Answered step by step

Verified Expert Solution

Question

1 Approved Answer

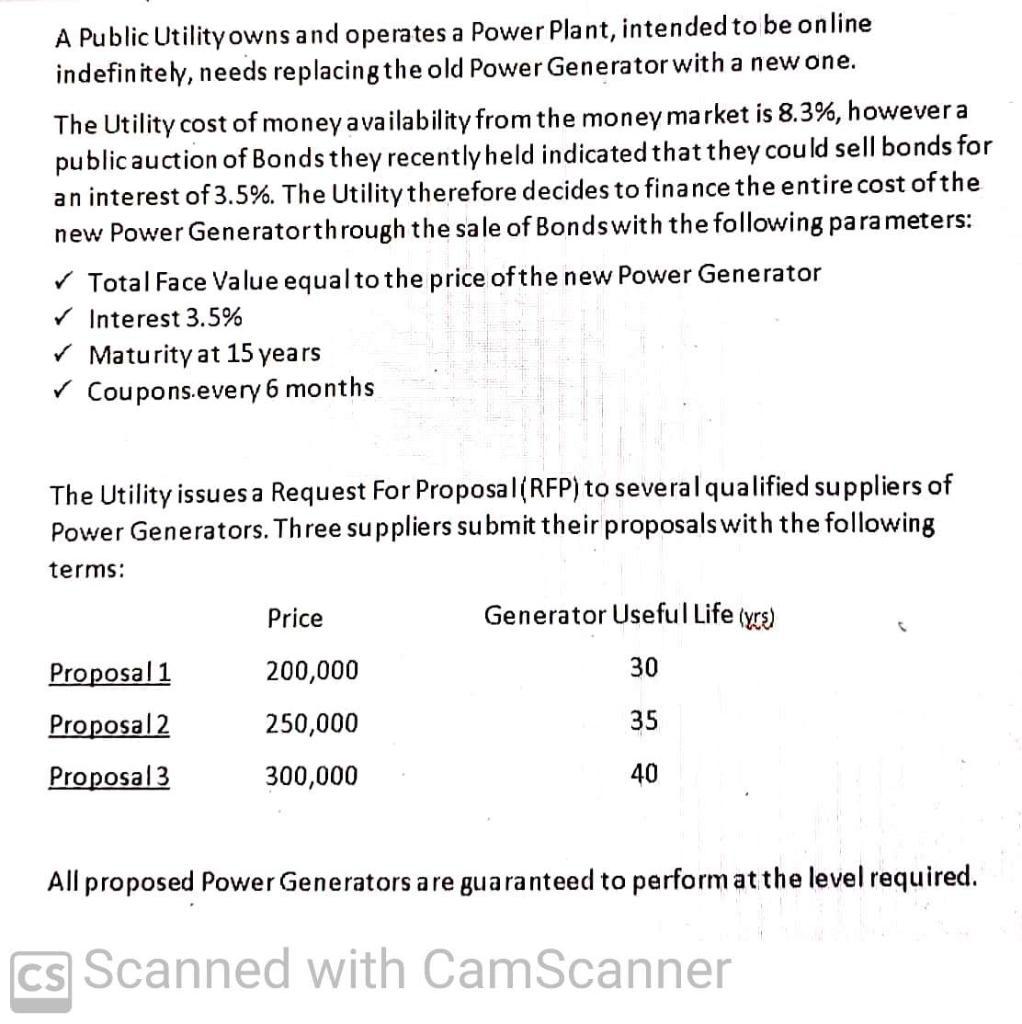

A Public Utility owns and operates a Power Plant, intended to be online indefinitely, needs replacing the old Power Generator with a new one.

