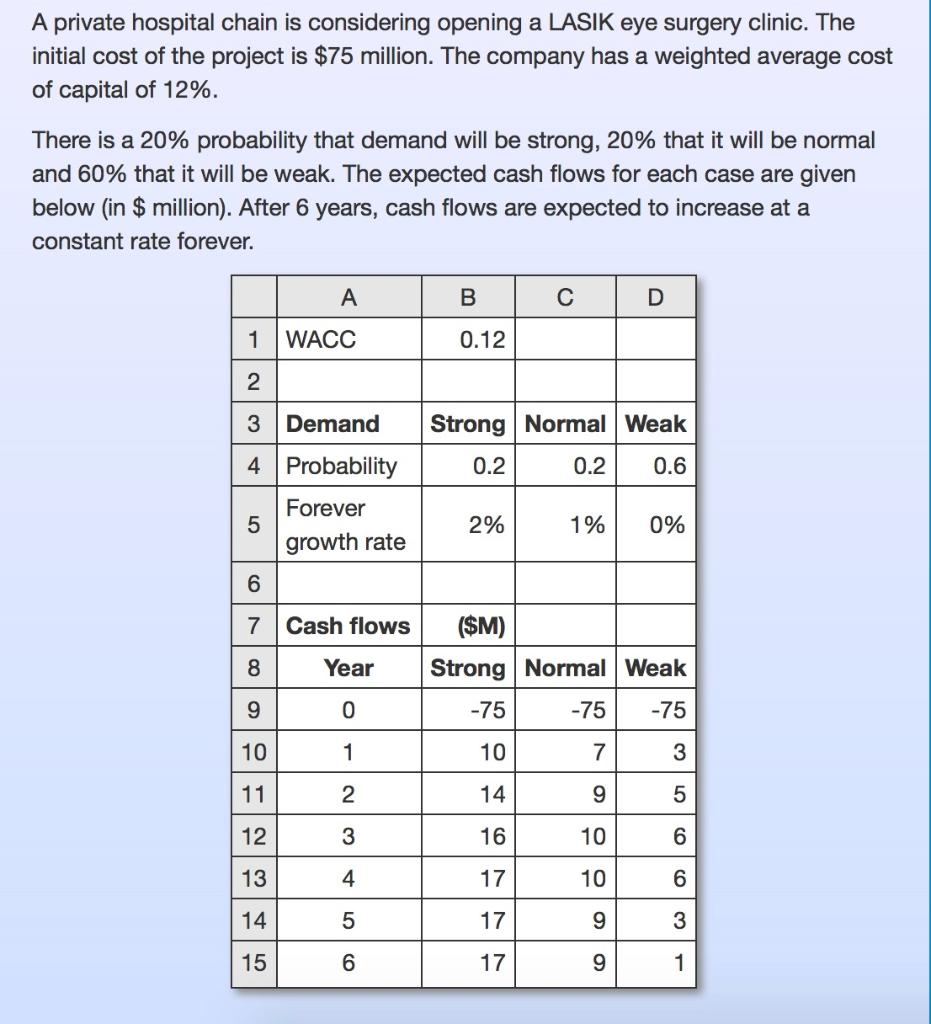

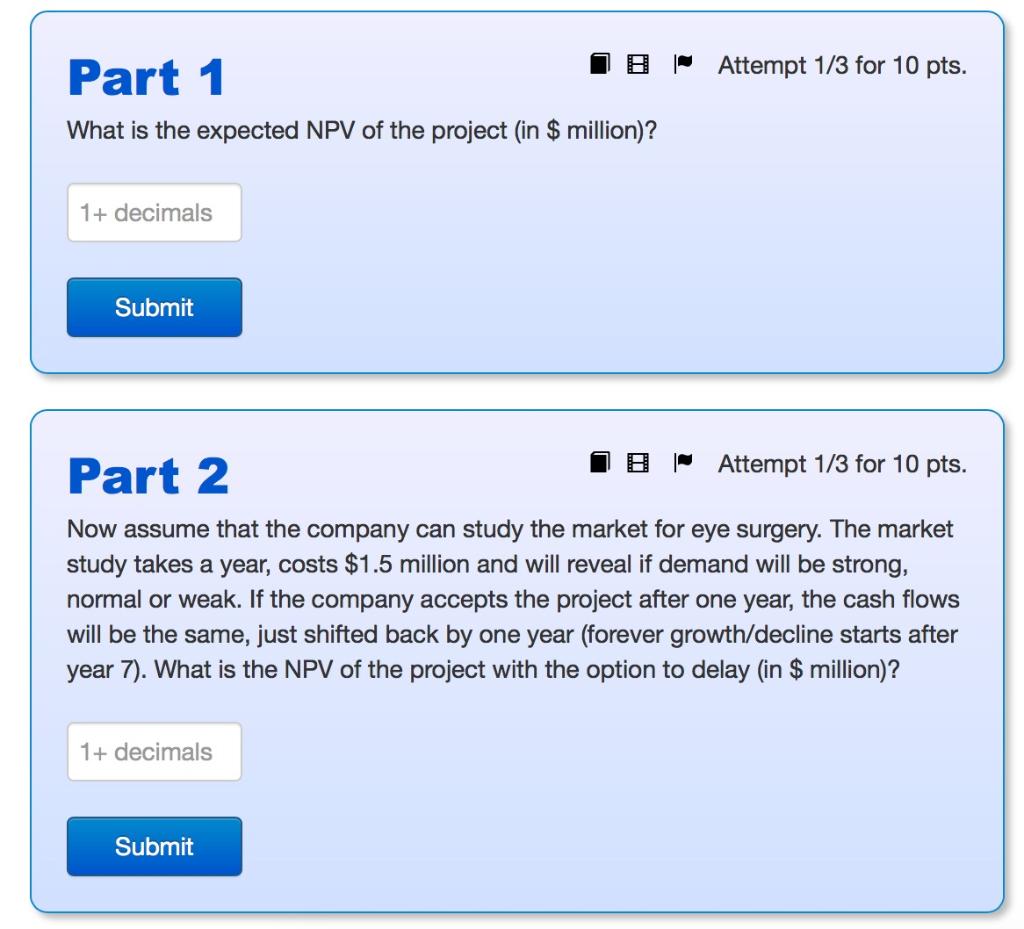

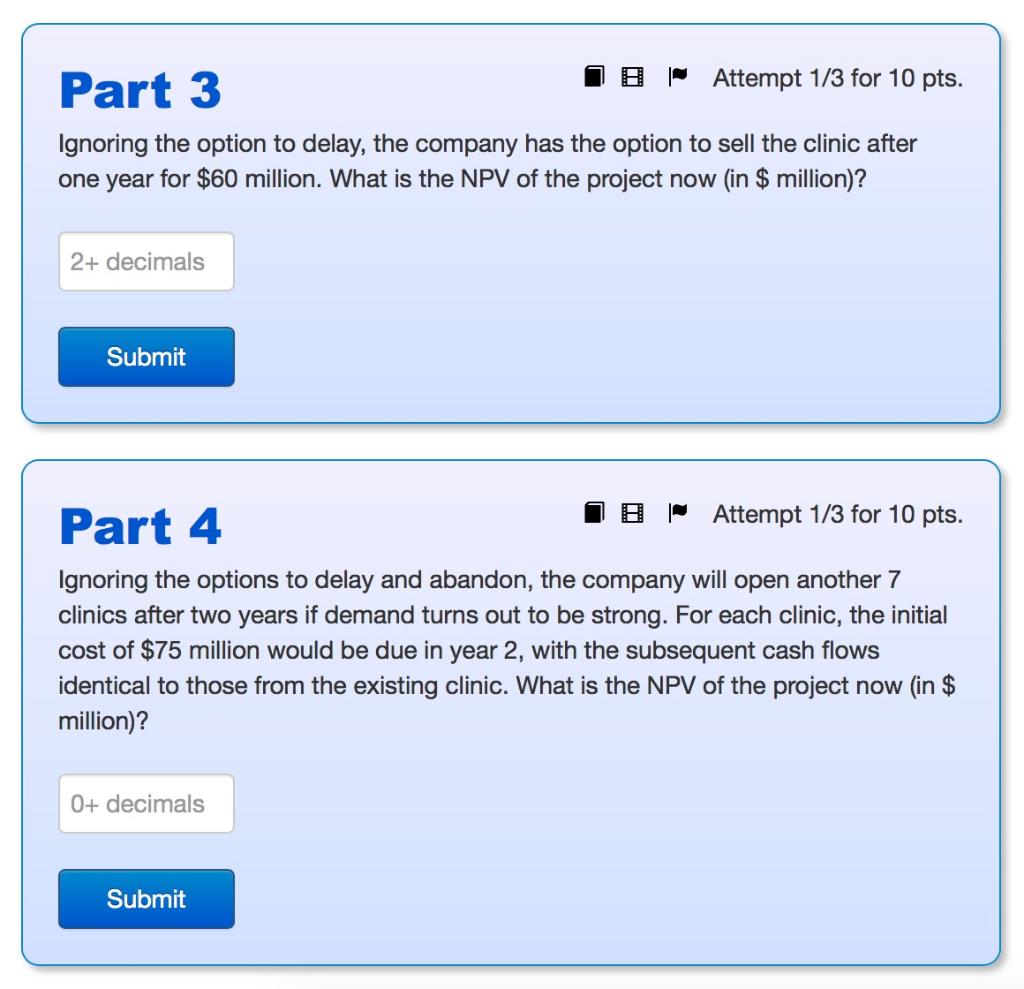

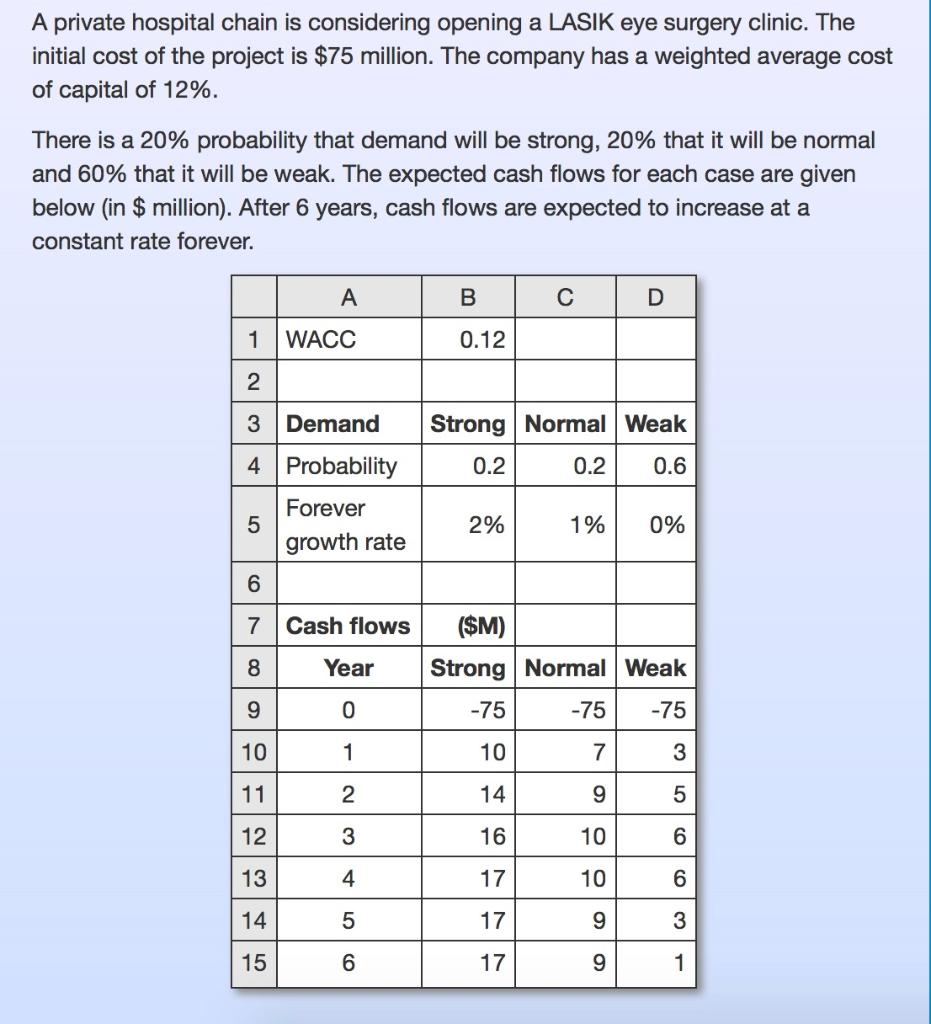

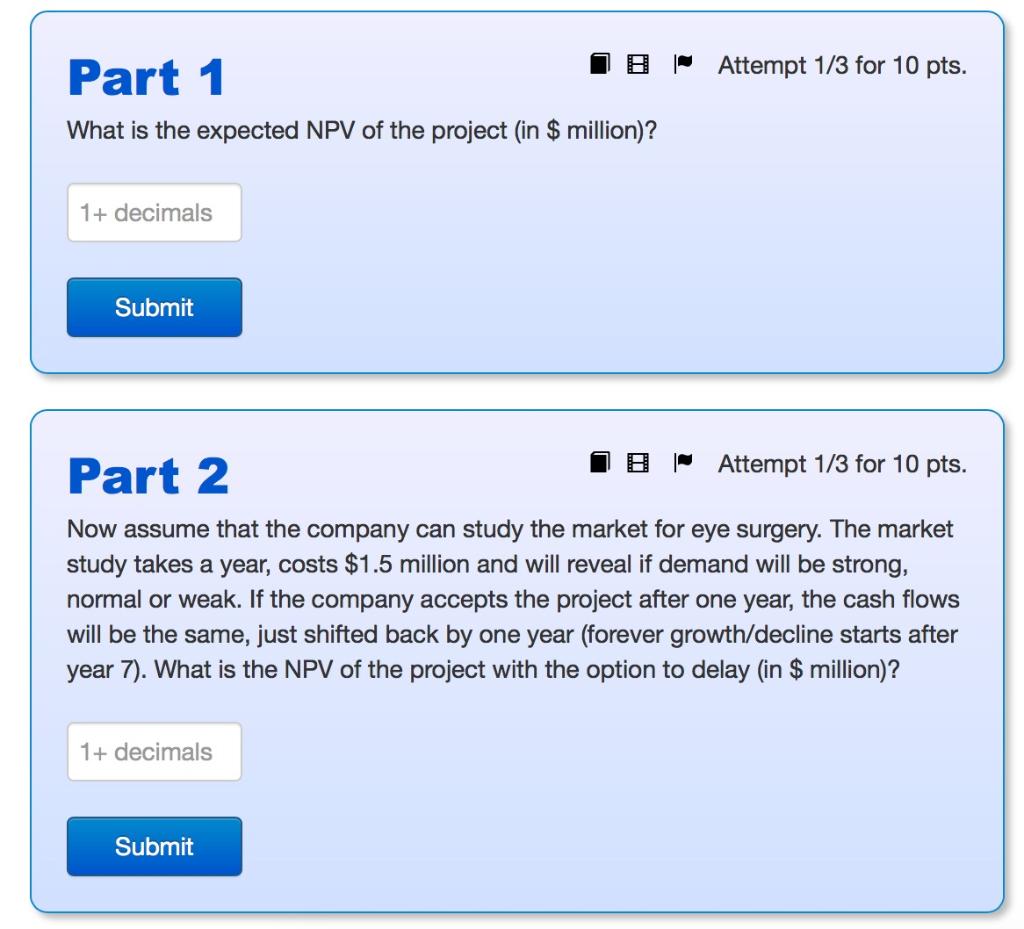

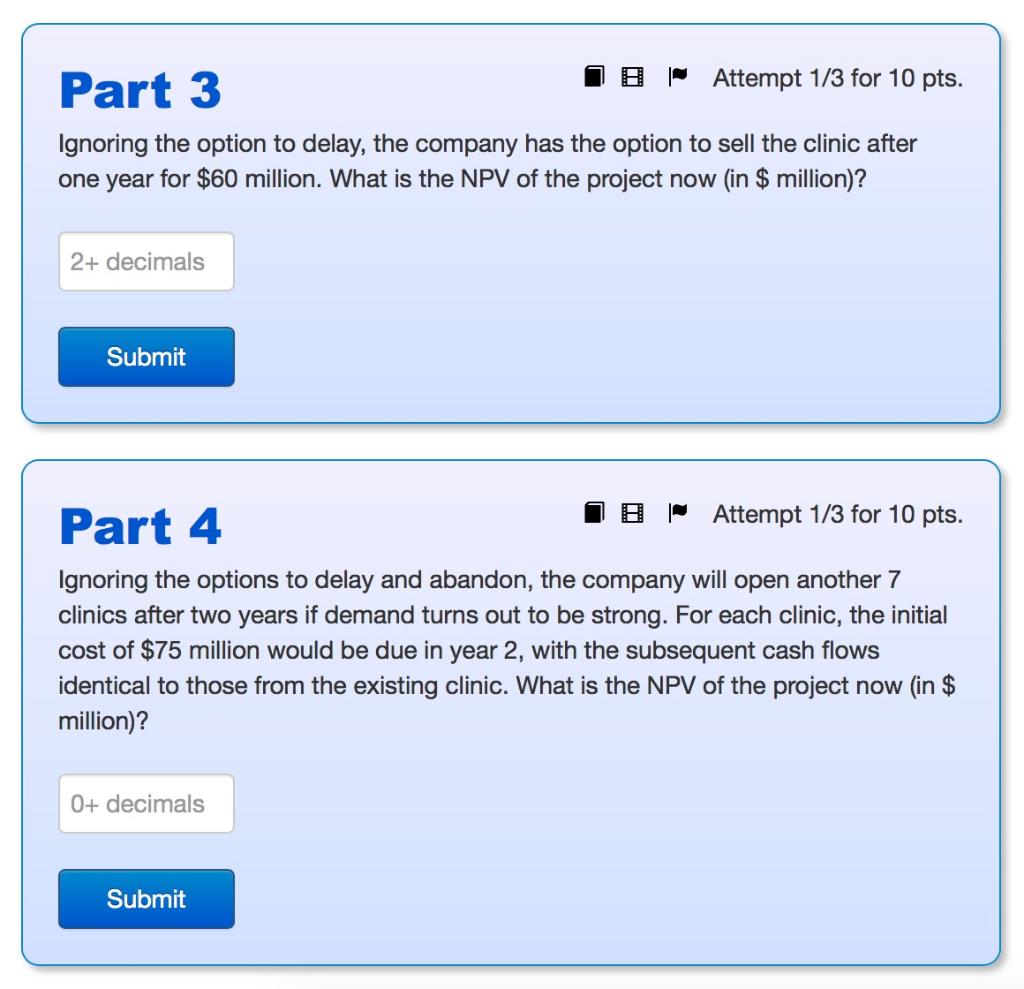

A private hospital chain is considering opening a LASIK eye surgery clinic. The initial cost of the project is $75 million. The company has a weighted average cost of capital of 12%. There is a 20% probability that demand will be strong, 20% that it will be normal and 60% that it will be weak. The expected cash flows for each case are given below (in $ million). After 6 years, cash flows are expected to increase at a constant rate forever. A B D 1 WACC 0.12 2 Strong Normal Weak 0.2 0.2 0.6 3 Demand 4 Probability Forever 5 growth rate 