Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A privately held company ABB wants to be listed on a stock exchange. The company expects to earn a net profit of $50 million

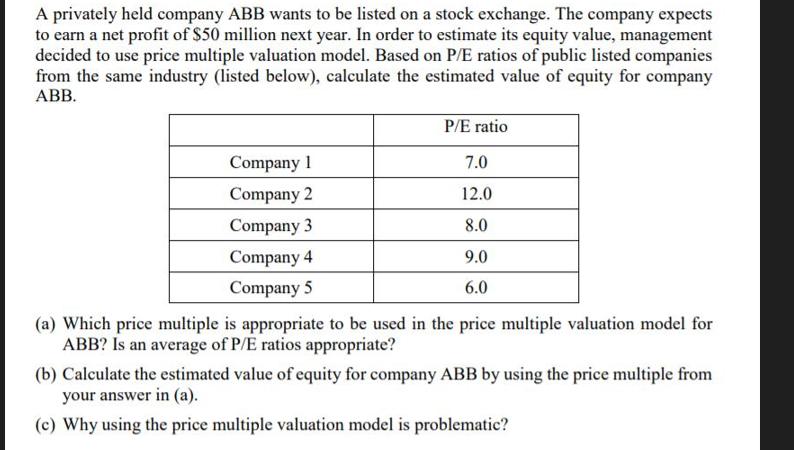

A privately held company ABB wants to be listed on a stock exchange. The company expects to earn a net profit of $50 million next year. In order to estimate its equity value, management decided to use price multiple valuation model. Based on P/E ratios of public listed companies from the same industry (listed below), calculate the estimated value of equity for company ABB. Company 1 Company 2 Company 3 Company 4 Company 5 P/E ratio 7.0 12.0 8.0 9.0 6.0 (a) Which price multiple is appropriate to be used in the price multiple valuation model for ABB? Is an average of P/E ratios appropriate? (b) Calculate the estimated value of equity for company ABB by using the price multiple from your answer in (a). (c) Why using the price multiple valuation model is problematic?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets address each part of the question step by step a Which price multiple is appropriate to be used in the price multiple valuation model for ABB Is an average of PE ratios appropriate To determine t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started