A) Rank Alanson, Boyne, and Conway from most profitable to least profitable according to the initial systems estimate of the contribution of each customer to Jamestowns bottomline profitability. What are Jamestowns options regarding the treatment of these three customers? Based on this initial customer profitability analysis, what action do you recommend Jamestown take with each of these three customers?

A) Rank Alanson, Boyne, and Conway from most profitable to least profitable according to the initial systems estimate of the contribution of each customer to Jamestowns bottomline profitability. What are Jamestowns options regarding the treatment of these three customers? Based on this initial customer profitability analysis, what action do you recommend Jamestown take with each of these three customers?

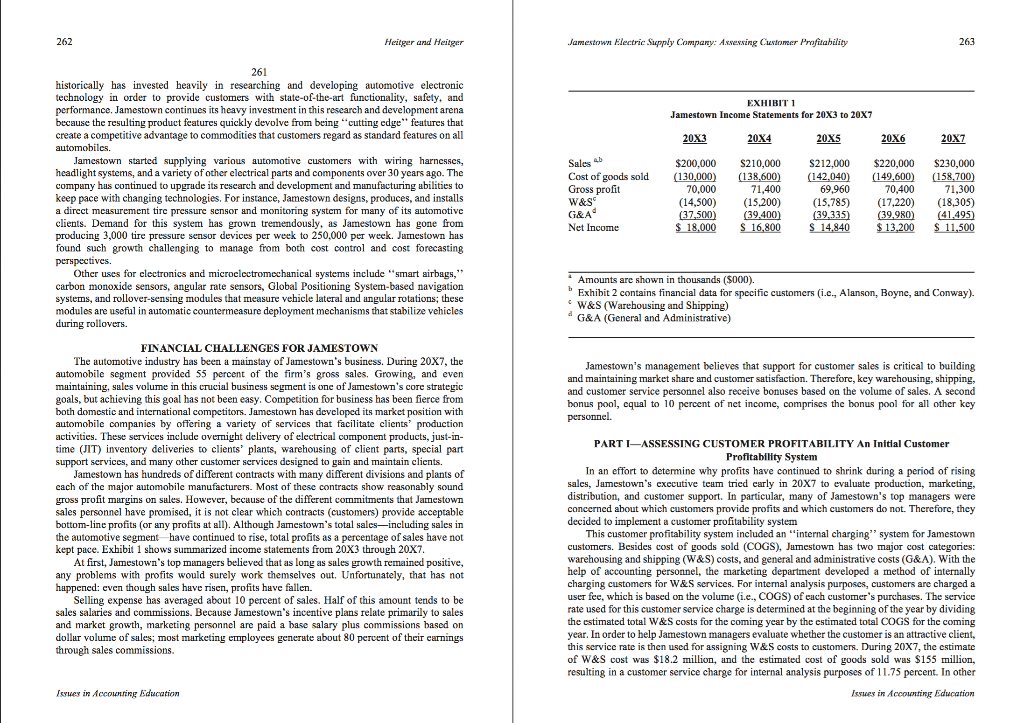

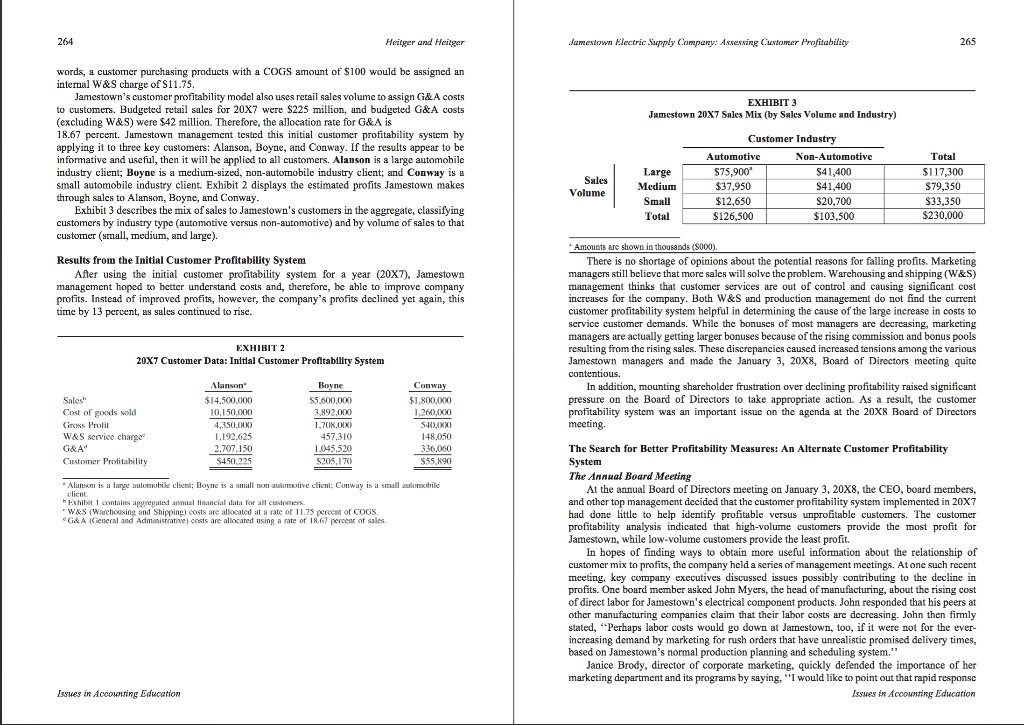

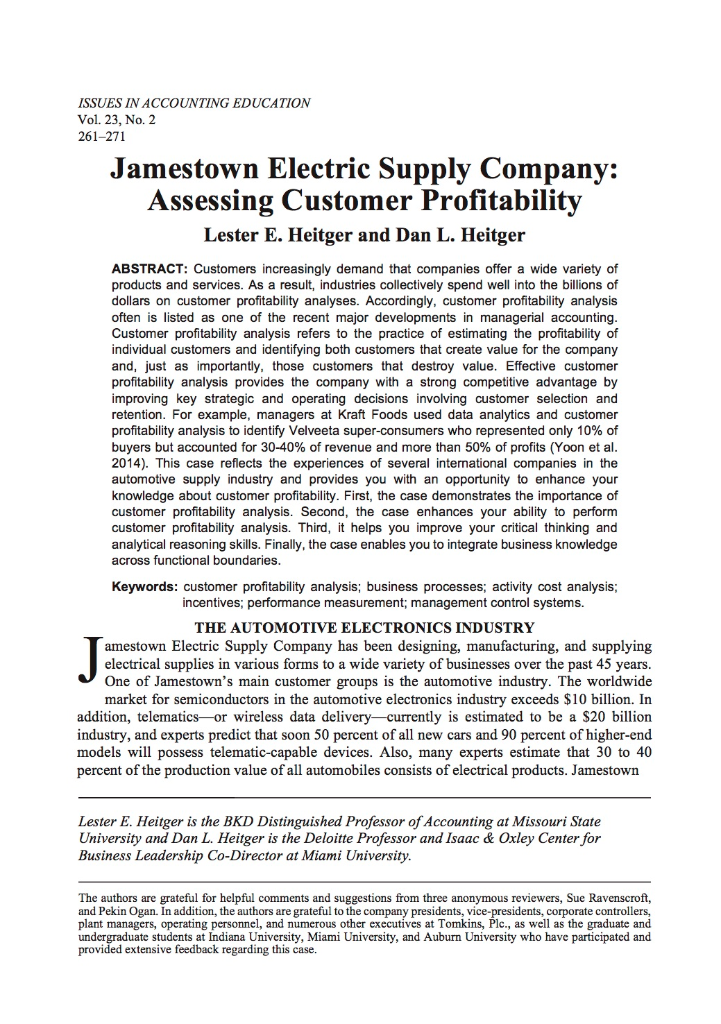

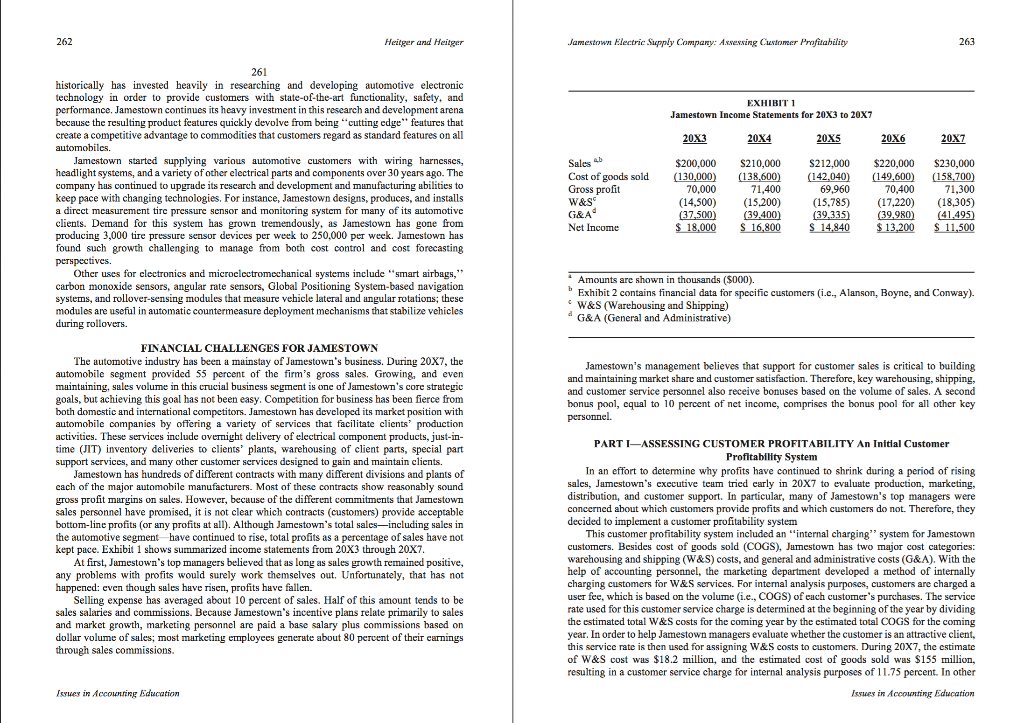

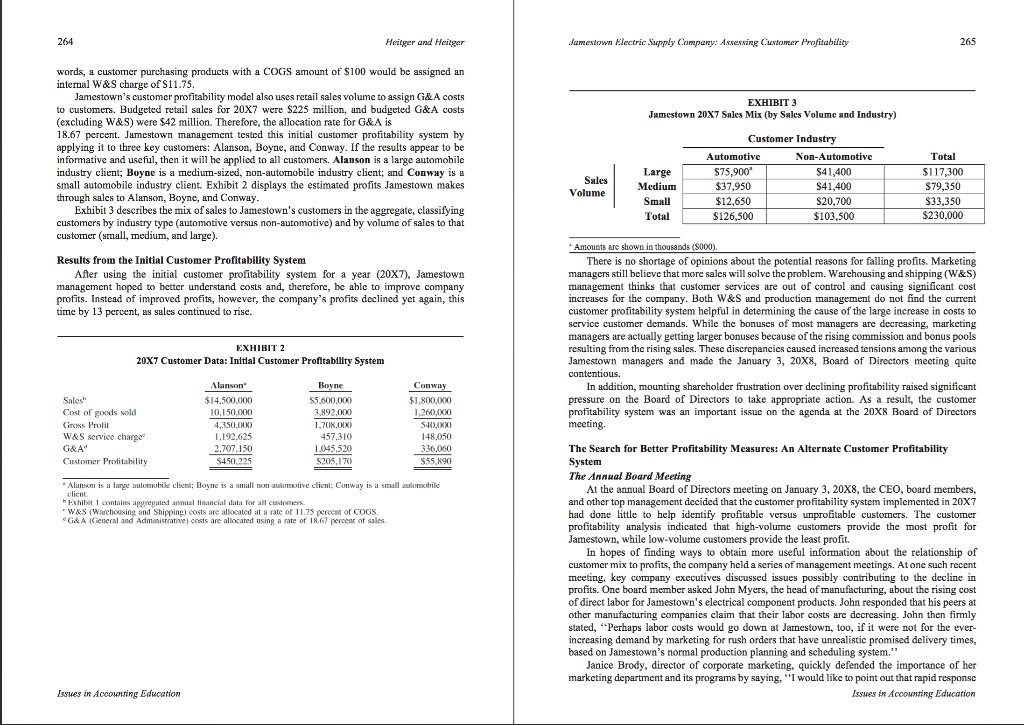

262 Jamestown Electric Supply Company: Assexsing Customer Profitahility 263 Heitger and Heitger 261 historically has invested heavily in researching and developing automotive electronic technology in order to provide customers with state-of-the-art functionality, safety, and performance. Jamestown continues its heavy investment in this research and development arena because the resulting product features quickly devolve from being "cutting edge" features that create a competitive advantage to commodities that customers regard as standard features on all automobiles. EXHIBIT 1 Jamestown Income Statements for 20X3 to 20X7 20X4 20x6 20x7 20X3 20X5 Jamestown started supplying headlight systems, and a variety of other electrical parts and components over 30 years ago. The company has continued to upgrade its rescarch and development and manufacturing abilities to keep pace with changing technologies. For instance, Jamestown designs, produces, and installs a direct measurement tire pressure sensor and monitoring system for many of its automotive clients. Demand for this system has grown tremendously, as Jamestown has gone from producing 3,000 tire pressure sensor devices per week to 250,000 per week. Jamestown has found such growth challenging to manage from both cost control and cost forecasting various automotive customers with wiring ab $200,000 S210,000 S212,000 $220,000 $230,000 042.040 