Question

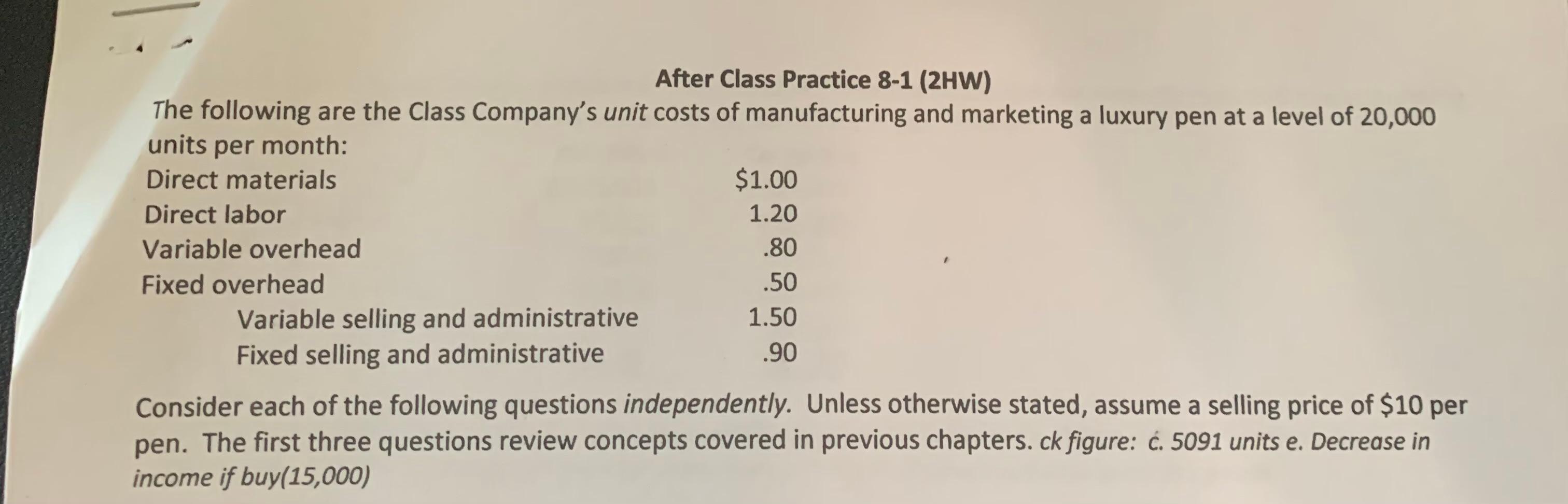

A proposal is received from an outside supplier who will make and ship the pens for $5 per pen. With the newly freed capacity, Class

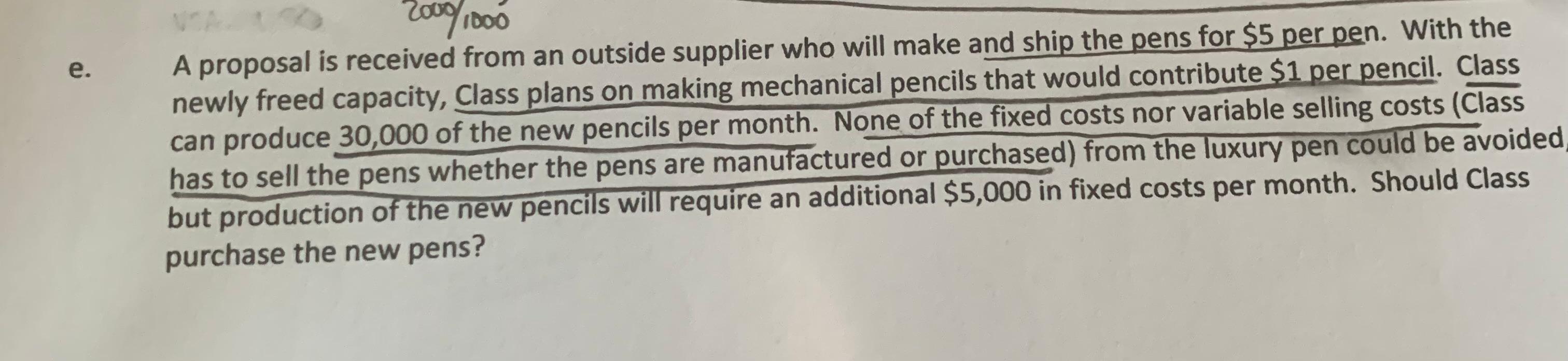

A proposal is received from an outside supplier who will make and ship the pens for $5 per pen. With the newly freed capacity, Class plans on making mechanical pencils that would contribute $1 per pencil. Class can produce 30,000 of the new pencils per month. None of the fixed costs nor variable selling costs (Class has to sell the pens whether the pens are manufactured or purchased) from the luxury pen could be avoided, but production of the new pencils will require an additional $5,000 in fixed costs per month. Should Class purchase the new pens?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started