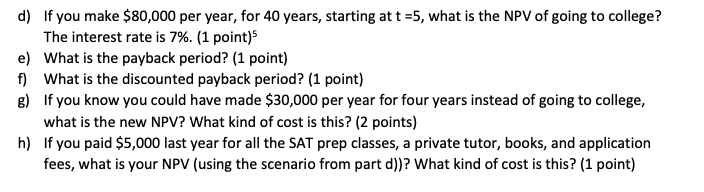

Question

a) Read this article and explain what ISAs are (don't need answer to this) b) Attending school costs $160,000 total right now, after scholarships. This

-

a) Read this article and explain what ISAs are (don't need answer to this)

-

b) Attending school costs $160,000 total right now, after scholarships. This would pay for your full education. You expect to make $80,000 every year once you graduate. You have two options to finance this: Student loans or income-sharing agreements. If you take out a student loan, you want to take out $160,000 right now, and you have to start paying it back at the end of the year (at t =1). As in question 2, you want to make equal payments, but this time, annually. How much do you have to pay if you want to be done paying off your student loans 26 years after your graduation? (I.e. in 30 years from now)3? Assume an interest rate of 7%.

-

c) If you take out an income-sharing agreement (ISA), you will be required to pay 20% of your income every year for the first 15 years after graduation (i.e. from t = 5 to t = 20). Is this a better offer than taking out a loan? Keep using the 7% interest rate.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started