Sales Cost ofgoods sold Gross profit W&s G&A Net Income (130,000) 70,000 (138.600) 71,400 (14,500) (15,200) 3750 39.400) (l49.600) 70,400 (15.785) 17,220) 0.58.700) 71,300 (18,305) 69,960 (39335(3998O 41495 $ 18,000 S 16,800 S 14,840 13,200 11,500 Other uses for clectronics and microclectromcchanical systems include "smart airbags," carbon monoxide sensors, angular rate sensors, Global Positioning System-based navigation systems, and rollover-sensing modules that measure vehicle lateral and angular rotations; these modules are useful in automatic countermeasure deployment mechanisms that stabilize vehicles during rollovers. Amounts are shown in thousands ($000). Exhibit 2 contains financial data for specific customers (1.c., Alanson, Boyne, and Conway). W&S (Warehousing and Shipping) G&A (General and Administrative) FINANCIAL CHALLENGES FOR JAMESTOWN The automotive industry has been a mainstay of Jamestown's business. During 20X7, the automobile segment provided 55 percent ofthe firm's gross sales. Growing, and even maintaining, sales volume in this crucial business segment is one of Jamestown's core strategic goals, but achieving this goal has not been easy. Competition for business has been fierce from both domestic and international competitors Jamestown has developed its market position with automobile companics by offering a variety of services that facilitate clients' production activities. These services include overnight delivery of electrical compont products, just-in time (JIT) inventory deliveries to clients' plants, warehousing of client parts, special part support services, and many other customer services designed to gain and maintain clients. Jamestown's management believes that support for customer sales is critical to building and maintaining market share and customer satisfaction. Therefore, key warehousing, shipping, and customer service personnel also receive bonuses based on the volume of sales. A second bonus pool, cqual to 10 percent of net income, comprises the bonus pool for all other key PART IASSESSING CUSTOMER PROFITABILITY An Initlal Customer Profitability System In an effort to determine why profits have continued to shrink during a period of rising sales, Jamestown's executive team tried carly in 20X7 to evaluate production, marketing, distribution, and customer support. In particular, many of Jamestown's top managers were concerned about which customers