Answered step by step

Verified Expert Solution

Question

1 Approved Answer

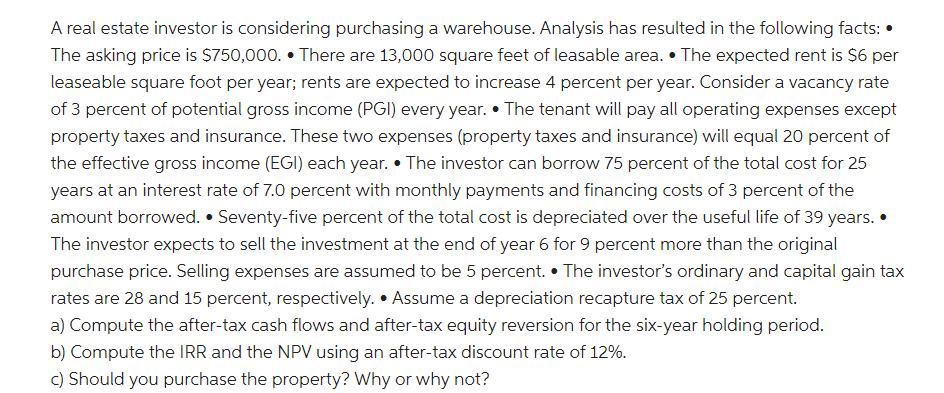

A real estate investor is considering purchasing a warehouse. Analysis has resulted in the following facts: The asking price is $750,000. There are 13,000

A real estate investor is considering purchasing a warehouse. Analysis has resulted in the following facts: The asking price is $750,000. There are 13,000 square feet of leasable area. The expected rent is $6 per leaseable square foot per year; rents are expected to increase 4 percent per year. Consider a vacancy rate of 3 percent of potential gross income (PGI) every year. The tenant will pay all operating expenses except property taxes and insurance. These two expenses (property taxes and insurance) will equal 20 percent of the effective gross income (EGI) each year. The investor can borrow 75 percent of the total cost for 25 years at an interest rate of 7.0 percent with monthly payments and financing costs of 3 percent of the amount borrowed. Seventy-five percent of the total cost is depreciated over the useful life of 39 years. The investor expects to sell the investment at the end of year 6 for 9 percent more than the original purchase price. Selling expenses are assumed to be 5 percent. The investor's ordinary and capital gain tax rates are 28 and 15 percent, respectively. Assume a depreciation recapture tax of 25 percent. a) Compute the after-tax cash flows and after-tax equity reversion for the six-year holding period. b) Compute the IRR and the NPV using an after-tax discount rate of 12%. c) Should you purchase the property? Why or why not?

Step by Step Solution

★★★★★

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

a Aftertax cash flows and aftertax equity reversion Year 1 Rent Income 13000 sqft x 600sqft 78000 Pr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started