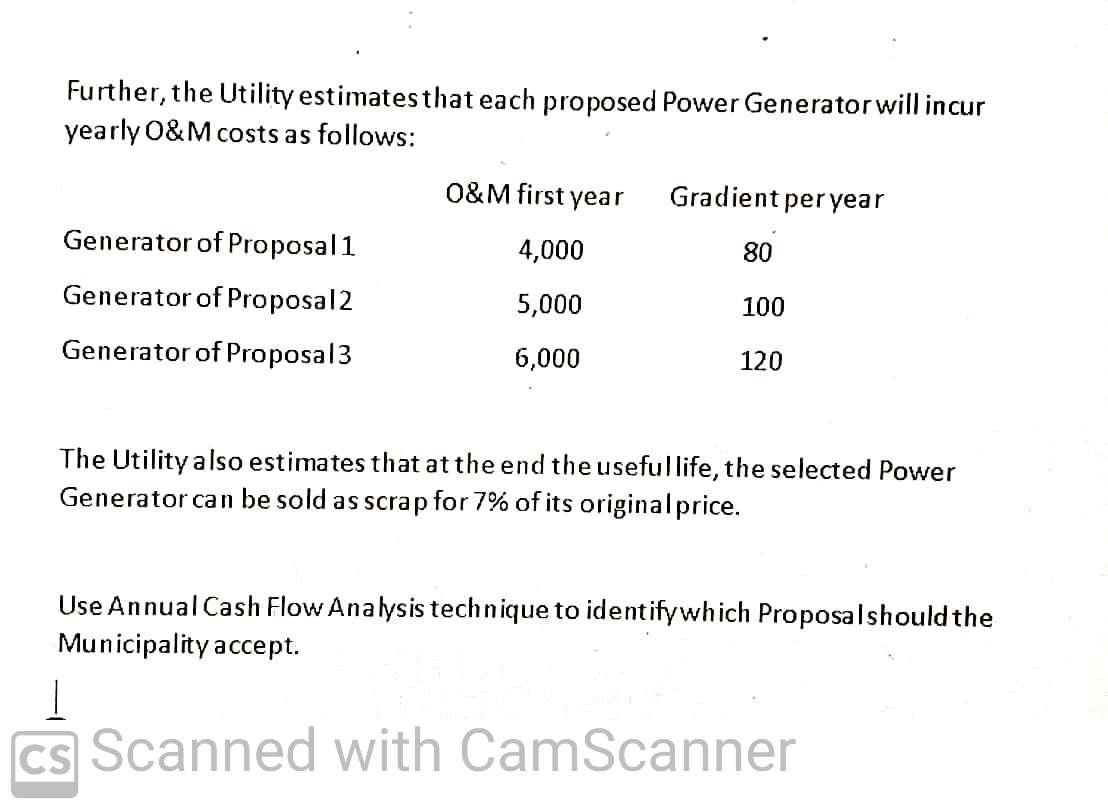

A Public Utility owns and operates a Power Plant, intended to be online indefinitely, needs replacing the old Power Generator with a new one. The Utility cost of money availability from the money market is 8.3%, however a public auction of Bonds they recently held indicated that they could sell bonds for an interest of 3.5%. The Utility therefore decides to finance the entire cost of the new Power Generator through the sale of Bonds with the following parameters: Total Face Value equal to the price of the new Power Generator Interest 3.5% Maturity at 15 years Coupons.every 6 months The Utility issues a Request For Proposal (RFP) to several qualified suppliers of Power Generators. Three suppliers submit their proposals with the following terms: Proposal 1 Proposal 2 Proposal 3 Price 200,000 250,000 300,000 Generator Useful Life (yr) 30 35 40 All proposed Power Generators are guaranteed to perform at the level required. cs Scanned with CamScanner Further, the Utility estimates that each proposed Power Generator will incur yearly O&M costs as follows: Generator of Proposal 1 Generator of Proposal 2 Generator of Proposal 3 O&M first year 4,000 5,000 6,000 Gradient per year 80 100 120 The Utility also estimates that at the end the useful life, the selected Power Generator can be sold as scrap for 7% of its original price. Use Annual Cash Flow Analysis technique to identify which Proposalshould the Municipality accept. cs Scanned with CamScanner

Step by Step Solution

There are 3 Steps involved in it

Step: 1

In the question the Gradient given is assumed a negative gradient Because if it is a posit...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started