Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(a) Provide a detailed discussion on the characteristics of the two methods of reinsurance i.e. facultative and treaty reinsurance. Make sure to include a

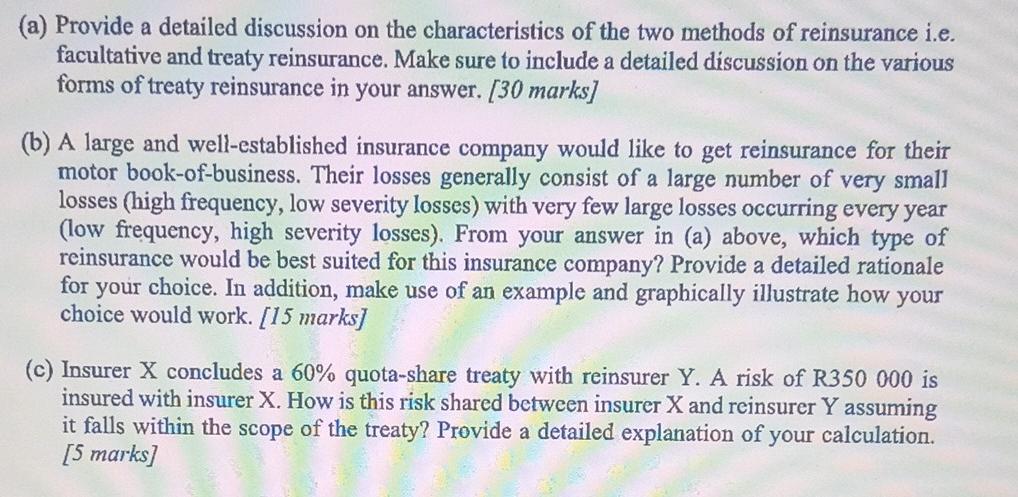

(a) Provide a detailed discussion on the characteristics of the two methods of reinsurance i.e. facultative and treaty reinsurance. Make sure to include a detailed discussion on the various forms of treaty reinsurance in your answer. [30 marks] (b) A large and well-established insurance company would like to get reinsurance for their motor book-of-business. Their losses generally consist of a large number of very small losses (high frequency, low severity losses) with very few large losses occurring every year (low frequency, high severity losses). From your answer in (a) above, which type of reinsurance would be best suited for this insurance company? Provide a detailed rationale for your choice. In addition, make use of an example and graphically illustrate how your choice would work. [15 marks] (c) Insurer X concludes a 60% quota-share treaty with reinsurer Y. A risk of R350 000 is insured with insurer X. How is this risk shared between insurer X and reinsurer Y assuming it falls within the scope of the treaty? Provide a detailed explanation of your calculation. [5 marks]

Step by Step Solution

★★★★★

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

a Characteristics of Facultative and Treaty Reinsurance Facultative Reinsurance 1 Nature Casebycase basis insurer decides which risks to cede 2 Flexib...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started