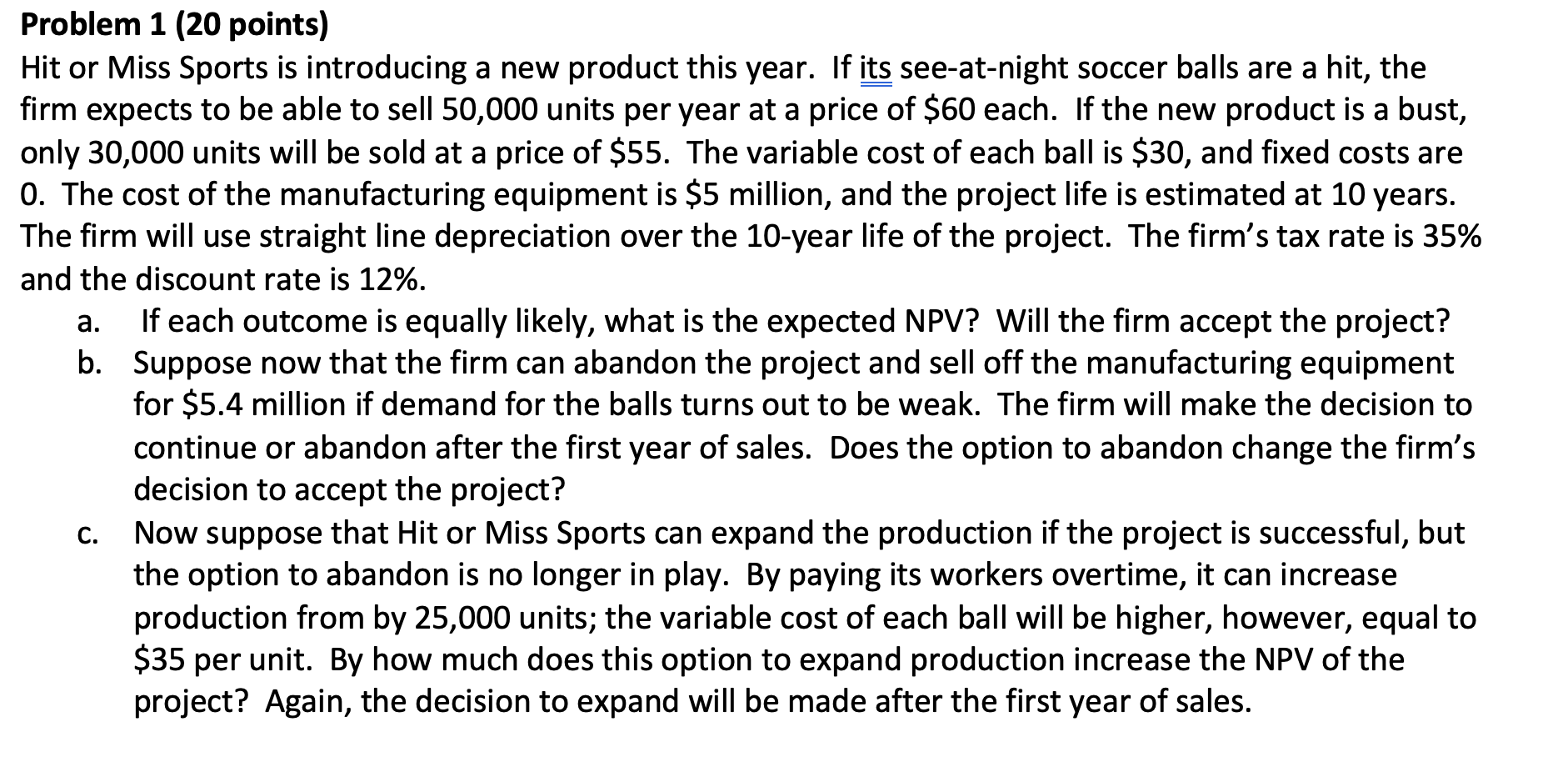

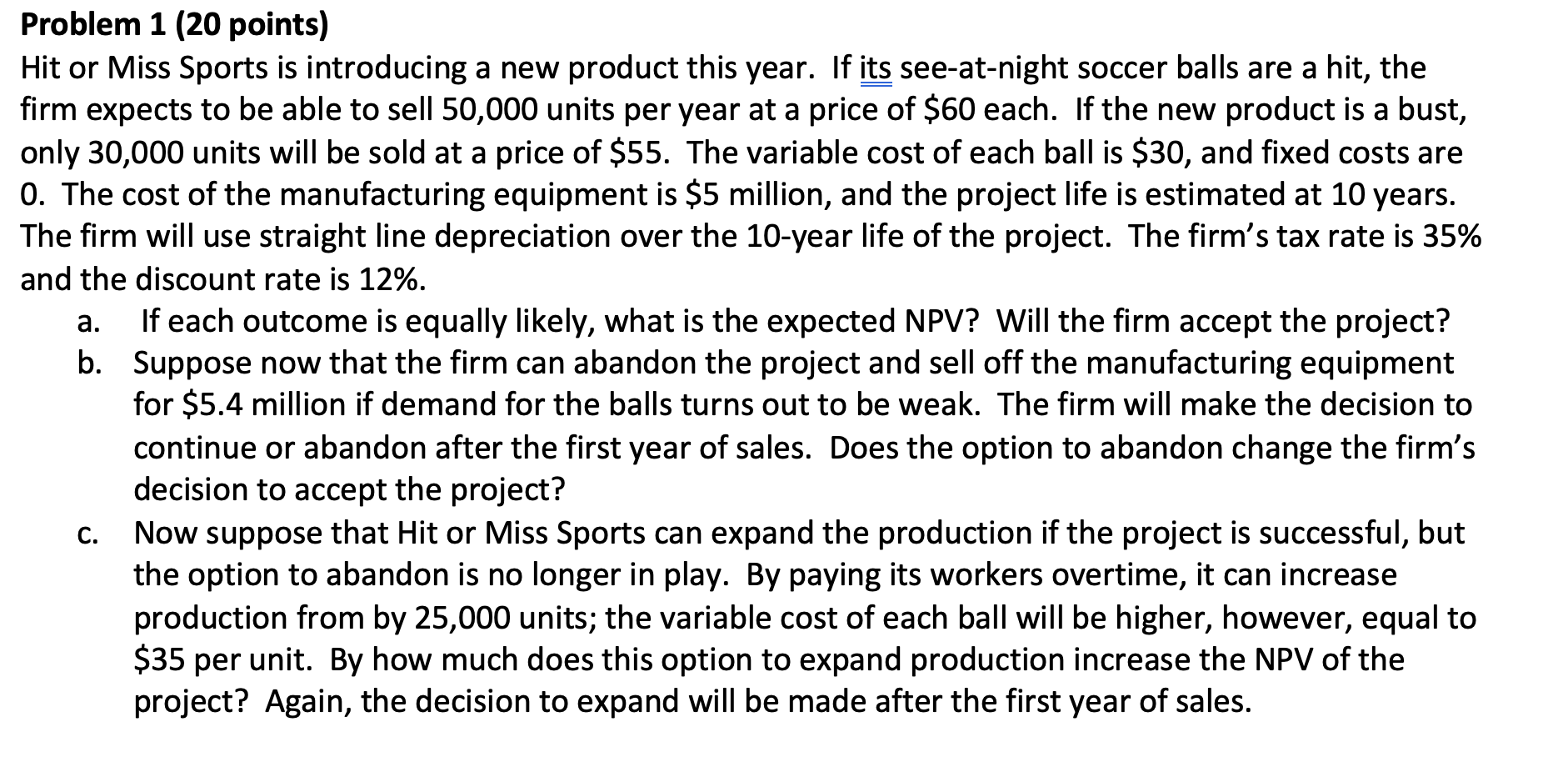

a. Problem 1 (20 points) Hit or Miss Sports is introducing a new product this year. If its see-at-night soccer balls are a hit, the firm expects to be able to sell 50,000 units per year at a price of $60 each. If the new product is a bust, only 30,000 units will be sold at a price of $55. The variable cost of each ball is $30, and fixed costs are 0. The cost of the manufacturing equipment is $5 million, and the project life is estimated at 10 years. The firm will use straight line depreciation over the 10-year life of the project. The firm's tax rate is 35% and the discount rate is 12%. If each outcome is equally likely, what is the expected NPV? Will the firm accept the project? b. Suppose now that the firm can abandon the project and sell off the manufacturing equipment for $5.4 million if demand for the balls turns out to be weak. The firm will make the decision to continue or abandon after the first year of sales. Does the option to abandon change the firm's decision to accept the project? C. Now suppose that Hit or Miss Sports can expand the production if the project is successful, but the option to abandon is no longer in play. By paying its workers overtime, it can increase production from by 25,000 units; the variable cost of each ball will be higher, however, equal to $35 per unit. By how much does this option to expand production increase the NPV of the project? Again, the decision to expand will be made after the first year of sales. a. Problem 1 (20 points) Hit or Miss Sports is introducing a new product this year. If its see-at-night soccer balls are a hit, the firm expects to be able to sell 50,000 units per year at a price of $60 each. If the new product is a bust, only 30,000 units will be sold at a price of $55. The variable cost of each ball is $30, and fixed costs are 0. The cost of the manufacturing equipment is $5 million, and the project life is estimated at 10 years. The firm will use straight line depreciation over the 10-year life of the project. The firm's tax rate is 35% and the discount rate is 12%. If each outcome is equally likely, what is the expected NPV? Will the firm accept the project? b. Suppose now that the firm can abandon the project and sell off the manufacturing equipment for $5.4 million if demand for the balls turns out to be weak. The firm will make the decision to continue or abandon after the first year of sales. Does the option to abandon change the firm's decision to accept the project? C. Now suppose that Hit or Miss Sports can expand the production if the project is successful, but the option to abandon is no longer in play. By paying its workers overtime, it can increase production from by 25,000 units; the variable cost of each ball will be higher, however, equal to $35 per unit. By how much does this option to expand production increase the NPV of the project? Again, the decision to expand will be made after the first year of sales