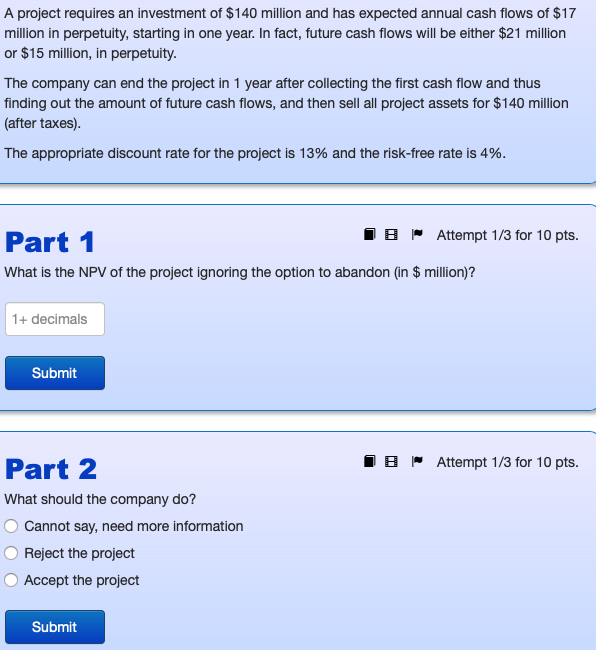

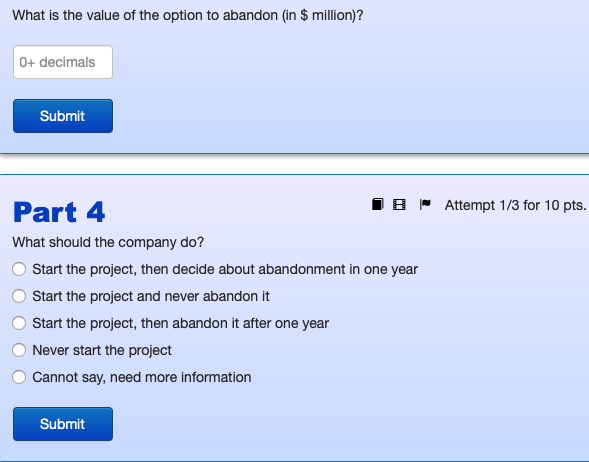

A project requires an investment of $140 million and has expected annual cash flows of $17 million in perpetuity, starting in one year. In fact, future cash flows will be either $21 million or $15 million, in perpetuity. The company can end the project in 1 year after collecting the first cash flow and thus finding out the amount of future cash flows, and then sell all project assets for $140 million (after taxes). The appropriate discount rate for the project is 13% and the risk-free rate is 4%. IB Attempt 1/3 for 10 pts. Part 1 What is the NPV of the project ignoring the option to abandon (in $ million)? 1+ decimals Submit IB Attempt 1/3 for 10 pts. Part 2 What should the company do? Cannot say, need more information Reject the project Accept the project Submit What is the value of the option to abandon (in $ million)? 0+ decimals Submit Part 4 IBAttempt 1/3 for 10 pts. What should the company do? Start the project, then decide about abandonment in one year Start the project and never abandon it Start the project, then abandon it after one year Never start the project Cannot say, need more information Submit A project requires an investment of $140 million and has expected annual cash flows of $17 million in perpetuity, starting in one year. In fact, future cash flows will be either $21 million or $15 million, in perpetuity. The company can end the project in 1 year after collecting the first cash flow and thus finding out the amount of future cash flows, and then sell all project assets for $140 million (after taxes). The appropriate discount rate for the project is 13% and the risk-free rate is 4%. IB Attempt 1/3 for 10 pts. Part 1 What is the NPV of the project ignoring the option to abandon (in $ million)? 1+ decimals Submit IB Attempt 1/3 for 10 pts. Part 2 What should the company do? Cannot say, need more information Reject the project Accept the project Submit What is the value of the option to abandon (in $ million)? 0+ decimals Submit Part 4 IBAttempt 1/3 for 10 pts. What should the company do? Start the project, then decide about abandonment in one year Start the project and never abandon it Start the project, then abandon it after one year Never start the project Cannot say, need more information Submit