Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A recent graduate, 25 years old, is starting a career with an engineering firm. She intends to deposit a portion of her annual salary

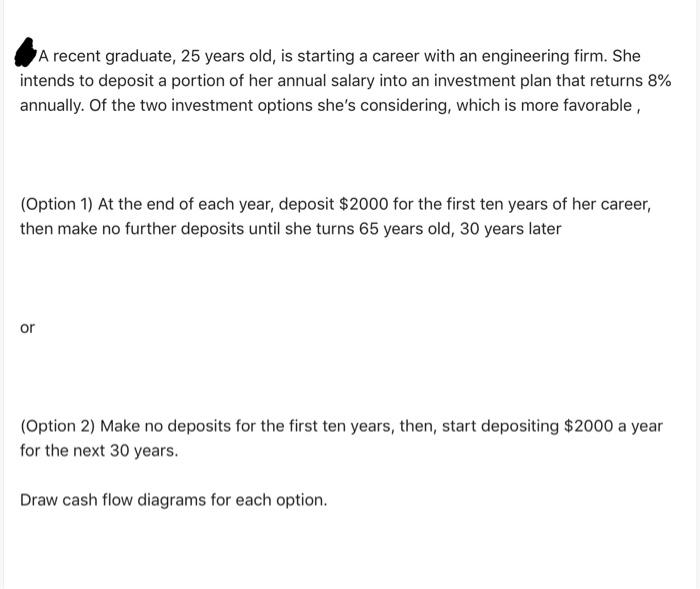

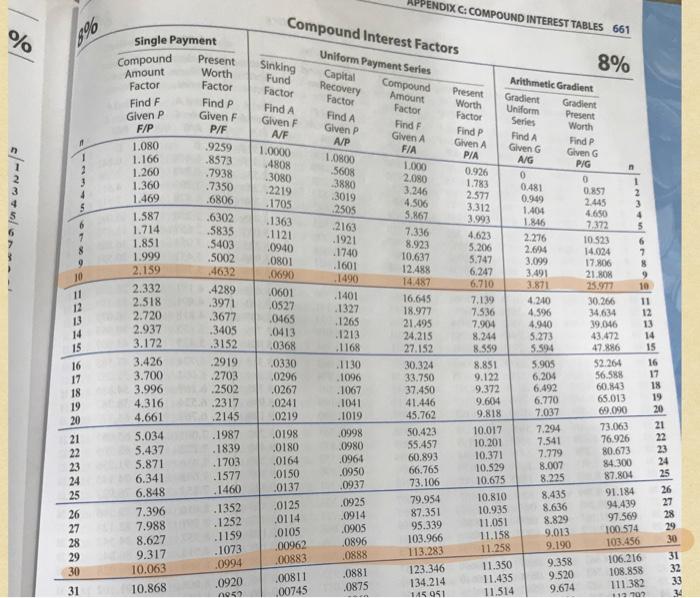

A recent graduate, 25 years old, is starting a career with an engineering firm. She intends to deposit a portion of her annual salary into an investment plan that returns 8% annually. Of the two investment options she's considering, which is more favorable, (Option 1) At the end of each year, deposit $2000 for the first ten years of her career, then make no further deposits until she turns 65 years old, 30 years later or (Option 2) Make no deposits for the first ten years, then, start depositing $2000 a year for the next 30 years. Draw cash flow diagrams for each option. % 896 Single Payment Compound Amount Present Worth Sinking Factor Factor Fund Capital Factor Find F Find P Given P Given F Find A Factor Recovery Compound Amount PPENDIX C: COMPOUND INTEREST TABLES 661 Compound Interest Factors Uniform Payment Series 8% Present Arithmetic Gradient F/P P/F Given F Find A Factor Worth Gradient Factor Uniform Gradient A/F Given P Find F Series Present 1.080 .9259 A/P Given A Find P Worth 1.0000 F/A Given A Find A 1.166 .8573 1.260 4808 1.0800 P/A Given G Find P Given G A/G .7938 .3080 5608 1.000 P/G 0.926 " 1.360 .7350 2219 3880 2.080 0 1.783 0 1.469 .6806 .1705 3019 3.246 0.481 2.577 0.857 2 2505 4.506 0.949 3.312 2.445 3 1.587 .6302 5.867 1.404 4.650 4 .1363 3.993 1.714 .5835 2163 1.846 7.372 5 .1121 7.336 1.851 .5403 .1921 4.623 2.276 0940 8.923 10.523 6 1.999 .5002 .1740 5.206 2.694 0801 10.637 14.024 7 5.747 2.159 .1601 3.099 17.806 8 10 4632 12.488 .0690 6.247 3.491 .1490 21.808 9 14.487 2.332 6.710 11 4289 3.871 25.977 10 0601 .1401 2.518 12 .3971 16.645 7,139 4.240 0527 30.266 11 .1327 13 2.720 .3677 18.977 7.536 4.596 34.634 12 .0465 .1265 21.495 7,904 14 2.937 .3405 4.940 39.046 13 .0413 .1213 24.215 8.244 5.273 43.472 14 15 3.172 .3152 0368 .1168 27.152 8.559 5.594 47.886 15 16 3.426 .2919 .0330 .1130 30.324 8.851 5.905 52.264 16 17 3.700 2703 .0296 .1096 33.750 9.122 6.204 56.588 17 18 3.996 2502 .0267 .1067 37.450 9.372 6.492 60.843 18 19 4.316 .2317 .0241 .1041 41.446 9.604 6.770 65.013 19 20 4.661 .2145 .0219 .1019 45.762 9.818 7.037 69.090 20 21 5.034 .1987 .0198 .0998 50.423 10.017 7.294 73.063 21 22 5.437 .1839 .0180 .0980 55.457 10.201 7.541 76.926 22 23 5.871 .1703 .0164 .0964 60.893 10.371 7.779 80.673 23 24 6.341 .1577 0150 .0950 66.765 10.529 8.007 84.300 24 25 6.848 .1460 .0137 .0937 73.106 10.675 8.225 87.804 25 26 7.396 .1352 .0125 .0925 79.954 10.810 8.435 91.184 26 27 7.988 .1252 .0114 .0914 87.351 10.935 8.636 94.439 27 28 8.627 .1159 .0105 0905 95.339 11.051 8.829 97.569 28 29 9.317 .1073 .00962 .0896 103.966 11.158 9.013 100.574 29 30 10.063 .0994 .00883 .0888 113.283 11.258 9.190 103.456 30 31 10.868 .0920 .00811 .0881 123.346 11.350 9.358 106.216 31 0852 ,00745 .0875 134.214 11.435 9.520 108.858 32 145 051 11.514 9.674 111.382 33 $12.707 34

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The time value of money principle states that receiving money earlier is better than receiving it la...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started