Question

A proposed bridge would cost $4 million to build and $180,000 per year in maintenance. The bridge should last 40 years. Benefits to the

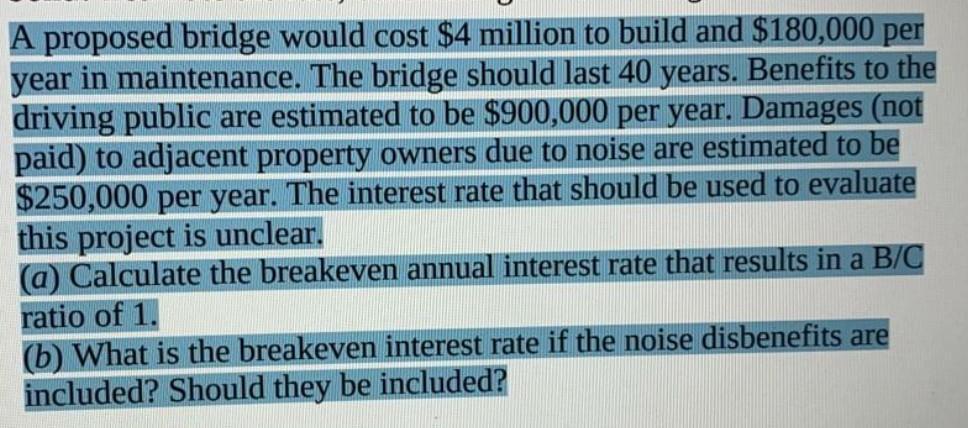

A proposed bridge would cost $4 million to build and $180,000 per year in maintenance. The bridge should last 40 years. Benefits to the driving public are estimated to be $900,000 per year. Damages (not paid) to adjacent property owners due to noise are estimated to be $250,000 per year. The interest rate that should be used to evaluate this project is unclear. (a) Calculate the breakeven annual interest rate that results in a B/C ratio of 1. (b) What is the breakeven interest rate if the noise disbenefits are included? Should they be included?

Step by Step Solution

3.58 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Dus here Aw benefit 300000 250000 650000 BC ratioAN bo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Engineering Economic Analysis

Authors: Donald Newnan, Ted Eschanbach, Jerome Lavelle

9th Edition

978-0195168075, 9780195168075

Students also viewed these Economics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App