Question

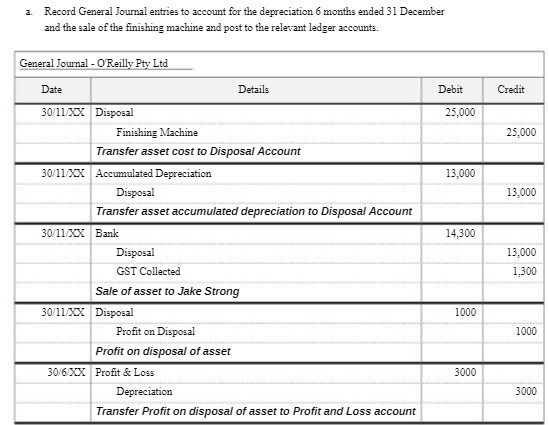

a. Record General Journal entries to account for the depreciation 6 months ended 31 December and the sale of the finishing machine and post

a. Record General Journal entries to account for the depreciation 6 months ended 31 December and the sale of the finishing machine and post to the relevant ledger accounts. General Journal - O'Reilly Pty Ltd Date Details 30/11/XX Disposal Finishing Machine Transfer asset cost to Disposal Account 30/11/XX Accumulated Depreciation Disposal Transfer asset accumulated depreciation to Disposal Account 30/11/XX Bank Disposal GST Collected Sale of asset to Jake Strong 30/11/XX Disposal Profit on Disposal Profit on disposal of asset 30/6/XX Profit & Loss Depreciation Transfer Profit on disposal of asset to Profit and Loss account Debit Credit 25,000 25,000 13,000 13,000 14,300 13,000 1,300 1000 1000 3000 3000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Interpreting and Analyzing Financial Statements

Authors: Karen P. Schoenebeck, Mark P. Holtzman

6th edition

132746247, 978-0132746243

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App