provide profits and which customers do not. Therefore, they Jamestown has hundreds of different contracts with many different divisions and plants of cach of the major automobile manufacturers. Most of these contracts show reasonably sound gross profit margins on sales. However, because of the different commitments that Jamestown sales personnel have promised, it is not clear which contracts (customers) provide acceptable bottom-line profits (or any profits at ). Although Jamestown's total sales-including sales in the automotive segment have continued to rise, total profits as a percentage of sales have not kept pace. Exhibit 1 shows summarized income statements from 20X3 through 20X7 decided to implement a customer profitability system This customer profitability system included an "internal charging" system for Jamestown customers. Besides cost of goods sold (COGS), Jamestown has two major cost categories: warehousing and shipping (W&S) costs, and general and administrative costs (G&A). With the help of accounting personnel, the marketing department developed a method of internally charging customers for W&S services. For internal analysis purposes, customers are charged a user fee, which is based on the volume (i.e., COGS) of each customer's purchases. The service rate used for this customer service charge is determined at the beginning of the year by dividing the estimated total W&S costs for the coming year by the estimated total COGS for the coming year. In order to help Jamestown managers evaluate whether the customer is an attractive client, this service rate is then used for assigning W&S costs to customers. During 20X7, the cstimate of W&S cost was $18.2 million, and the estimated cost of goods sold was $155 million, resulting in a customer service charge for internal analysis purposes of 11.75 percent. In other At first, Jamestown's top managers believed that as long as sales growth remained positive, any problems with profits would surely work themselves out. Unfortunately, that has not happened: even though sales have risen, profits have fallen. Selling expense has averaged about 10 percent of sales. Half of this amount tends to be sales salaries and commissions. Because Jamestown's incentive plans relate primarily to sales and market growth, marketing personnel are paid a base salary plus commissions based on dollar volume of sales; most marketing employees generate about 80 percent