Question

A property that was valued at $750,000 three years ago is being held as security for a loan. The bank's policy is to lend

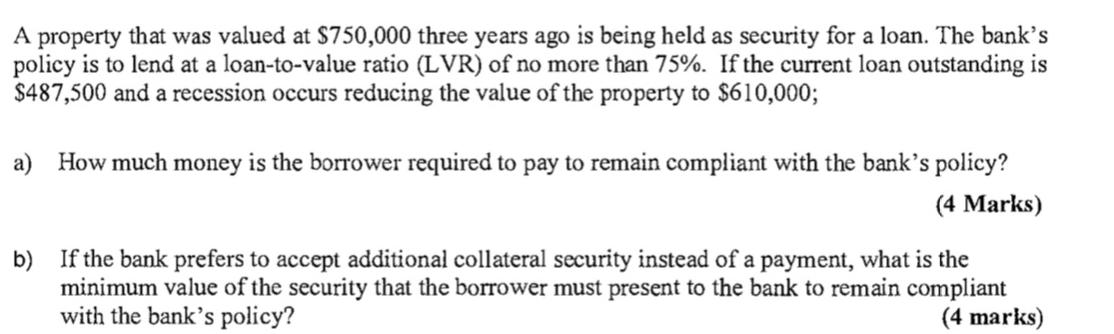

A property that was valued at $750,000 three years ago is being held as security for a loan. The bank's policy is to lend at a loan-to-value ratio (LVR) of no more than 75%. If the current loan outstanding is $487,500 and a recession occurs reducing the value of the property to $610,000; a) How much money is the borrower required to pay to remain compliant with the bank's policy? (4 Marks) b) If the bank prefers to accept additional collateral security instead of a payment, what is the minimum value of the security that the borrower must present to the bank to remain compliant with the bank's policy? (4 marks)

Step by Step Solution

3.38 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Auditing a business risk appraoch

Authors: larry e. rittenberg, bradley j. schwieger, karla m. johnston

6th Edition

9780324645095, 324645090, 978-0324375589

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App