Answered step by step

Verified Expert Solution

Question

1 Approved Answer

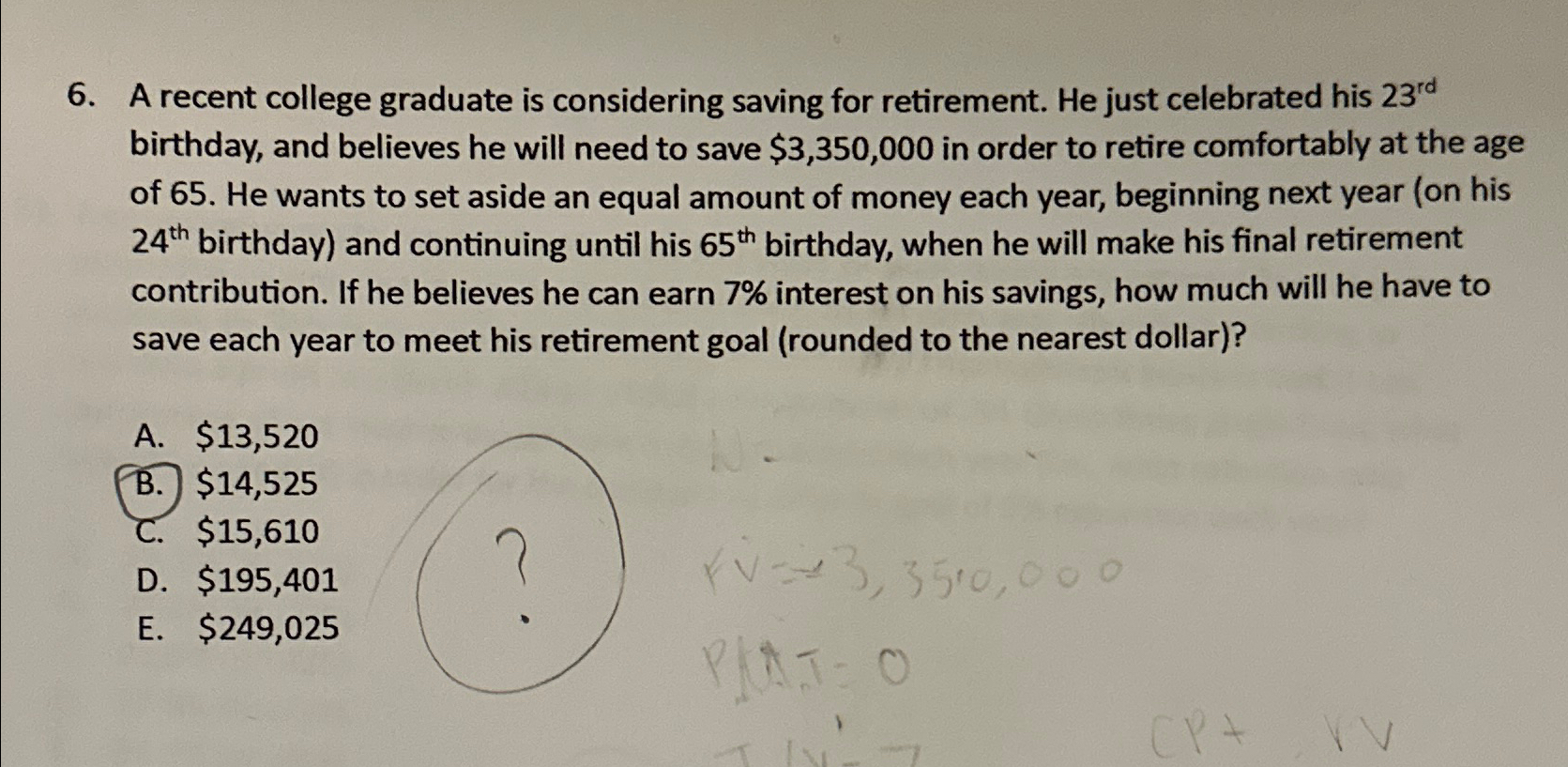

A recent college graduate is considering saving for retirement. He just celebrated his 2 3 r d birthday, and believes he will need to save

A recent college graduate is considering saving for retirement. He just celebrated his birthday, and believes he will need to save $ in order to retire comfortably at the age of He wants to set aside an equal amount of money each year, beginning next year on his birthday and continuing until his birthday, when he will make his final retirement contribution. If he believes he can earn interest on his savings, how much will he have to save each year to meet his retirement goal rounded to the nearest dollar

A $

B $

C $

D $

E $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started