of their earnings through sales commissions. suey in ccowting Education Issues in Accounting Education 262 Jamestown Electric Supply Company: Assexsing Customer Profitahility 263 Heitger and Heitger 261 historically has invested heavily in researching and developing automotive electronic technology in order to provide customers with state-of-the-art functionality, safety, and performance. Jamestown continues its heavy investment in this research and development arena because the resulting product features quickly devolve from being "cutting edge" features that create a competitive advantage to commodities that customers regard as standard features on all automobiles. EXHIBIT 1 Jamestown Income Statements for 20X3 to 20X7 20X4 20x6 20x7 20X3 20X5 Jamestown started supplying headlight systems, and a variety of other electrical parts and components over 30 years ago. The company has continued to upgrade its rescarch and development and manufacturing abilities to keep pace with changing technologies. For instance, Jamestown designs, produces, and installs a direct measurement tire pressure sensor and monitoring system for many of its automotive clients. Demand for this system has grown tremendously, as Jamestown has gone from producing 3,000 tire pressure sensor devices per week to 250,000 per week. Jamestown has found such growth challenging to manage from both cost control and cost forecasting various automotive customers with wiring ab $200,000 S210,000 S212,000 $220,000 $230,000 042.040 Sales Cost ofgoods sold Gross profit W&s G&A Net Income (130,000) 70,000 (138.600) 71,400 (14,500) (15,200) 3750 39.400) (l49.600) 70,400 (15.785) 17,220) 0.58.700) 71,300 (18,305) 69,960 (39335(3998O 41495 $ 18,000 S 16,800 S 14,840 13,200 11,500 Other uses for clectronics and microclectromcchanical systems include "smart airbags," carbon monoxide sensors, angular rate sensors, Global Positioning System-based navigation systems, and rollover-sensing modules that measure vehicle lateral and angular rotations; these modules are useful in automatic countermeasure deployment mechanisms that stabilize vehicles during rollovers. Amounts are shown in thousands ($000). Exhibit 2 contains financial data for specific customers (1.c., Alanson, Boyne, and Conway). W&S (Warehousing and Shipping) G&A (General and Administrative) FINANCIAL CHALLENGES FOR JAMESTOWN The automotive industry has been a mainstay of Jamestown's