Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A project is being considered that requires $10,000,000 for fixed-capital investment in year j = -1 and $3,000,000 for working capital in year j

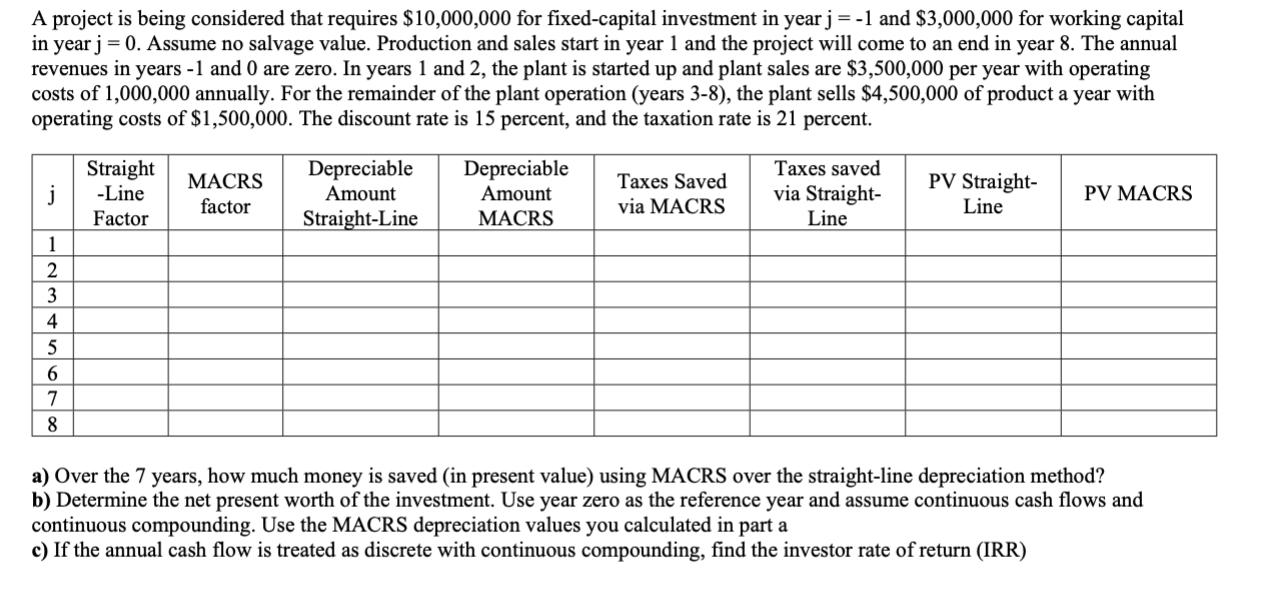

A project is being considered that requires $10,000,000 for fixed-capital investment in year j = -1 and $3,000,000 for working capital in year j = 0. Assume no salvage value. Production and sales start in year 1 and the project will come to an end in year 8. The annual revenues in years -1 and 0 are zero. In years 1 and 2, the plant is started up and plant sales are $3,500,000 per year with operating costs of 1,000,000 annually. For the remainder of the plant operation (years 3-8), the plant sells $4,500,000 of product a year with operating costs of $1,500,000. The discount rate is 15 percent, and the taxation rate is 21 percent. j 1 2 3 4 5 6 7 8 Straight -Line Factor MACRS factor Depreciable Amount Straight-Line Depreciable Amount MACRS Taxes Saved via MACRS Taxes saved via Straight- Line PV Straight- Line PV MACRS a) Over the 7 years, how much money is saved (in present value) using MACRS over the straight-line depreciation method? b) Determine the net present worth of the investment. Use year zero as the reference year and assume continuous cash flows and continuous compounding. Use the MACRS depreciation values you calculated in part a c) If the annual cash flow is treated as discrete with continuous compounding, find the investor rate of return (IRR)

Step by Step Solution

★★★★★

3.35 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

a Over the 7 years how much money is saved in present value using MAC RS over the straight line depreciation method ANS WER The present value of taxes saved over the 7 year period using MAC RS over th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started