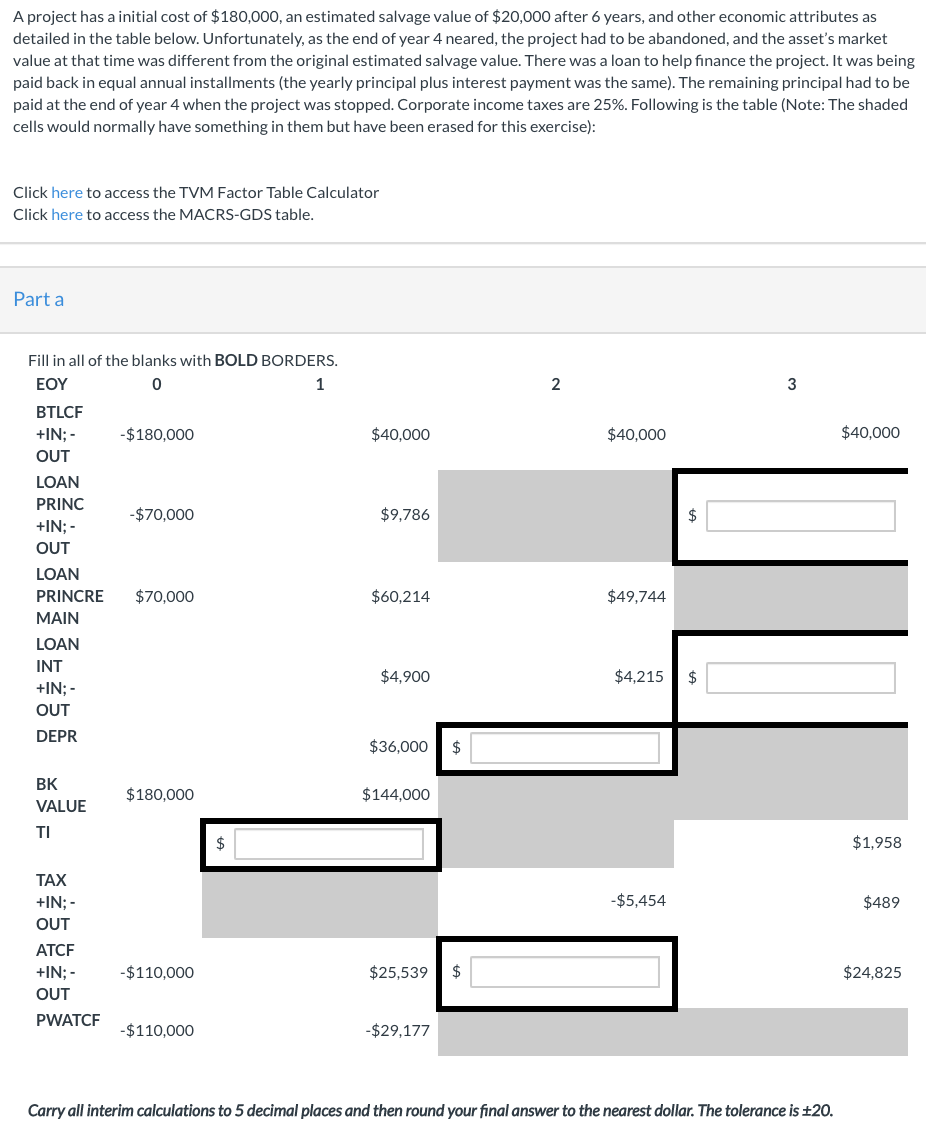

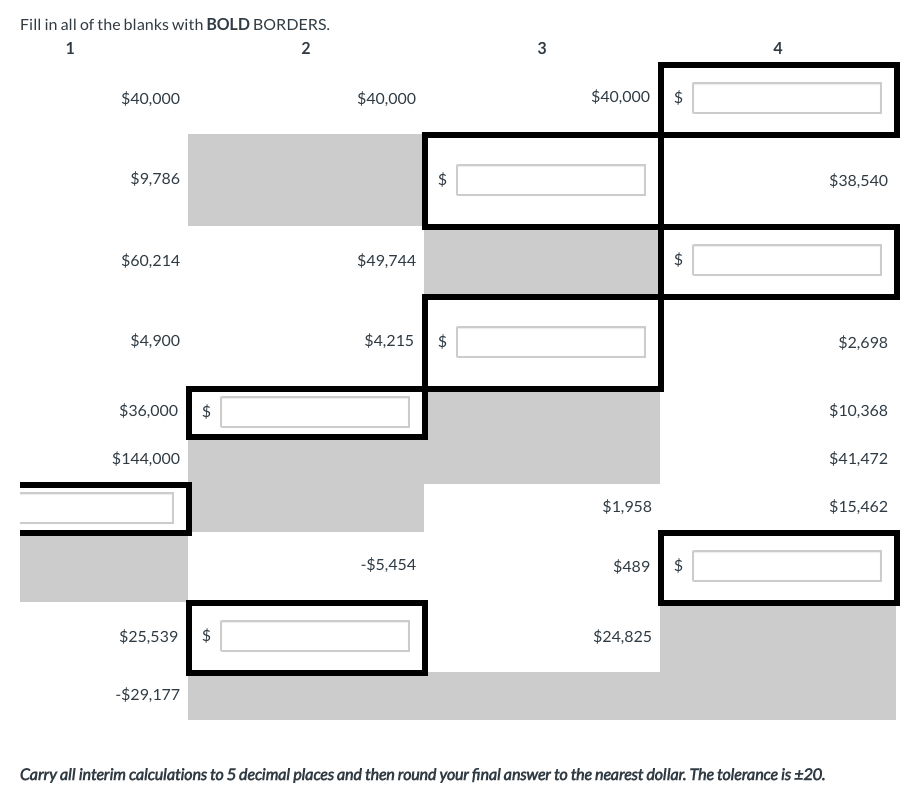

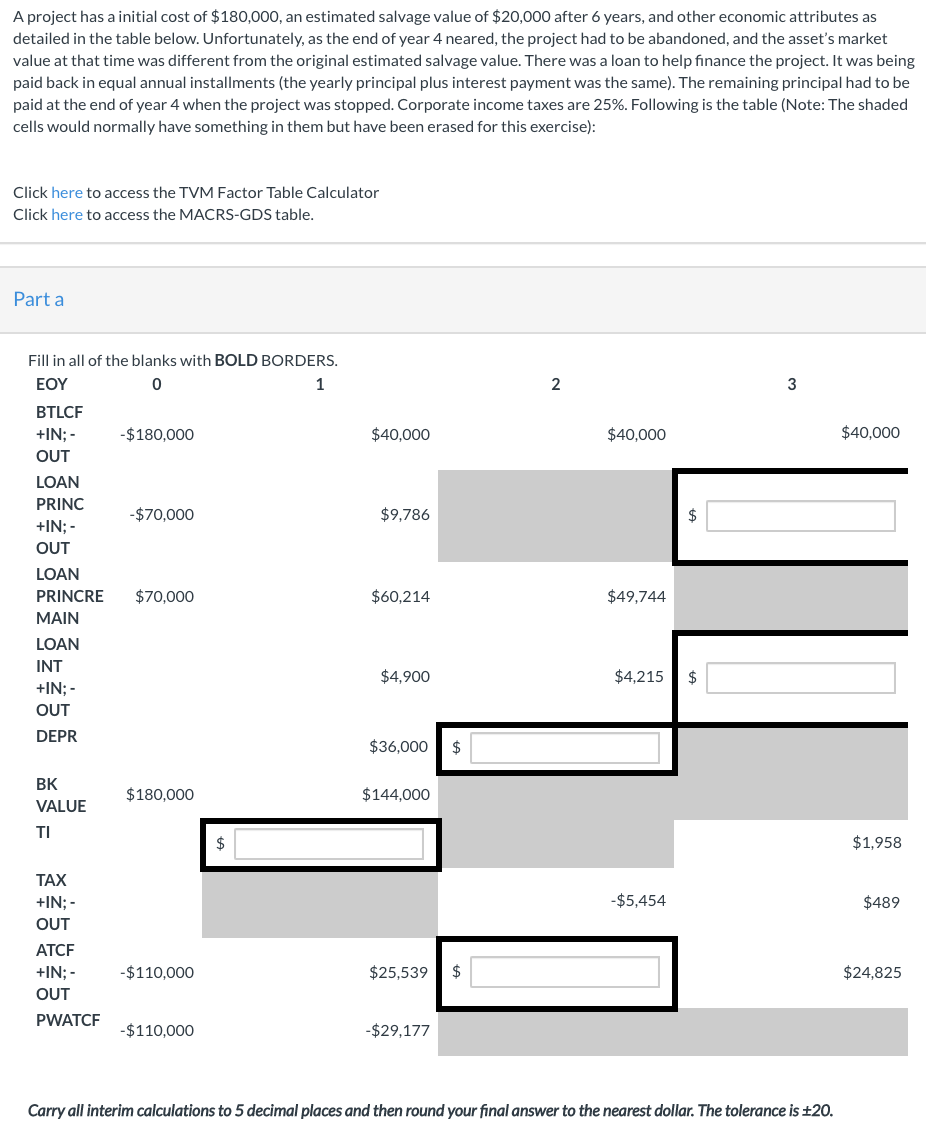

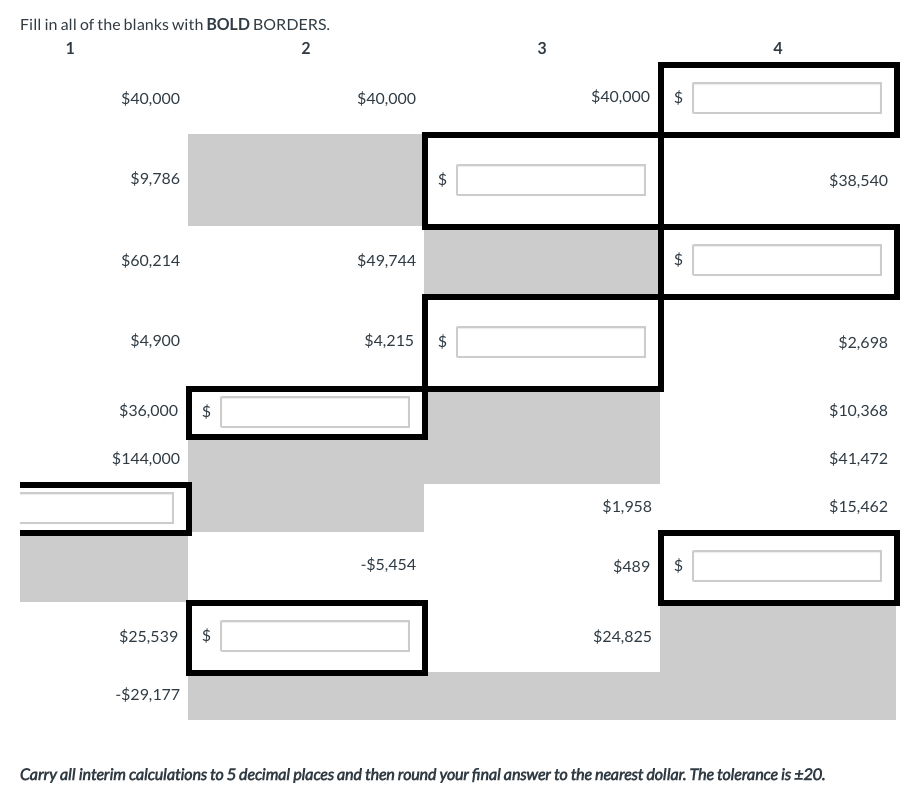

A project has a initial cost of $180,000, an estimated salvage value of $20,000 after 6 years, and other economic attributes as detailed in the table below. Unfortunately, as the end of year 4 neared, the project had to be abandoned, and the asset's market value at that time was different from the original estimated salvage value. There was a loan to help finance the project. It was being paid back in equal annual installments (the yearly principal plus interest payment was the same). The remaining principal had to be paid at the end of year 4 when the project was stopped. Corporate income taxes are 25%. Following is the table (Note: The shaded cells would normally have something in them but have been erased for this