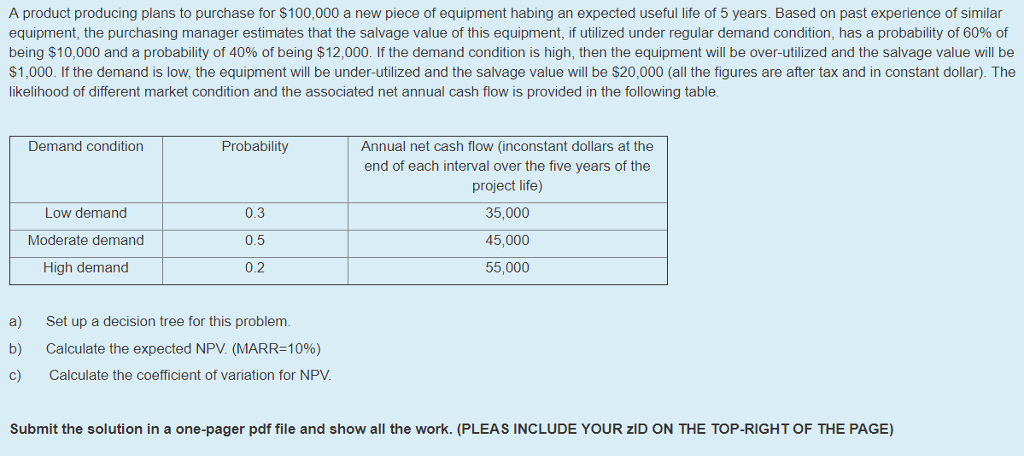

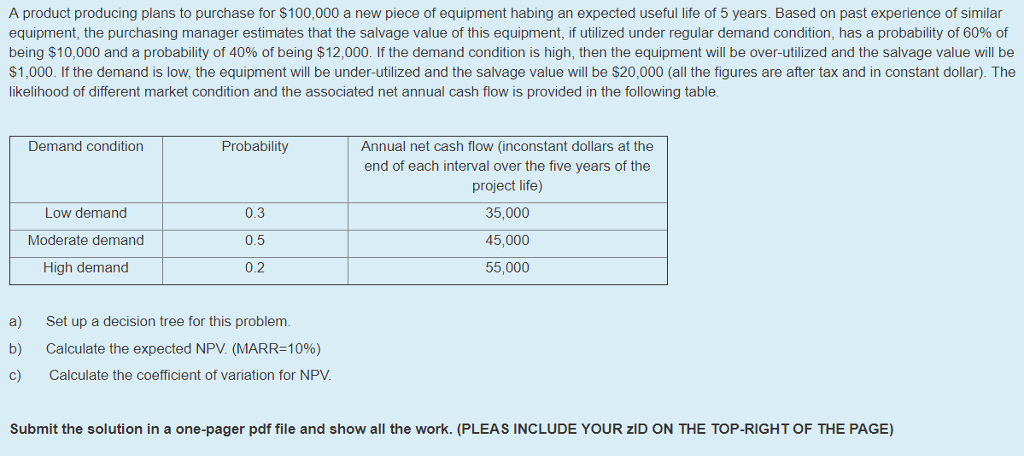

A product producing plans to purchase for $100,000 a new piece of equipment habing an expected useful life of 5 years. Based on past experience of similar equipment, the purchasing manager estimates that the salvage value of this equipment, if utilized under regular demand condition, has a probability of 60% of being $10,000 and a probability of 40% of being $12,000. If the demand condition is high, then the equipment will be over-utilized and the salvage value will be $1,000. If the demand is low, the equipment will be under-utilized and the salvage value will be $20,000 (all the figures are after tax and in constant dollar). The likelihood of different market condition and the associated net annual cash flow is provided in the following table. Demand condition Probability Low demand Moderate demand High demand Annual net cash flow (inconstant dollars at the end of each interval over the five years of the project life) 35,000 45,000 55,000 0.3 0.5 0.2 a) b) c) Set up a decision tree for this problem. Calculate the expected NPV (MARR-1096) Calculate the coefficient of variation for NPV. Submit the solution in a one-pager pdf file and show all the work. (PLEAS INCLUDE YOUR zID ON THE TOP-RIGHT OF THE PAGE) A product producing plans to purchase for $100,000 a new piece of equipment habing an expected useful life of 5 years. Based on past experience of similar equipment, the purchasing manager estimates that the salvage value of this equipment, if utilized under regular demand condition, has a probability of 60% of being $10,000 and a probability of 40% of being $12,000. If the demand condition is high, then the equipment will be over-utilized and the salvage value will be $1,000. If the demand is low, the equipment will be under-utilized and the salvage value will be $20,000 (all the figures are after tax and in constant dollar). The likelihood of different market condition and the associated net annual cash flow is provided in the following table. Demand condition Probability Low demand Moderate demand High demand Annual net cash flow (inconstant dollars at the end of each interval over the five years of the project life) 35,000 45,000 55,000 0.3 0.5 0.2 a) b) c) Set up a decision tree for this problem. Calculate the expected NPV (MARR-1096) Calculate the coefficient of variation for NPV. Submit the solution in a one-pager pdf file and show all the work. (PLEAS INCLUDE YOUR zID ON THE TOP-RIGHT OF THE PAGE)