Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A real estate investor has the following information on a warehouse: Purchase Price is $1,125,000, 33,600 leasable square feet. Initial rent of $20/sq. ft.

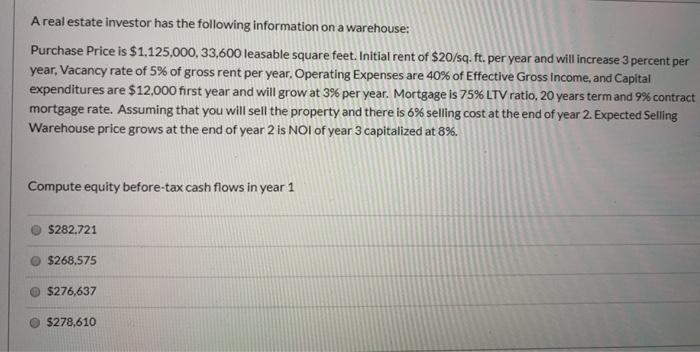

A real estate investor has the following information on a warehouse: Purchase Price is $1,125,000, 33,600 leasable square feet. Initial rent of $20/sq. ft. per year and will increase 3 percent per year, Vacancy rate of 5% of gross rent per year. Operating Expenses are 40% of Effective Gross Income, and Capital expenditures are $12,000 first year and will grow at 3% per year. Mortgage is 75% LTV ratio, 20 years term and 9% contract mortgage rate. Assuming that you will sell the property and there is 6% selling cost at the end of year 2. Expected Selling Warehouse price grows at the end of year 2 is NOI of year 3 capitalized at 8%. Compute equity before-tax cash flows in year 1 $282,721 $268,575 $276,637 $278,610

Step by Step Solution

★★★★★

3.31 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Loan Amount Purchase price LTV ratio 1125000075 ie 843750 PMT in Excel PMTrate nperPV PMT920843...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started