exercise): Click here to access the TVM Factor Table Calculator Click here to access the MACRS-GDS table. Parta 2 3 $40,000 $40,000 $40,000 $9,786 $ Fill in all of the blanks with BOLD BORDERS. EOY 0 1 BTLCF +IN; - -$180,000 OUT LOAN PRINC -$70,000 +IN; - OUT LOAN PRINCRE $70,000 MAIN LOAN INT +IN; - OUT $60,214 $49,744 $4,900 $4,215 $ DEPR $36,000 BK VALUE $180,000 $144,000 TI $ $1,958 TAX +IN; - OUT -$5,454 $489 ATCF +IN; - OUT $110,000 $25,539 $ $24,825 PWATCF -$110,000 -$29,177 Carry all interim calculations to 5 decimal places and then round your final answer to the nearest dollar. The tolerance is +20. Fill in all of the blanks with BOLD BORDERS. 1 2 3 4 $40,000 $40,000 $40,000 $ $ $9,786 $ $38,540 $60,214 $49,744 LA $ $4,900 $4,215 $ $2,698 $36,000 $ $10,368 $144,000 $41,472 $1,958 $15,462 $5,454 $489 $ $25,539 $ $24,825 -$29,177 Carry all interim calculations to 5 decimal places and then round your final answer to the nearest dollar. The tolerance is +20. A project has a initial cost of $180,000, an estimated salvage value of $20,000 after 6 years, and other economic attributes as detailed in the table below. Unfortunately, as the end of year 4 neared, the project had to be abandoned, and the asset's market value at that time was different from the original estimated salvage value. There was a loan to help finance the project. It was being paid back in equal annual installments (the yearly principal plus interest payment was the same). The remaining principal had to be paid at the end of year 4 when the project was stopped. Corporate income taxes are 25%. Following is the table (Note: The shaded cells would normally have something in them but have been erased for this exercise): Click here to access the TVM Factor Table Calculator Click here to access the MACRS-GDS table. Parta 2 3 $40,000 $40,000 $40,000 $9,786 $ Fill in all of the blanks with BOLD BORDERS. EOY 0 1 BTLCF +IN; - -$180,000 OUT LOAN PRINC -$70,000 +IN; - OUT LOAN PRINCRE $70,000 MAIN LOAN INT +IN; - OUT $60,214 $49,744 $4,900 $4,215 $ DEPR $36,000 BK VALUE $180,000 $144,000 TI $ $1,958 TAX +IN; - OUT -$5,454 $489 ATCF +IN; - OUT $110,000 $25,539 $ $24,825 PWATCF -$110,000 -$29,177 Carry all interim calculations to 5 decimal places and then round your final answer to the nearest dollar. The tolerance is +20. Fill in all of the blanks with BOLD BORDERS. 1 2 3 4 $40,000 $40,000 $40,000 $ $ $9,786 $ $38,540 $60,214 $49,744 LA $ $4,900 $4,215 $ $2,698 $36,000 $ $10,368 $144,000 $41,472 $1,958 $15,462 $5,454 $489 $ $25,539 $ $24,825 -$29,177 Carry all interim calculations to 5 decimal places and then round your final answer to the nearest dollar. The tolerance is +20