Question

A proposed nuclear power plant will cost $2.9 billion to build and then will produce cash flows of $370 million a year for 15

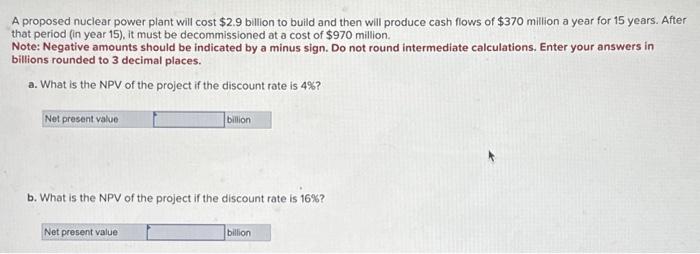

A proposed nuclear power plant will cost $2.9 billion to build and then will produce cash flows of $370 million a year for 15 years. After that period (in year 15), it must be decommissioned at a cost of $970 million. Note: Negative amounts should be indicated by a minus sign. Do not round intermediate calculations. Enter your answers in billions rounded to 3 decimal places. a. What is the NPV of the project if the discount rate is 4%? Net present value billion b. What is the NPV of the project if the discount rate is 16%? Net present value billion

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the Net Present Value NPV of the proposed nuclear power plant project we can use the fo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Corporate Finance

Authors: Richard Brealey, Stewart Myers, Alan Marcus

8th edition

77861620, 978-0077861629

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App