business. During 20X7, the automobile segment provided 55 percent ofthe firm's gross sales. Growing, and even maintaining, sales volume in this crucial business segment is one of Jamestown's core strategic goals, but achieving this goal has not been easy. Competition for business has been fierce from both domestic and international competitors Jamestown has developed its market position with automobile companics by offering a variety of services that facilitate clients' production activities. These services include overnight delivery of electrical compont products, just-in time (JIT) inventory deliveries to clients' plants, warehousing of client parts, special part support services, and many other customer services designed to gain and maintain clients. Jamestown's management believes that support for customer sales is critical to building and maintaining market share and customer satisfaction. Therefore, key warehousing, shipping, and customer service personnel also receive bonuses based on the volume of sales. A second bonus pool, cqual to 10 percent of net income, comprises the bonus pool for all other key PART IASSESSING CUSTOMER PROFITABILITY An Initlal Customer Profitability System In an effort to determine why profits have continued to shrink during a period of rising sales, Jamestown's executive team tried carly in 20X7 to evaluate production, marketing, distribution, and customer support. In particular, many of Jamestown's top managers were concerned about which customers provide profits and which customers do not. Therefore, they Jamestown has hundreds of different contracts with many different divisions and plants of cach of the major automobile manufacturers. Most of these contracts show reasonably sound gross profit margins on sales. However, because of the different commitments that Jamestown sales personnel have promised, it is not clear which contracts (customers) provide acceptable bottom-line profits (or any profits at ). Although Jamestown's total sales-including sales in the automotive segment have continued to rise, total profits as a percentage of sales have not kept pace. Exhibit 1 shows summarized income statements from 20X3 through 20X7 decided to implement a customer profitability system This customer profitability system included an "internal charging" system for Jamestown customers. Besides cost of goods sold (COGS), Jamestown has two major cost categories: