Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A public water utility is replacing its service trucks with more fuel-efficient vehicles. Two types of trucks are under consideration: Type 1 uses start- stop

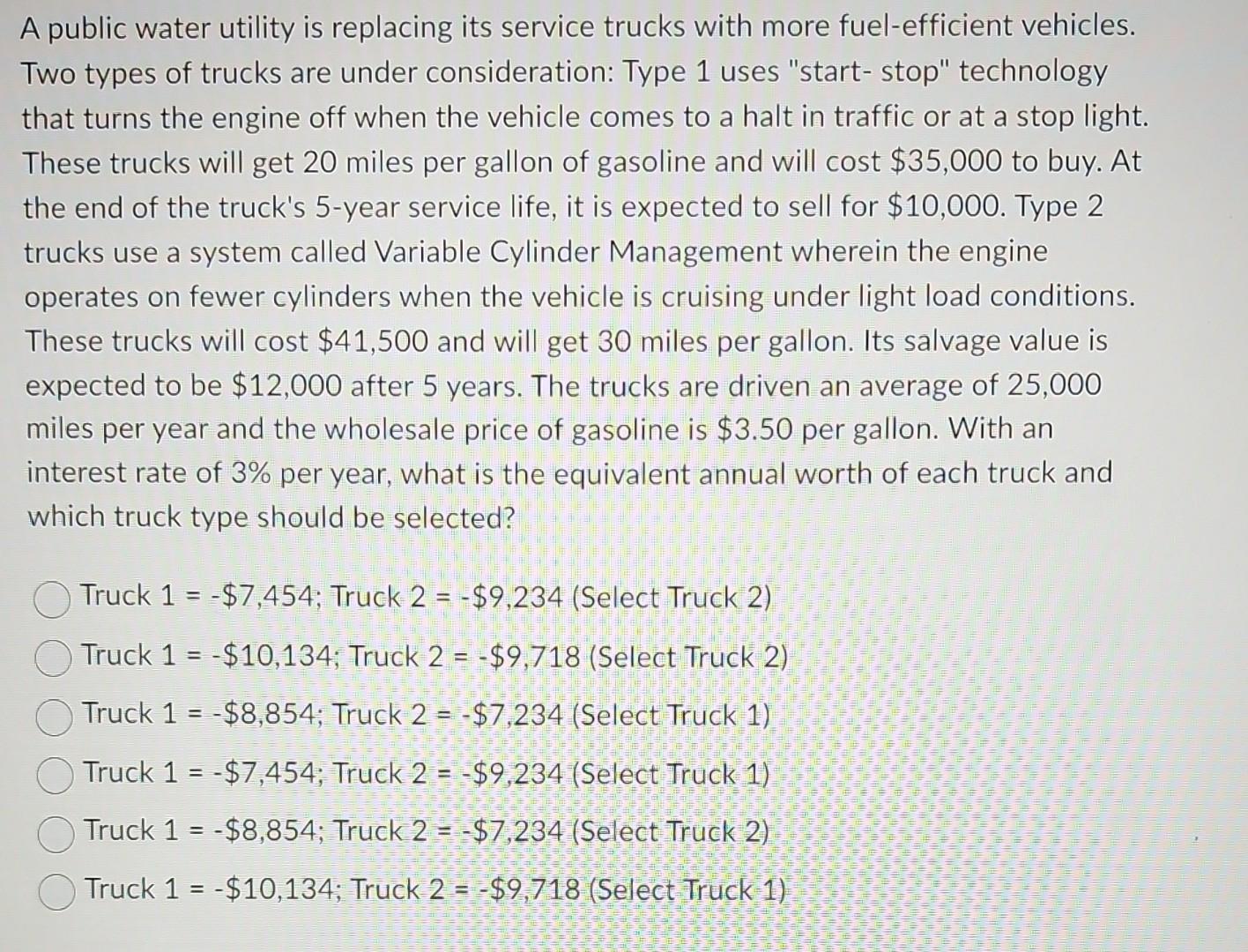

A public water utility is replacing its service trucks with more fuel-efficient vehicles. Two types of trucks are under consideration: Type 1 uses "start- stop" technology that turns the engine off when the vehicle comes to a halt in traffic or at a stop light. These trucks will get 20 miles per gallon of gasoline and will cost $35,000 to buy. At the end of the truck's 5-year service life, it is expected to sell for $10,000. Type 2 trucks use a system called Variable Cylinder Management wherein the engine operates on fewer cylinders when the vehicle is cruising under light load conditions. These trucks will cost $41,500 and will get 30 miles per gallon. Its salvage value is expected to be $12,000 after 5 years. The trucks are driven an average of 25,000 miles per year and the wholesale price of gasoline is $3.50 per gallon. With an interest rate of 3% per year, what is the equivalent annual worth of each truck and which truck type should be selected? Truck 1=$7,454; Truck 2=$9,234 (Select Truck 2) Truck 1=$10,134; Truck 2 =$9,718 (Select Truck 2) Truck 1=$8,854; Truck 2=$7,234 (Select Truck 1) Truck 1=$7,454; Truck 2=$9,234 (Select Truck 1) Truck 1=$8,854; Truck 2=$7,234 (Select Truck 2) Truck 1=$10,134; Truck 2=$9,718 (Select Truck 1 )

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started