Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A proposal for investment and return is presented to you in constant dollars. If the inflation rate is 2 percent per year and the tax

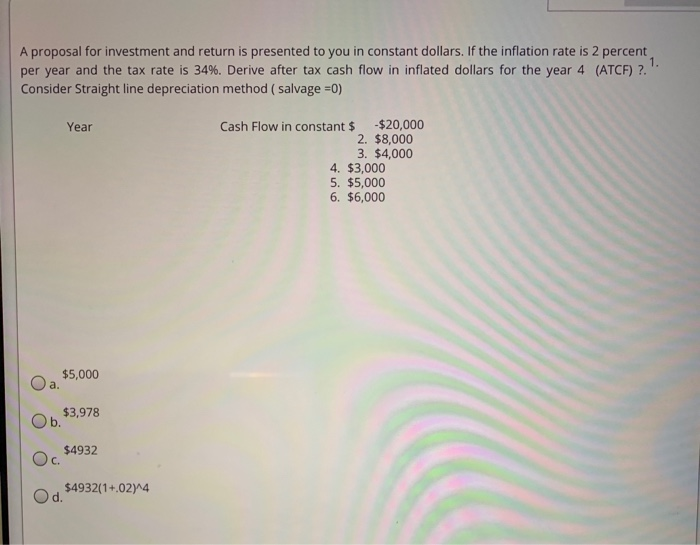

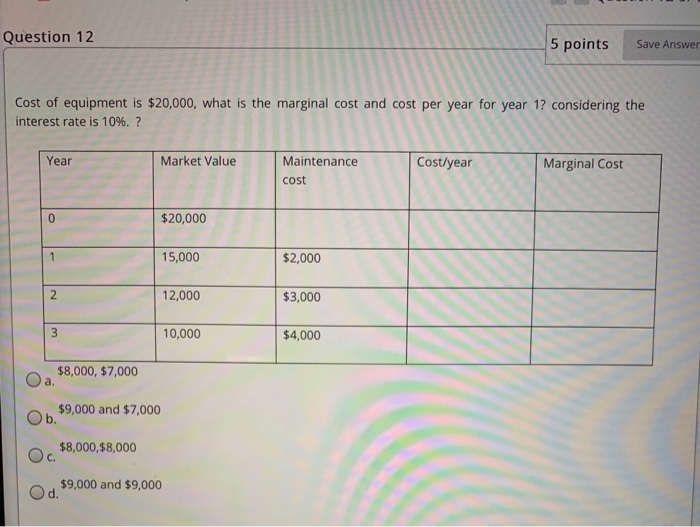

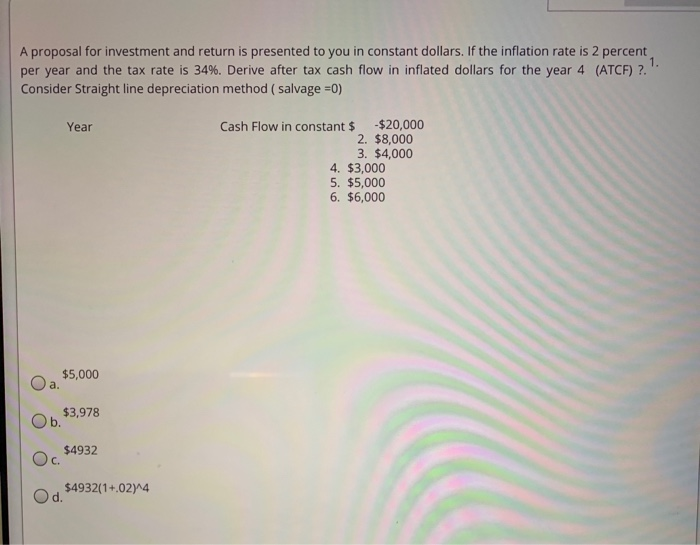

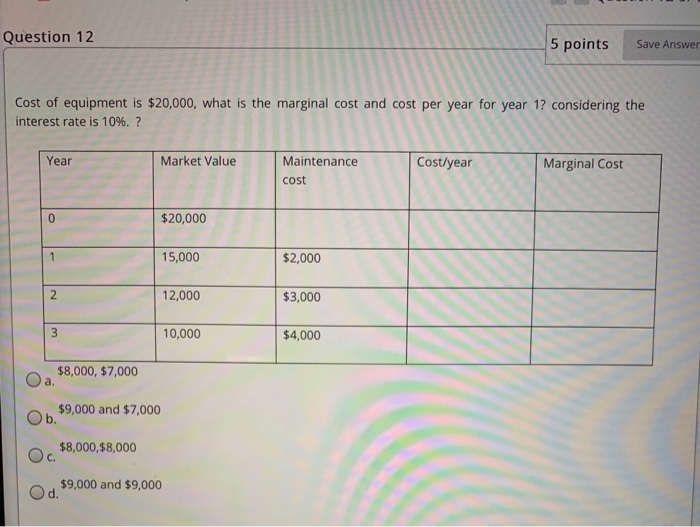

A proposal for investment and return is presented to you in constant dollars. If the inflation rate is 2 percent per year and the tax rate is 34%. Derive after tax cash flow in inflated dollars for the year 4 (ATCF) ?.. Consider Straight line depreciation method (salvage =0) Year Cash Flow in constant $ $20,000 2. $8,000 3. $4,000 4. $3,000 5. $5,000 6. $6,000 O a $5,000 Ob. $3,978 O $4932 O $4932(17.02714 Question 12 5 points Cost of equipment is $20,000, what is the marginal cost and cost per year for year 1? considering the interest rate is 10%. ? Year Market Value Cost/year Marginal Cost Maintenance cost $20,000 15,000 $2,000 12,000 $3,000 10,000 $4,000 $8,000, $7,000 $9,000 and $7,000 O $8,000,$8,000 Od $9,000 and $9,000 A proposal for investment and return is presented to you in constant dollars. If the inflation rate is 2 percent per year and the tax rate is 34%. Derive after tax cash flow in inflated dollars for the year 4 (ATCF) ?.. Consider Straight line depreciation method (salvage =0) Year Cash Flow in constant $ $20,000 2. $8,000 3. $4,000 4. $3,000 5. $5,000 6. $6,000 O a $5,000 Ob. $3,978 O $4932 O $4932(17.02714 Question 12 5 points Cost of equipment is $20,000, what is the marginal cost and cost per year for year 1? considering the interest rate is 10%. ? Year Market Value Cost/year Marginal Cost Maintenance cost $20,000 15,000 $2,000 12,000 $3,000 10,000 $4,000 $8,000, $7,000 $9,000 and $7,000 O $8,000,$8,000 Od $9,000 and $9,000