2% 1% 0% 6 7 Cash flows 8 Year ($M) Strong Normal Weak -75 -75 -75 9 0 10 1 10 7 3 11 2 14 9 5 12 3 16 10 6 13 4 17 10 6 14 LO 17 9 3 15 6 17 9 1 | Attempt 1/3 for 10 pts. Part 1 What is the expected NPV of the project (in $ million)? 1+ decimals Submit Part 2 8 | Attempt 1/3 for 10 pts. Now assume that the company can study the market for eye surgery. The market study takes a year, costs $1.5 million and will reveal if demand will be strong, normal or weak. If the company accepts the project after one year, the cash flows will be the same, just shifted back by one year (forever growth/decline starts after year 7). What is the NPV of the project with the option to delay (in $ million)? 1+ decimals Submit Part 3 | Attempt 1/3 for 10 pts. Ignoring the option to delay, the company has the option to sell the clinic after one year for $60 million. What is the NPV of the project now (in $ million)? 2+ decimals Submit Part 4 | Attempt 1/3 for 10 pts. Ignoring the options to delay and abandon, the company will open another 7 clinics after two years if demand turns out to be strong. For each clinic, the initial cost of $75 million would be due in year 2, with the subsequent cash flows identical to those from the existing clinic. What is the NPV of the project now (in $ million)? 0+ decimals Submit A private hospital chain is considering opening a LASIK eye surgery clinic. The initial cost of the project is $75 million. The company has a weighted average cost of capital of 12%. There is a 20% probability that demand will be strong, 20% that it will be normal and 