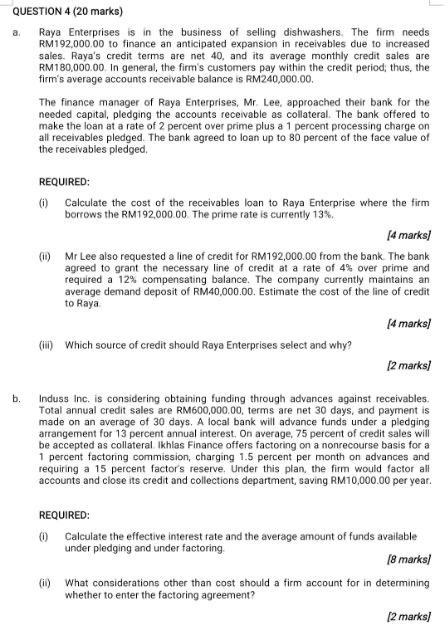

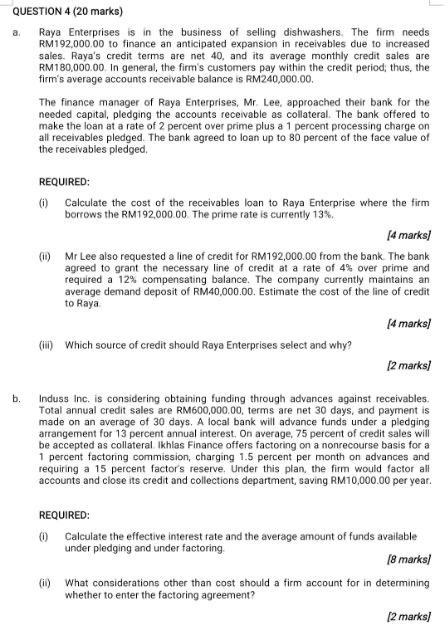

a QUESTION 4 (20 marks) Raya Enterprises is in the business of selling dishwashers. The firm needs RM192,000.00 to finance an anticipated expansion in receivables due to increased sales. Raya's credit terms are net 40, and its average monthly credit sales are RM180,000.00 In general, the firm's customers pay within the credit period, thus, the firm's average accounts receivable balance is RM240,000.00 The finance manager of Raya Enterprises, Mr. Lee, approached their bank for the needed capital, pledging the accounts receivable as collateral. The bank offered to make the loan at a rate of 2 percent over prime plus a 1 percent processing charge on all receivables pledged. The bank agreed to loan up to 80 percent of the face value of the receivables pledged REQUIRED: 0 Calculate the cost of the receivables loan to Raya Enterprise where the firm borrows the RM192,000.00 The prime rate is currently 13% [4 marks/ () Mr Lee atso requested a line of credit for RM192,000.00 from the bank. The bank agreed to grant the necessary line of credit at a rate of 4% over prime and required a 12% compensating balance. The company currently maintains an average demand deposit of RM40,000.00. Estimate the cost of the line of credit to Raya [4 marks/ (H) Which source of credit should Raya Enterprises select and why? [2 marks/ b. Induss Inc. is considering obtaining funding through advances against receivables. Total annual credit sales are RM600,000.00, terms are net 30 days, and payment is made on an average of 30 days. A local bank will advance funds under a pledging arrangement for 13 percent annual interest. On average, 75 percent of credit sales will be accepted as collateral Ikhlas Finance offers factoring on a nonrecourse basis for a 1 percent factonng commission, charging 1.5 percent per month on advances and requiring a 15 percent factors reserve. Under this plan, the firm would factor all accounts and close its credit and collections department, saving RM10,000.00 per year. REQUIRED: 0 Calculate the effective interest rate and the average amount of funds available under pledging and under factoring 18 marks/ (i) What considerations other than cost should a firm account for in determining whether to enter the factoring agreement? [2 marks/ a QUESTION 4 (20 marks) Raya Enterprises is in the business of selling dishwashers. The firm needs RM192,000.00 to finance an anticipated expansion in receivables due to increased sales. Raya's credit terms are net 40, and its average monthly credit sales are RM180,000.00 In general, the firm's customers pay within the credit period, thus, the firm's average accounts receivable balance is RM240,000.00 The finance manager of Raya Enterprises, Mr. Lee, approached their bank for the needed capital, pledging the accounts receivable as collateral. The bank offered to make the loan at a rate of 2 percent over prime plus a 1 percent processing charge on all receivables pledged. The bank agreed to loan up to 80 percent of the face value of the receivables pledged REQUIRED: 0 Calculate the cost of the receivables loan to Raya Enterprise where the firm borrows the RM192,000.00 The prime rate is currently 13% [4 marks/ () Mr Lee atso requested a line of credit for RM192,000.00 from the bank. The bank agreed to grant the necessary line of credit at a rate of 4% over prime and required a 12% compensating balance. The company currently maintains an average demand deposit of RM40,000.00. Estimate the cost of the line of credit to Raya [4 marks/ (H) Which source of credit should Raya Enterprises select and why? [2 marks/ b. Induss Inc. is considering obtaining funding through advances against receivables. Total annual credit sales are RM600,000.00, terms are net 30 days, and payment is made on an average of 30 days. A local bank will advance funds under a pledging arrangement for 13 percent annual interest. On average, 75 percent of credit sales will be accepted as collateral Ikhlas Finance offers factoring on a nonrecourse basis for a 1 percent factonng commission, charging 1.5 percent per month on advances and requiring a 15 percent factors reserve. Under this plan, the firm would factor all accounts and close its credit and collections department, saving RM10,000.00 per year. REQUIRED: 0 Calculate the effective interest rate and the average amount of funds available under pledging and under factoring 18 marks/ (i) What considerations other than cost should a firm account for in determining whether to enter the factoring agreement? [2 marks/