Answered step by step

Verified Expert Solution

Question

1 Approved Answer

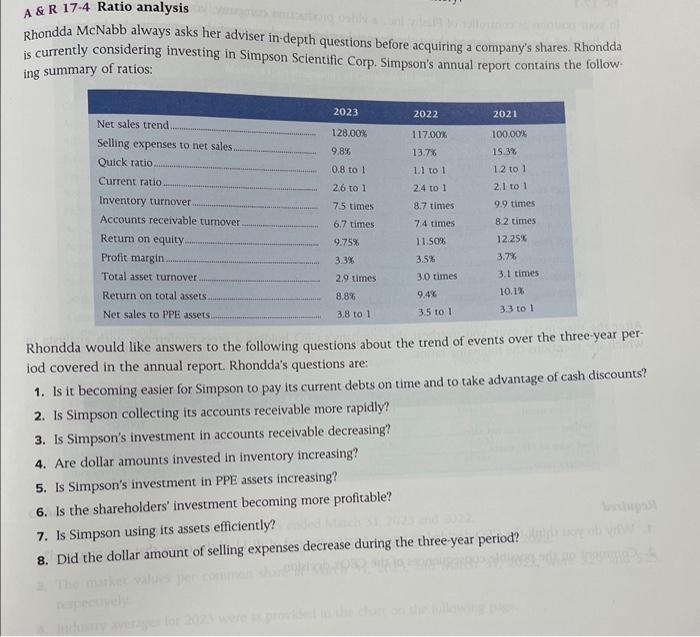

A & R 17-4 Ratio analysis ovan ubong osblvon vies7 to 19llounos es nontzog oy nl Rhondda McNabb always asks her adviser in-depth questions before

A & R 17-4 Ratio analysis ovan ubong osblvon vies7 to 19llounos es nontzog oy nl Rhondda McNabb always asks her adviser in-depth questions before acquiring a company's shares. Rhondda is currently considering investing in Simpson Scientific Corp. Simpson's annual report contains the follow- ing summary of ratios: Net sales trend. Selling expenses to net sales.. Quick ratio..... Current ratio. Inventory turnover. Accounts receivable turnover. Return on equity... Profit margin. Total asset turnover Return on total assets. Net sales to PPE assets. 2023 128.00% 9.8% 0.8 to 1 2.6 to 1 7.5 times 6.7 times 9.75% 3.3% 2.9 times 8.8% 3.8 to 1 2022 117.00% 13.7% 1.1 to 1 2.4 to 1 8.7 times 7.4 times 11.50% 3.5% 3.0 times 9.4% 3.5 to 1 2021 100.00% 15.3% 1.2 to 1 2.1 to 1 9.9 times 8.2 times 12.25% 3.7% 3.1 times 10.1% 3.3 to 1 adi 1911A Rhondda would like answers to the following questions about the trend of events over the three-year per- iod covered in the annual report. Rhondda's questions are: wolk 1. Is it becoming easier for Simpson to pay its current debts on time and to take advantage of cash discounts? 2. Is Simpson collecting its accounts receivable more rapidly? 3. Is Simpson's investment in accounts receivable decreasing? 4. Are dollar amounts invested in inventory increasing? 5. Is Simpson's investment in PPE assets increasing? 6. Is the shareholders' investment becoming more profitable? 7. Is Simpson using its assets efficiently? ended Ma and 2022. bsthups 8. Did the dollar amount of selling expenses decrease during the three-year period?di u ob v 3. The market values per common sharola izango de tom respectively. Industry averages for 2023 were as provided in the chart on the following page.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started