Question

A real-estate developer seeks to determine the most economical height for a new office building, which will be sold after five years. The developer uses

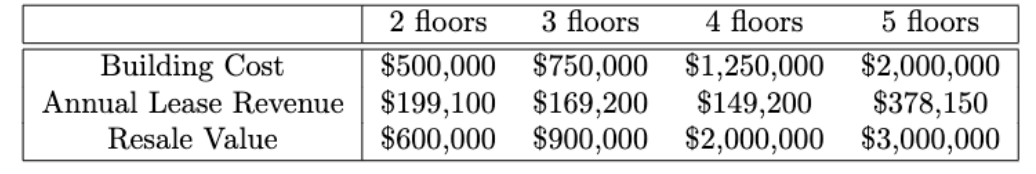

A real-estate developer seeks to determine the most economical height for a new office building, which will be sold after five years. The developer uses an interest rate of i for its evaluation. The relevant net revenues and salvage values on after-tax basis are given below:

(a) The developer is uncertain about the exact interest rate i, but is certain that it is in the range from 10% to 25%. For each value of i {10%, 15%, 20%, 25%}, determine which building option is the most economical. (b) Suppose that the developers interest rate turns out to be 15%. If the resale costs are 30% overestimated for each height plan (i.e., the resale value turns out to be 70% of $600,000 for the 2 floors, 70% of $900,000, and so on), how does that scenario affect the PW values for the floor options?

\begin{tabular}{|c|cccc|} \hline & 2 floors & 3 floors & 4 floors & 5 floors \\ \hline \hline Building Cost & $500,000 & $750,000 & $1,250,000 & $2,000,000 \\ Annual Lease Revenue & $199,100 & $169,200 & $149,200 & $378,150 \\ Resale Value & $600,000 & $900,000 & $2,000,000 & $3,000,000 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started