Answered step by step

Verified Expert Solution

Question

1 Approved Answer

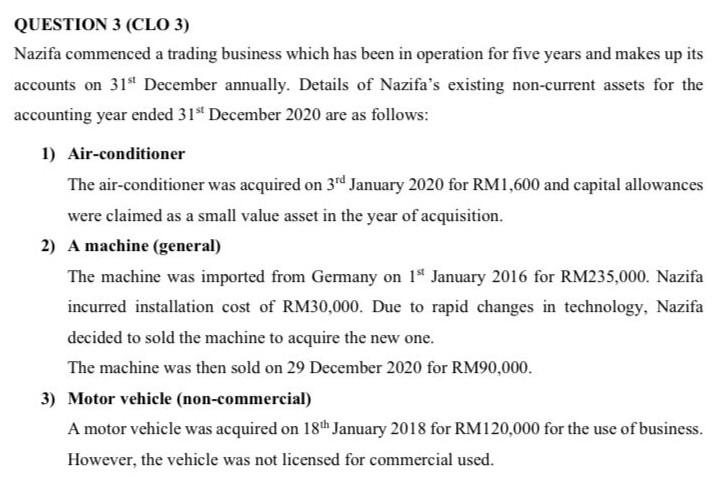

a QUESTION 3 (CLO 3) Nazifa commenced a trading business which has been in operation for five years and makes up its accounts on 31

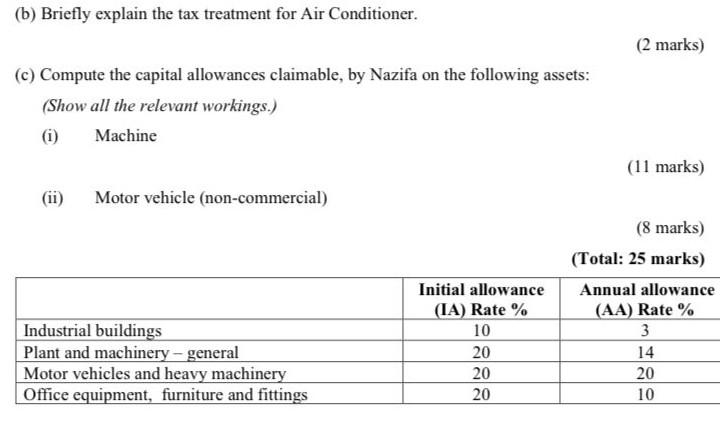

a QUESTION 3 (CLO 3) Nazifa commenced a trading business which has been in operation for five years and makes up its accounts on 31" December annually. Details of Nazifa's existing non-current assets for the accounting year ended 31 December 2020 are as follows: 1) Air-conditioner The air-conditioner was acquired on 3rd January 2020 for RM1,600 and capital allowances were claimed as a small value asset in the year of acquisition. 2) A machine (general) The machine was imported from Germany on 19 January 2016 for RM235,000. Nazifa incurred installation cost of RM30,000. Due to rapid changes in technology, Nazifa decided to sold the machine to acquire the new one. The machine was then sold on 29 December 2020 for RM90,000. 3) Motor vehicle (non-commercial) A motor vehicle was acquired on 18th January 2018 for RM120,000 for the use of business. However, the vehicle was not licensed for commercial used. (b) Briefly explain the tax treatment for Air Conditioner. (2 marks) (c) Compute the capital allowances claimable, by Nazifa on the following assets: (Show all the relevant workings.) (i) Machine (11 marks) (ii) Motor vehicle (non-commercial) (8 marks) (Total: 25 marks) Annual allowance (AA) Rate % 3 14 20 10 Initial allowance (IA) Rate % 10 20 20 20 Industrial buildings Plant and machinery - general Motor vehicles and heavy machinery Office equipment, furniture and fittings

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started