Question

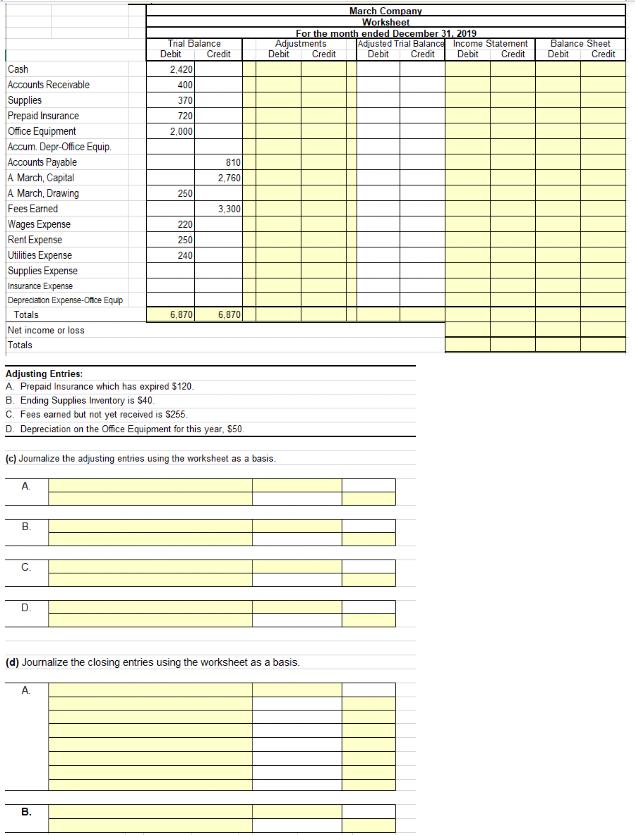

A. Put your name and section number at the top of the worksheet under each tab. B. Record the adjustments in the adjustments columns on

A. Put your name and section number at the top of the worksheet under each tab.

B. Record the adjustments in the adjustments columns on the worksheet; then complete the worksheet. Record the adjustments in the formatted journal entries at the bottom of the worksheet. Record the closing entries in the formatted journal entries below the adjusting entries on the worksheet.

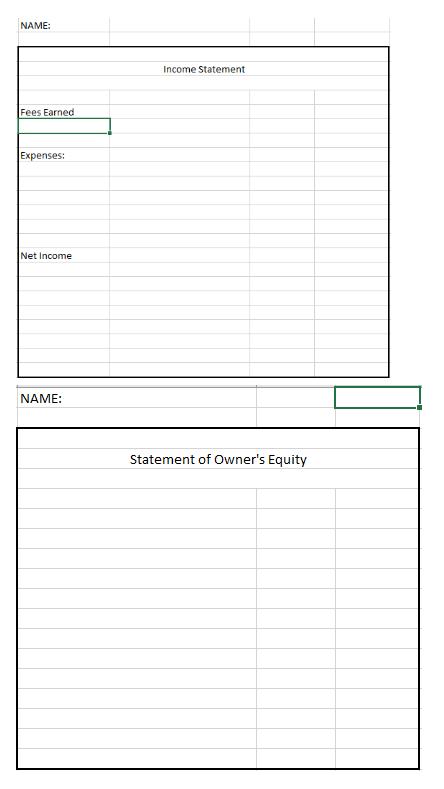

C. Prepare an Income Statement, including a proper heading, on the Income Statement Tab.

D. Prepare a Statement of Owner's Equity, including a proper heading, on the Statement of Owner's Equity Tab. Assume the capital balance on the worksheet is the beginning balance for the period and that there are no additional investments.

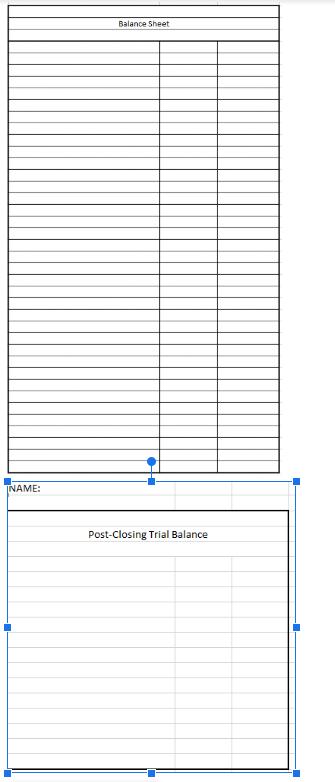

E. Prepare a Classified Balance Sheet, including a proper heading, on the Balance Sheet Tab.

F. Prepare a Post Closing Trial Balance, including a proper heading, e on the Post-Closing Trial Balance Tab.

This should have all the information need as all you need for each step is a trial balance.

