Question

A project promises to reduce operating expenses by $30 million per year. The project requires a significant initial investment in net working capital, but

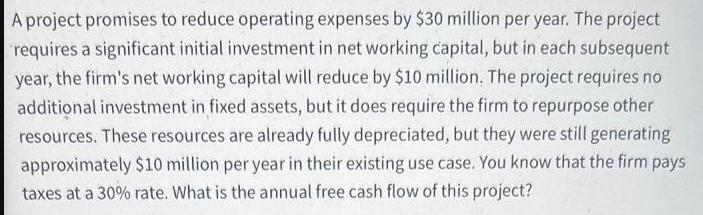

A project promises to reduce operating expenses by $30 million per year. The project requires a significant initial investment in net working capital, but in each subsequent year, the firm's net working capital will reduce by $10 million. The project requires no additional investment in fixed assets, but it does require the firm to repurpose other resources. These resources are already fully depreciated, but they were still generating approximately $10 million per year in their existing use case. You know that the firm pays taxes at a 30% rate. What is the annual free cash flow of this project?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the annual free cash flow of the project well need to consider the operating expenses n...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Reporting Financial Statement Analysis And Valuation A Strategic Perspective

Authors: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

9th Edition

1337614689, 1337614688, 9781337668262, 978-1337614689

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App