Answered step by step

Verified Expert Solution

Question

1 Approved Answer

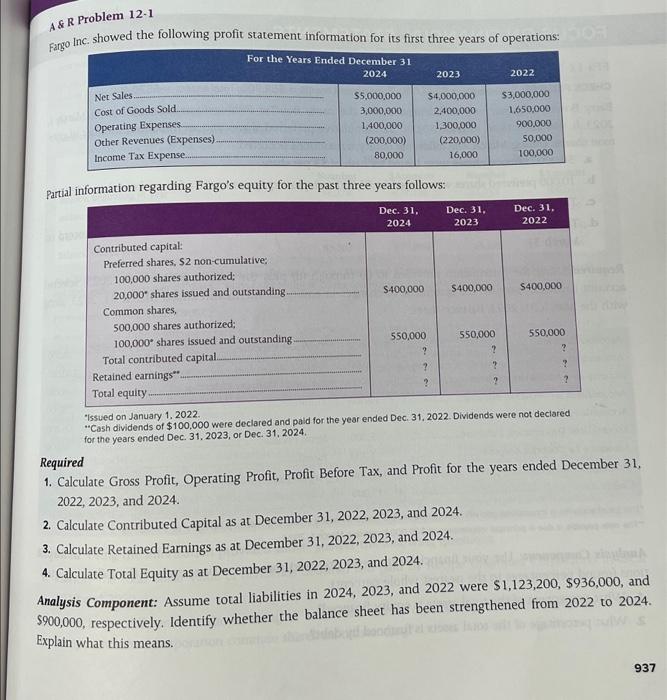

A & R Problem 12-1 Fargo Inc. showed the following profit statement information for its first three years of operations: Net Sales. Cost of Goods

A & R Problem 12-1 Fargo Inc. showed the following profit statement information for its first three years of operations: Net Sales. Cost of Goods Sold. Operating Expenses........ Other Revenues (Expenses). Income Tax Expense........ For the Years Ended December 31 2024 Partial information regarding Fargo's equity for the Contributed capital: Preferred shares, $2 non-cumulative; 100,000 shares authorized; 20,000 shares issued and outstanding. Common shares, 500,000 shares authorized; 100,000 shares issued and outstanding.. Total contributed capital.......... Retained earnings**... Total equity ........ $5,000,000 3,000,000 1,400,000 (200,000) 80,000 past three years Dec. 31, 2024 $400,000 follows: 550,000 2023 ? $4,000,000 2,400,000 1,300,000 (220,000) 16,000 Dec. 31, 2023 $400,000 550,000 ? ? ? 2022 $3,000,000 1,650,000 900,000 50,000 100,000 Dec. 31, 2022 $400,000 550,000 ? ? ? "Issued on January 1, 2022. **Cash dividends of $100,000 were declared and paid for the year ended Dec. 31, 2022. Dividends were not declared for the years ended Dec. 31, 2023, or Dec. 31, 2024. nom 0036 Required 1. Calculate Gross Profit, Operating Profit, Profit Before Tax, and Profit for the years ended December 31, 2022, 2023, and 2024. 2. Calculate Contributed Capital as at December 31, 2022, 2023, and 2024. 3. Calculate Retained Earnings as at December 31, 2022, 2023, and 2024. 4. Calculate Total Equity as at December 31, 2022, 2023, and 2024. mo zisulonA paludy, c Analysis Component: Assume total liabilities in 2024, 2023, and 2022 were $1,123,200, $936,000, and $900,000, respectively. Identify whether the balance sheet has been strengthened from 2022 to 2024. 2 Explain what this means. bandit el 9225 ISTOJ you wo 937

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started