Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A project has the following stream of costs and benefits over time. Discount the amounts to their present worth and determine the Net Present

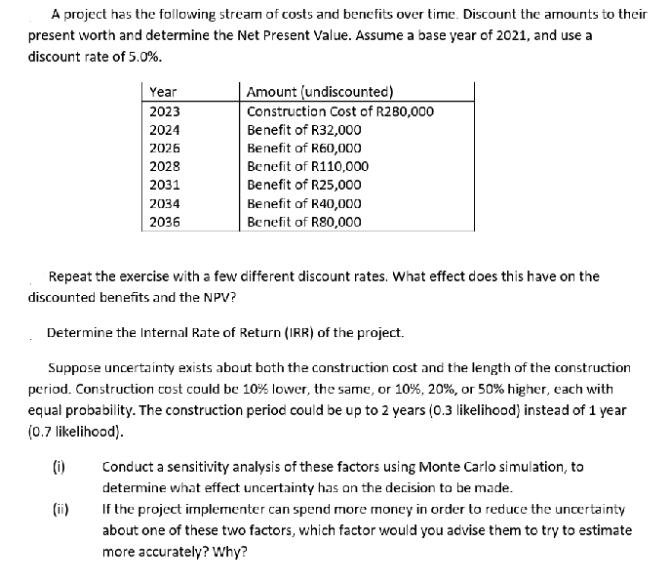

A project has the following stream of costs and benefits over time. Discount the amounts to their present worth and determine the Net Present Value. Assume a base year of 2021, and use a discount rate of 5.0%. Year 2023 2024 2026 2028 2031 2034 2036 Amount (undiscounted) Construction Cost of R280,000 Benefit of R32,000 Benefit of R60,000 Benefit of R110,000 Benefit of R25,000 Benefit of R40,000 Benefit of R80,000 Repeat the exercise with a few different discount rates. What effect does this have on the discounted benefits and the NPV? Determine the Internal Rate of Return (IRR) of the project. Suppose uncertainty exists about both the construction cost and the length of the construction period. Construction cost could be 10% lower, the same, or 10%, 20%, or 50% higher, each with equal probability. The construction period could be up to 2 years (0.3 likelihood) instead of 1 year (0.7 likelihood). (i) Conduct a sensitivity analysis of these factors using Monte Carlo simulation, to determine what effect uncertainty has on the decision to be made. If the project implementer can spend more money in order to reduce the uncertainty about one of these two factors, which factor would you advise them to try to estimate more accurately? Why?

Step by Step Solution

★★★★★

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the Net Present Value NPV of the project we need to discount the future cash flows to their present value using the discount rate The formula for NPV is NPV CF1 1 r1 CF2 1 r2 CFn 1 rn whe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started