warehousing and shipping (W&S) costs, and general and administrative costs (G&A). With the help of accounting personnel, the marketing department developed a method of internally charging customers for W&S services. For internal analysis purposes, customers are charged a user fee, which is based on the volume (i.e., COGS) of each customer's purchases. The service rate used for this customer service charge is determined at the beginning of the year by dividing the estimated total W&S costs for the coming year by the estimated total COGS for the coming year. In order to help Jamestown managers evaluate whether the customer is an attractive client, this service rate is then used for assigning W&S costs to customers. During 20X7, the cstimate of W&S cost was $18.2 million, and the estimated cost of goods sold was $155 million, resulting in a customer service charge for internal analysis purposes of 11.75 percent. In other At first, Jamestown's top managers believed that as long as sales growth remained positive, any problems with profits would surely work themselves out. Unfortunately, that has not happened: even though sales have risen, profits have fallen. Selling expense has averaged about 10 percent of sales. Half of this amount tends to be sales salaries and commissions. Because Jamestown's incentive plans relate primarily to sales and market growth, marketing personnel are paid a base salary plus commissions based on dollar volume of sales; most marketing employees generate about 80 percent of their earnings through sales commissions. suey in ccowting Education Issues in Accounting Education

A) Rank Alanson, Boyne, and Conway from most profitable to least profitable according to the initial systems estimate of the contribution of each customer to Jamestowns bottomline profitability. What are Jamestowns options regarding the treatment of these three customers? Based on this initial customer profitability analysis, what action do you recommend Jamestown take with each of these three customers?

A) Rank Alanson, Boyne, and Conway from most profitable to least profitable according to the initial systems estimate of the contribution of each customer to Jamestowns bottomline profitability. What are Jamestowns options regarding the treatment of these three customers? Based on this initial customer profitability analysis, what action do you recommend Jamestown take with each of these three customers?