Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A proposed cost-saving device has an installed cost of $650,000. It is in Class 8 (CCA rate=20%) for CCA purposes. It will actually function

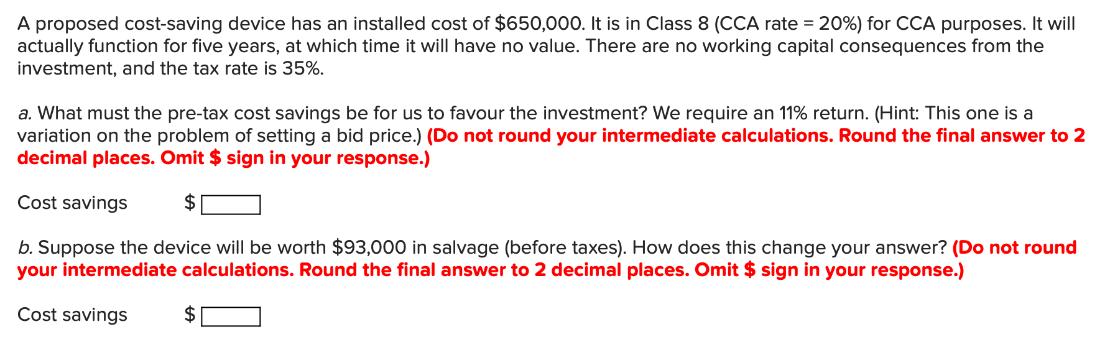

A proposed cost-saving device has an installed cost of $650,000. It is in Class 8 (CCA rate=20%) for CCA purposes. It will actually function for five years, at which time it will have no value. There are no working capital consequences from the investment, and the tax rate is 35%. a. What must the pre-tax cost savings be for us to favour the investment? We require an 11% return. (Hint: This one is a variation on the problem of setting a bid price.) (Do not round your intermediate calculations. Round the final answer to 2 decimal places. Omit $ sign in your response.) Cost savings $ b. Suppose the device will be worth $93,000 in salvage (before taxes). How does this change your answer? (Do not round your intermediate calculations. Round the final answer to 2 decimal places. Omit $ sign in your response.) Cost savings $

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

a To determine the pretax cost savings required to favor the investment we need to calculate the minimum annual cash inflow necessary to achieve an 11 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started