March Company Worksheet For the month ended December 31, 2019 Tnal Balance Debit Credit Adjustments Debit Credit Adjusted Trial Balance Income Staternent Credit Balance Sheet Debit Debit Debit Credit Credit Cash 2,420 Accounts Receivable 400 Supplies Prepaid Insurance Office Equipment 370 720 2,000 Accum. Depr-Office Equip. Accounts Payable A March, Capital A March, Drawing 810 2,760 250 Fees Earned 3,300 220 Wages Expense Rent Expense Utilites Expense Supplies Expense 250 240 Insurance Expense Depreciation Expense-Once Equp Totals 6,870 6,870 Net income or loss Totals Adjusting Entries: A. Prepaid Insurance which has expired $120. B. Ending Supplies Imventory is $40. C. Fees earned but not yet received is S255. D. Depreciation on the Office Equipment for this year, $50 (c) Journalize the adjusting entries using the worksheet as a basis. A. B. C. D. (d) Journalize the closing entries using the worksheet as a basis. A. . March Company Worksheet For the month ended December 31, 2019 Tnal Balance Debit Credit Adjustments Debit Credit Adjusted Trial Balance Income Staternent Credit Balance Sheet Debit Debit Debit Credit Credit Cash 2,420 Accounts Receivable 400 Supplies Prepaid Insurance Office Equipment 370 720 2,000 Accum. Depr-Office Equip. Accounts Payable A March, Capital A March, Drawing 810 2,760 250 Fees Earned 3,300 220 Wages Expense Rent Expense Utilites Expense Supplies Expense 250 240 Insurance Expense Depreciation Expense-Once Equp Totals 6,870 6,870 Net income or loss Totals Adjusting Entries: A. Prepaid Insurance which has expired $120. B. Ending Supplies Imventory is $40. C. Fees earned but not yet received is S255. D. Depreciation on the Office Equipment for this year, $50 (c) Journalize the adjusting entries using the worksheet as a basis. A. B. C. D. (d) Journalize the closing entries using the worksheet as a basis. A. . March Company Worksheet For the month ended December 31, 2019 Tnal Balance Debit Credit Adjustments Debit Credit Adjusted Trial Balance Income Staternent Credit Balance Sheet Debit Debit Debit Credit Credit Cash 2,420 Accounts Receivable 400 Supplies Prepaid Insurance Office Equipment 370 720 2,000 Accum. Depr-Office Equip. Accounts Payable A March, Capital A March, Drawing 810 2,760 250 Fees Earned 3,300 220 Wages Expense Rent Expense Utilites Expense Supplies Expense 250 240 Insurance Expense Depreciation Expense-Once Equp Totals 6,870 6,870 Net income or loss Totals Adjusting Entries: A. Prepaid Insurance which has expired $120. B. Ending Supplies Imventory is $40. C. Fees earned but not yet received is S255. D. Depreciation on the Office Equipment for this year, $50 (c) Journalize the adjusting entries using the worksheet as a basis. A. B. C. D. (d) Journalize the closing entries using the worksheet as a basis. A. . March Company Worksheet For the month ended December 31, 2019 Tnal Balance Debit Credit Adjustments Debit Credit Adjusted Trial Balance Income Staternent Credit Balance Sheet Debit Debit Debit Credit Credit Cash 2,420 Accounts Receivable 400 Supplies Prepaid Insurance Office Equipment 370 720 2,000 Accum. Depr-Office Equip. Accounts Payable A March, Capital A March, Drawing 810 2,760 250 Fees Earned 3,300 220 Wages Expense Rent Expense Utilites Expense Supplies Expense 250 240 Insurance Expense Depreciation Expense-Once Equp Totals 6,870 6,870 Net income or loss Totals Adjusting Entries: A. Prepaid Insurance which has expired $120. B. Ending Supplies Imventory is $40. C. Fees earned but not yet received is S255. D. Depreciation on the Office Equipment for this year, $50 (c) Journalize the adjusting entries using the worksheet as a basis. A. B. C. D. (d) Journalize the closing entries using the worksheet as a basis. A. .

Step by Step Solution

3.35 Rating (142 Votes )

There are 3 Steps involved in it

Step: 1

Particulars Unadjusted TB Adjustments Adjusted TB Income statement Balance sheet Dr Cr Dr Cr Dr Cr Dr Cr Assets Liab Cash 2420 2420 2420 Accounts Rece...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started