A proposal for investment and return is presented to you in constant dollars. If the inflation rate is 2 percent per year and the tax rate is 34%. Derive after tax cash flow in inflated dollars for the year 4 (ATCF) ?.. Consider Straight line depreciation method (salvage =0) Year Cash Flow in constant $ $20,000 2. $8,000 3. $4,000 4. $3,000 5. $5,000 6. $6,000 O a $5,000 Ob. $3,978 O $4932 O $4932(17.02714 Question 12 5 points Cost of equipment is $20,000, what is the marginal cost and cost per year for year 1? considering the interest rate is 10%. ? Year Market Value Cost/year Marginal Cost Maintenance cost $20,000 15,000 $2,000 12,000 $3,000 10,000 $4,000 $8,000, $7,000 $9,000 and $7,000 O $8,000,$8,000 Od $9,000 and $9,000 A proposal for investment and return is presented to you in constant dollars. If the inflation rate is 2 percent per year and the tax rate is 34%. Derive after tax cash flow in inflated dollars for the year 4 (ATCF) ?.. Consider Straight line depreciation method (salvage =0) Year Cash Flow in constant $ $20,000 2. $8,000 3. $4,000 4. $3,000 5. $5,000 6. $6,000 O a $5,000 Ob. $3,978 O $4932 O $4932(17.02714 Question 12 5 points Cost of equipment is $20,000, what is the marginal cost and cost per year for year 1? considering the interest rate is 10%. ? Year Market Value Cost/year Marginal Cost Maintenance cost $20,000 15,000 $2,000 12,000 $3,000 10,000 $4,000 $8,000, $7,000 $9,000 and $7,000 O $8,000,$8,000 Od $9,000 and $9,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started