Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. Provide an example of a non-current asset that would be well suited to a reducing balance policy of depreciation. Justify your choice. (max.

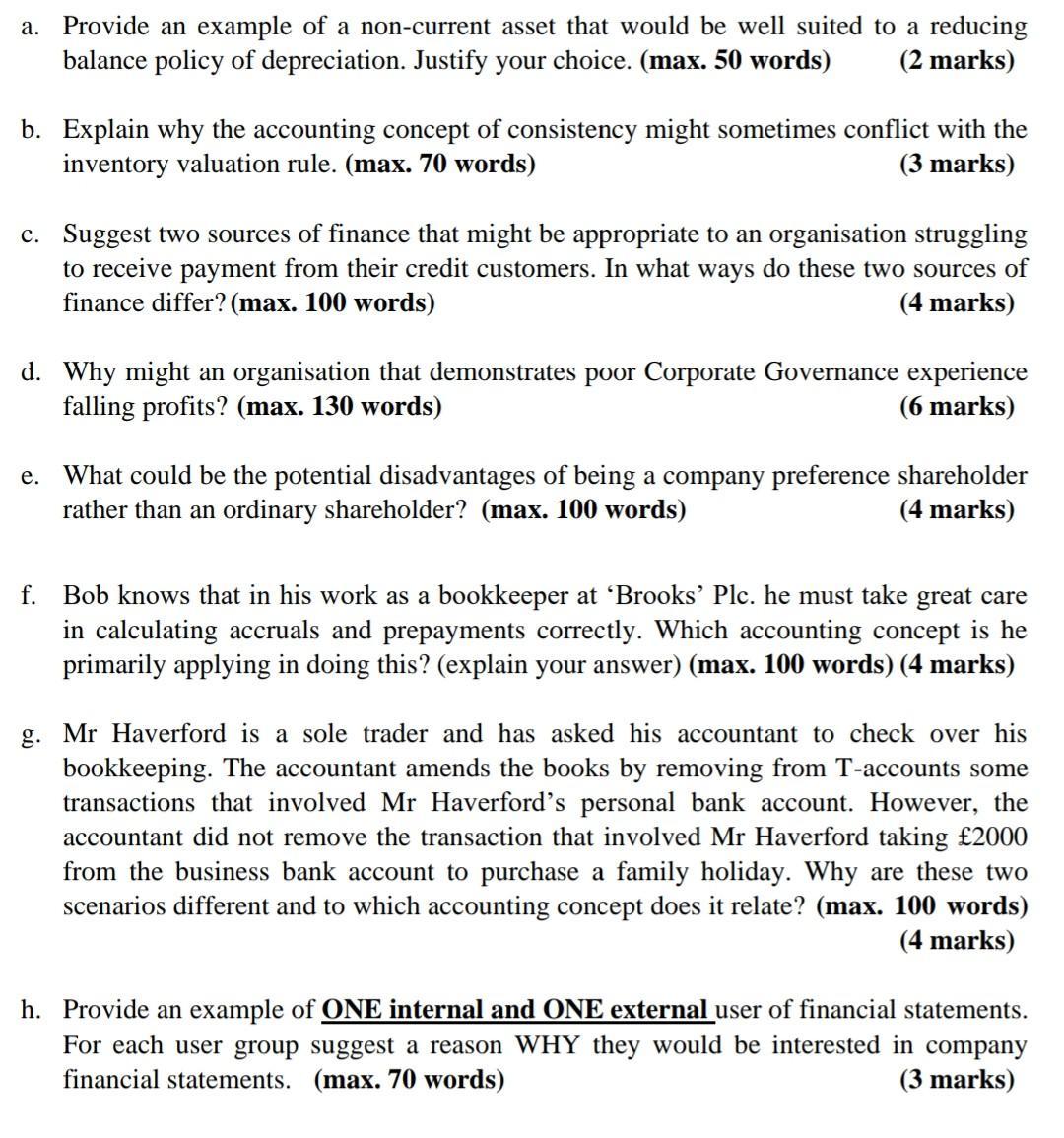

a. Provide an example of a non-current asset that would be well suited to a reducing balance policy of depreciation. Justify your choice. (max. 50 words) (2 marks) b. Explain why the accounting concept of consistency might sometimes conflict with the inventory valuation rule. (max. 70 words) (3 marks) c. Suggest two sources of finance that might be appropriate to an organisation struggling to receive payment from their credit customers. In what ways do these two sources of finance differ? (max. 100 words) (4 marks) d. Why might an organisation that demonstrates poor Corporate Governance experience falling profits? (max. 130 words) (6 marks) e. What could be the potential disadvantages of being a company preference shareholder rather than an ordinary shareholder? (max. 100 words) (4 marks) f. Bob knows that in his work as a bookkeeper at 'Brooks' Plc. he must take great care in calculating accruals and prepayments correctly. Which accounting concept is he primarily applying in doing this? (explain your answer) (max. 100 words) (4 marks) g. Mr Haverford is a sole trader and has asked his accountant to check over his bookkeeping. The accountant amends the books by removing from T-accounts some transactions that involved Mr Haverford's personal bank account. However, the accountant did not remove the transaction that involved Mr Haverford taking 2000 from the business bank account to purchase a family holiday. Why are these two scenarios different and to which accounting concept does it relate? (max. 100 words) (4 marks) h. Provide an example of ONE internal and ONE external user of financial statements. For each user group suggest a reason WHY they would be interested in company financial statements. (max. 70 words) (3 marks)

Step by Step Solution

★★★★★

3.36 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started