Answered step by step

Verified Expert Solution

Question

1 Approved Answer

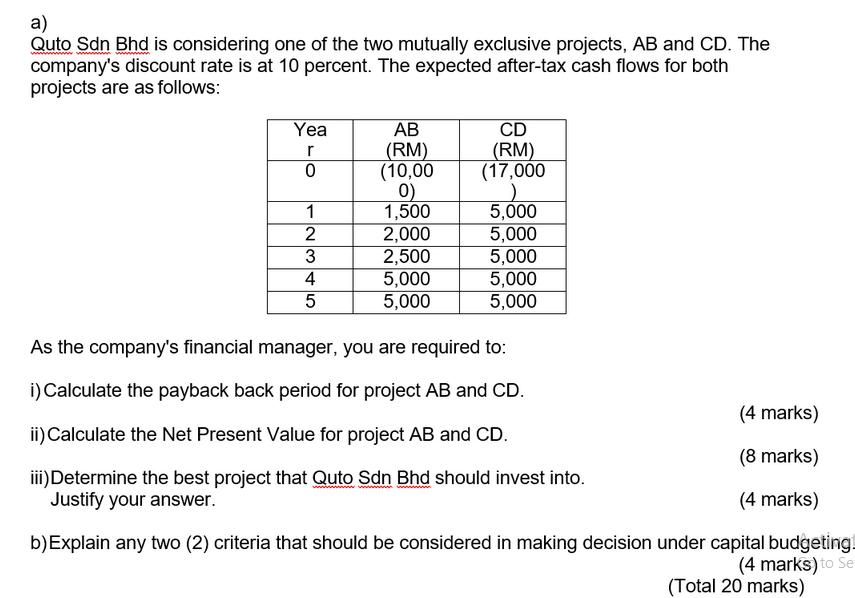

a) Quto Sdn Bhd is considering one of the two mutually exclusive projects, AB and CD. The company's discount rate is at 10 percent.

a) Quto Sdn Bhd is considering one of the two mutually exclusive projects, AB and CD. The company's discount rate is at 10 percent. The expected after-tax cash flows for both projects are as follows: Yea AB CD r (RM) (RM) 0 (10,00 (17,000 0) 1 1,500 5,000 2 2,000 5,000 3 2,500 5,000 4 5,000 5,000 5 5,000 5,000 As the company's financial manager, you are required to: i) Calculate the payback back period for project AB and CD. ii) Calculate the Net Present Value for project AB and CD. (4 marks) (8 marks) iii) Determine the best project that Quto Sdn Bhd should invest into. Justify your answer. (4 marks) b) Explain any two (2) criteria that should be considered in making decision under capital budgeting. (4 marks) to Set (Total 20 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started