Answered step by step

Verified Expert Solution

Question

1 Approved Answer

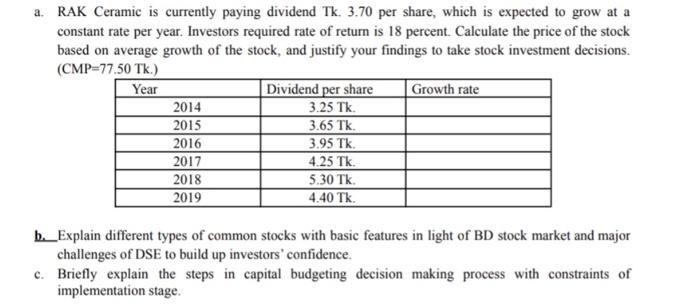

a. RAK Ceramic is currently paying dividend Tk. 3.70 per share, which is expected to grow at a constant rate per year. Investors required

a. RAK Ceramic is currently paying dividend Tk. 3.70 per share, which is expected to grow at a constant rate per year. Investors required rate of return is 18 percent. Calculate the price of the stock based on average growth of the stock, and justify your findings to take stock investment decisions. (CMP=77.50 TK.) Year 2014 2015 2016 2017 2018 2019 Dividend per share 3.25 Tk. 3.65 Tk. 3.95 Tk. 4.25 Tk. 5.30 TK. 4.40 TK. Growth rate b. Explain different types of common stocks with basic features in light of BD stock market and major challenges of DSE to build up investors' confidence. c. Briefly explain the steps in capital budgeting decision making process with constraints of implementation stage.

Step by Step Solution

★★★★★

3.33 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the price of the stock based on average growth we can use the Gordon Growth Model also known as the Dividend Discount Model which calculates the present value of all expected future div...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started