60% that it will be weak. The expected cash flows for each case are given below (in $ million). After 6 years, cash flows are expected to increase at a constant rate forever. A B D 1 WACC 0.12 2 Strong Normal Weak 0.2 0.2 0.6 3 Demand 4 Probability Forever 5 growth rate 2% 1% 0% 6 7 Cash flows 8 Year ($M) Strong Normal Weak -75 -75 -75 9 0 10 1 10 7 3 11 2 14 9 5 12 3 16 10 6 13 4 17 10 6 14 LO 17 9 3 15 6 17 9 1 | Attempt 1/3 for 10 pts. Part 1 What is the expected NPV of the project (in $ million)? 1+ decimals Submit Part 2 8 | Attempt 1/3 for 10 pts. Now assume that the company can study the market for eye surgery. The market study takes a year, costs $1.5 million and will reveal if demand will be strong, normal or weak. If the company accepts the project after one year, the cash flows will be the same, just shifted back by one year (forever growth/decline starts after year 7). What is the NPV of the project with the option to delay (in $ million)? 1+ decimals Submit Part 3 | Attempt 1/3 for 10 pts. Ignoring the option to delay, the company has the option to sell the clinic after one year for $60 million. What is the NPV of the project now (in $ million)? 2+ decimals Submit Part 4 | Attempt 1/3 for 10 pts. Ignoring the options to delay and abandon, the company will open another 7 clinics after two years if demand turns out to be strong. For each clinic, the initial cost of $75 million would be due in year 2, with the subsequent cash flows identical to those from the existing clinic. What is the NPV of the project now (in $ million)? 0+ decimals Submit