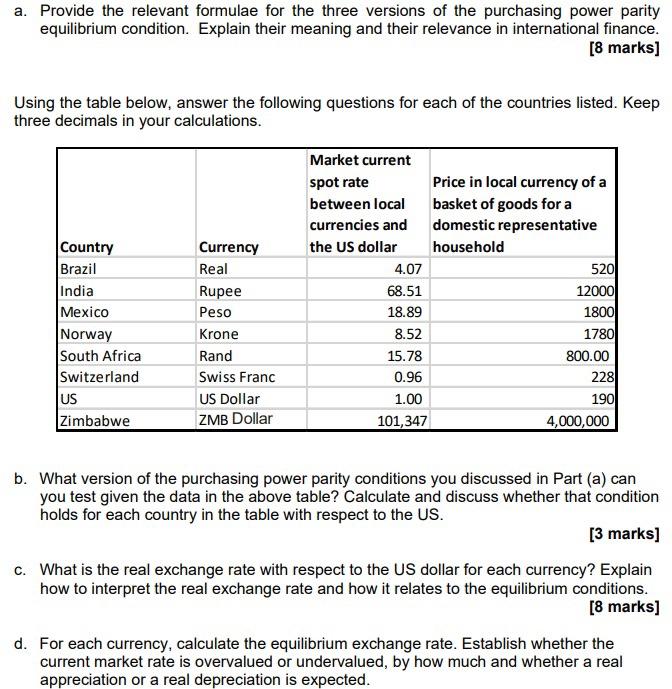

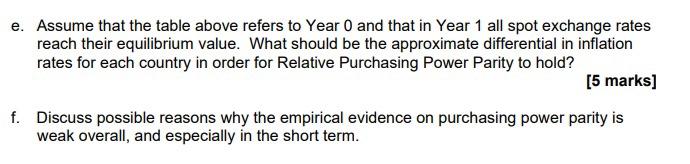

a. Provide the relevant formulae for the three versions of the purchasing power parity equilibrium condition. Explain their meaning and their relevance in international finance. [8 marks] Using the table below, answer the following questions for each of the countries listed. Keep three decimals in your calculations. Country Brazil India Mexico Norway South Africa Switzerland Currency Real Rupee Peso Krone Rand Swiss Franc US Dollar ZMB Dollar Market current spot rate Price in local currency of a between local basket of goods for a currencies and domestic representative the US dollar household 4.07 520 68.51 12000 18.89 1800 8.52 1780 15.78 800.00 0.96 228 1.00 190 101,347 4,000,000 US Zimbabwe b. What version of the purchasing power parity conditions you discussed in Part (a) can you test given the data in the above table? Calculate and discuss whether that condition holds for each country in the table with respect to the US. [3 marks] c. What is the real exchange rate with respect to the US dollar for each currency? Explain how to interpret the real exchange rate and how it relates to the equilibrium conditions. [8 marks] d. For each currency, calculate the equilibrium exchange rate. Establish whether the current market rate is overvalued or undervalued, by how much and whether a real appreciation or a real depreciation is expected. e. Assume that the table above refers to Year 0 and that in Year 1 all spot exchange rates reach their equilibrium value. What should be the approximate differential in inflation rates for each country in order for Relative Purchasing Power Parity to hold? [5 marks] f. Discuss possible reasons why the empirical evidence on purchasing power parity is weak overall, and especially in the short term. a. Provide the relevant formulae for the three versions of the purchasing power parity equilibrium condition. Explain their meaning and their relevance in international finance. [8 marks] Using the table below, answer the following questions for each of the countries listed. Keep three decimals in your calculations. Country Brazil India Mexico Norway South Africa Switzerland Currency Real Rupee Peso Krone Rand Swiss Franc US Dollar ZMB Dollar Market current spot rate Price in local currency of a between local basket of goods for a currencies and domestic representative the US dollar household 4.07 520 68.51 12000 18.89 1800 8.52 1780 15.78 800.00 0.96 228 1.00 190 101,347 4,000,000 US Zimbabwe b. What version of the purchasing power parity conditions you discussed in Part (a) can you test given the data in the above table? Calculate and discuss whether that condition holds for each country in the table with respect to the US. [3 marks] c. What is the real exchange rate with respect to the US dollar for each currency? Explain how to interpret the real exchange rate and how it relates to the equilibrium conditions. [8 marks] d. For each currency, calculate the equilibrium exchange rate. Establish whether the current market rate is overvalued or undervalued, by how much and whether a real appreciation or a real depreciation is expected. e. Assume that the table above refers to Year 0 and that in Year 1 all spot exchange rates reach their equilibrium value. What should be the approximate differential in inflation rates for each country in order for Relative Purchasing Power Parity to hold? [5 marks] f. Discuss possible reasons why the empirical evidence on purchasing power parity is weak overall, and especially in the short term