Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume Deere & Company's 2016 10-K reports the following footnote relating to long-term debt. Deere's borrowings include $200 million, 6.55% debentures (unsecured bonds), due

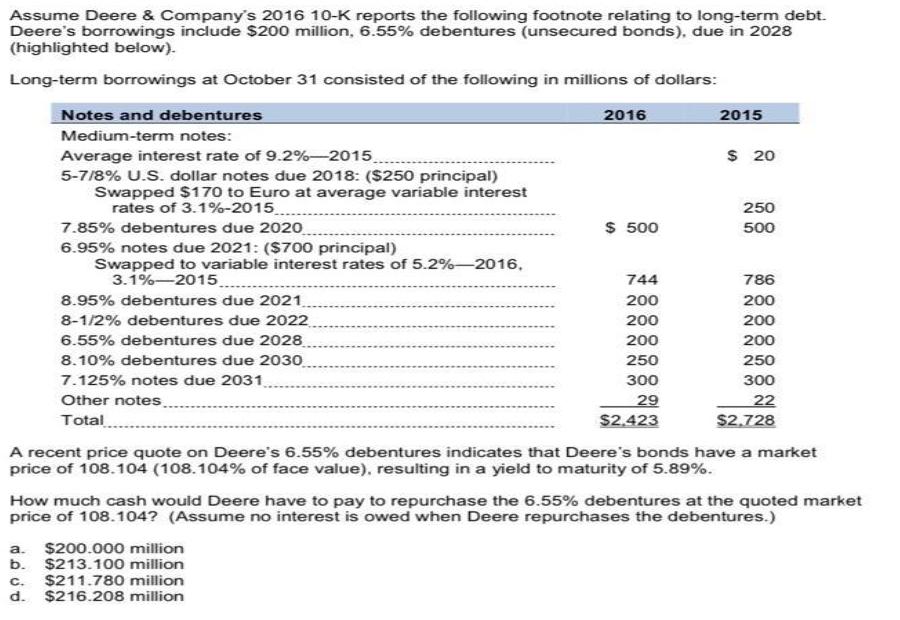

Assume Deere & Company's 2016 10-K reports the following footnote relating to long-term debt. Deere's borrowings include $200 million, 6.55% debentures (unsecured bonds), due in 2028 (highlighted below). Long-term borrowings at October 31 consisted of the following in millions of dollars: Notes and debentures 2016 2015 Medium-term notes: $ 20 Average interest rate of 9.2%-2015. 5-7/8% U.S. dollar notes due 2018: ($250 principal) Swapped $170 to Euro at average variable interest rates of 3.1%-2015 250 7.85% debentures due 2020 $ 500 500 6.95% notes due 2021: ($700 principal) Swapped to variable interest rates of 5.2%-2016, 3.1%-2015 744 786 8.95% debentures due 2021. 200 200 8-1/2% debentures due 2022 6.55% debentures due 2028 8.10% debentures due 2030 200 200 200 200 250 250 7.125% notes due 2031. 300 300 Other notes. Total 22 $2,728 29 $2.423 A recent price quote on Deere's 6.55% debentures indicates that Deere's bonds have a market price of 108.104 (108.104% of face value), resulting in a yield to maturity of 5.89%. How much cash would Deere have to pay to repurchase the 6.55% debentures at the quoted market price of 108.104? (Assume no interest is owed when Deere repurchases the debentures.) a. $200.000 million b. $213.1000 million C. d. $211.780 million $216.208 million

Step by Step Solution

★★★★★

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Solut...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started