Question

A public sector organization is creating budgets to assess the performance of all its departments. One of those departments is dealing with elderly citizens' well-being

A public sector organization is creating budgets to assess the performance of all its departments. One of those departments is dealing with elderly citizens' well-being and is named 'Social-Assistance (SA)'. SA is composed of employees who take care of senior 'customers' in their households to help them with their daily needs.

A monthly cost control report is produced and sent both to the SA department manager and to the Director who is responsible for all the departments. The budgeting system is still under development. The Director created it without discussing with the SA department manager about budgeted amounts, and the use of the monthly cost control report.

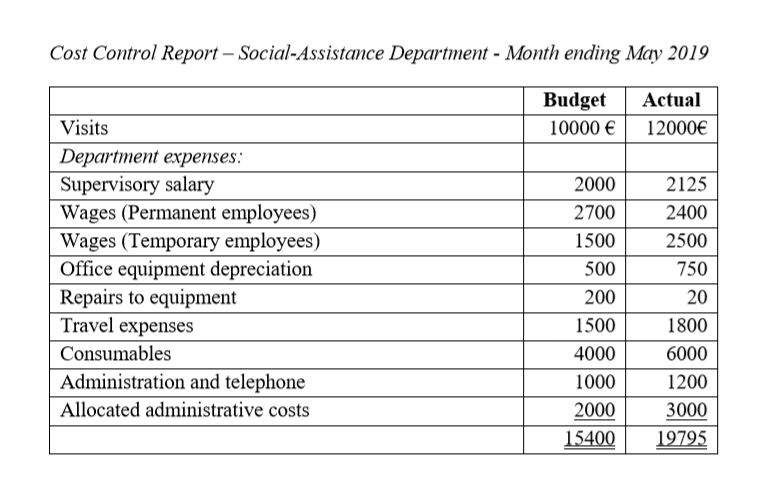

In the table below the first month's cost control report for the SA department is presented.

The workforce is composed of the manager and the permanent employees, supported by qualified temporary employees, which are hired on a weekly basis to manage possible fluctuations in the workload. Employees use their own means of transport and their travel expenses are reimbursed by the SA department. There is a central administration overhead charge over all departments. Consumables comprise supplies that are used by the employees to assist customers. Administration and telephone are incurred to communicate with the employees who usually work remotely.

Based on the negative results of the variance analysis of the report, the Director wrote to the SA department manager that the SA department should reduce its costs and operate within the funds allocated. Moreover, the Director stated that a negative variance above 5% of the budget on any item would not be accepted in the future. Finally, the Director demanded a thorough account of the negative results of the report.

Required:

a) Present an explanation of the responsibility accounting and budgeting system implemented at the SA department. Your answer should include a discussion around the social implications of the way the budget was created and operated in this setting

Cost Control Report - Social-Assistance Department - Month ending May 2019 Budget Actual Visits 10000 12000 Department expenses: Supervisory salary 2000 2125 Wages (Permanent employees) 2700 2400 Wages (Temporary employees) 1500 2500 Office equipment depreciation 500 750 Repairs to equipment 200 20 Travel expenses 1500 1800 Consumables 4000 6000 Administration and telephone 1000 1200 Allocated administrative costs 2000 3000 15400 19795

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started