Answered step by step

Verified Expert Solution

Question

1 Approved Answer

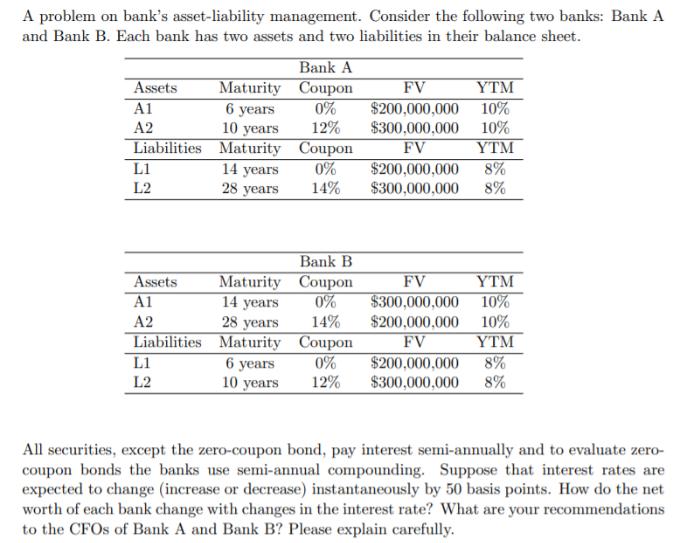

A problem on bank's asset-liability management. Consider the following two banks: Bank A and Bank B. Each bank has two assets and two liabilities

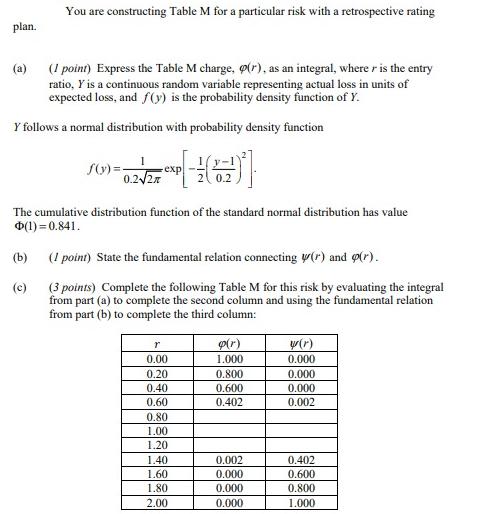

A problem on bank's asset-liability management. Consider the following two banks: Bank A and Bank B. Each bank has two assets and two liabilities in their balance sheet. Assets A1 A2 Liabilities L1 L2 Assets A1 A2 Liabilities L1 L2 Bank A Coupon 0% Maturity 6 years 10 years 12% Maturity 14 years 28 years Coupon 0% 14% Bank B Coupon 0% Maturity 14 years 28 years 14% Maturity Coupon 0% 6 years 10 years 12% YTM FV $200,000,000 10% $300,000,000 10% YTM FV $200,000,000 8% $300,000,000 8% YTM FV $300,000,000 10% $200,000,000 10% FV YTM $200,000,000 8% $300,000,000 8% All securities, except the zero-coupon bond, pay interest semi-annually and to evaluate zero- coupon bonds the banks use semi-annual compounding. Suppose that interest rates are expected to change (increase or decrease) instantaneously by 50 basis points. How do the net worth of each bank change with changes in the interest rate? What are your recommendations to the CFOs of Bank A and Bank B? Please explain carefully. plan. You are constructing Table M for a particular risk with a retrospective rating (a) (1 point) Express the Table M charge, (r), as an integral, where r is the entry ratio, Y is a continuous random variable representing actual loss in units of expected loss, and f(y) is the probability density function of Y. Y follows a normal distribution with probability density function 1 -0.227 C[-2(0-2)*] exp (b) (c) f(x)=- The cumulative distribution function of the standard normal distribution has value (1)=0.841. (1 point) State the fundamental relation connecting y(r) and (r). (3 points) Complete the following Table M for this risk by evaluating the integral from part (a) to complete the second column and using the fundamental relation from part (b) to complete the third column: r 0.00 0.20 0.40 0.60 0.80 1.00 1.20 1.40 1.60 1.80 2.00 p(r) 1.000 0.800 0.600 0.402 0.002 0.000 0.000 0.000 w(r) 0.000 0.000 0.000 0.002 0.402 0.600 0.800 1.000

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

a The integral expression for r is r r fy dy Where fy ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started